Despite a strong preference for in-office work, Kenya’s office sector is grappling with oversupply which has resulted in a contraction of planned future developments, a recent analysis by Knight Frank shows.

- •Approximately 16,000 sqm of office space is expected to be completed in 2025, a significant decrease from the over 50,000 sqm introduced to the market in 2024.

- •Several completions were added to the market’s inventory last year, including Purple Tower, Highway Heights, Matrix One, The Mandrake, and Museum Hill Towers.

- •Kenya is also witnessing a substantial uptick in adopting flexible and shared workspaces.

“Like most African countries, Kenya’s preference for in-office work still remains strong. This sharply contrasts with global patterns, where adopting remote and hybrid work models has become significant,” researchers said in the report.

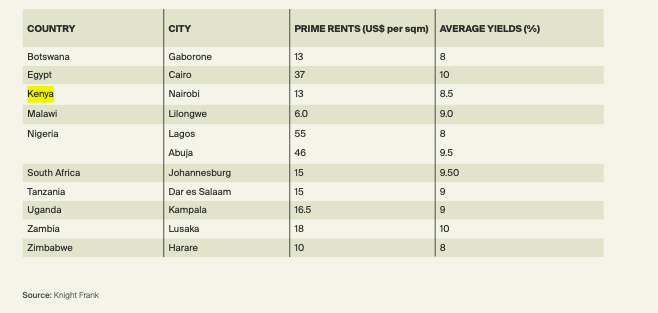

Clients are also demanding Grade A offices that also meet the environmental, social, and governance (ESG) considerations of their businesses. According to Knight Frank, occupancy rates for Grade A offices in prime locations such as Johannesburg and Nairobi ave steadily risen over the past two years, consistently exceeding 70%.

“On the continent, with the SME sector continuing to form the backbone of economic growth, as well as the current risk aversion of global firms, serviced office providers are well positioned to capitalise on the demand for smaller, ‘plug and play’ space,” Mark Dunford, CEO-Knight Frank Kenya, explained

Despite this, the continent is experiencing growing demand for co-working spaces catering to various business needs, from startups seeking affordable office solutions to multinational corporations exploring hybrid workplace models or spaces that they can flex in and out of. For example, KOFISI and Workshop17 manage more than 22 locations across the continent, offering a combined footprint of approximately 60,000 sqm.