The implementation of shareholders rights and other corporate governance structures in listed companies reduced marginally in 2023/24, according to an analysis by the Capital Markets Authority (CMA).

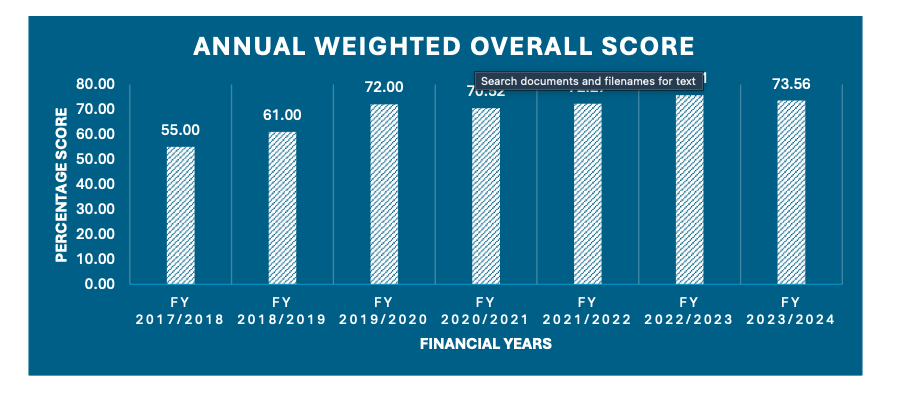

- •The annual weighted overall governance score of listed companies has improved from a Fair Rating of 55% in 2017/2018 to 73.56% in 2023/2024.

- •But it declined year on year by 2.15%, from 75.71% (Leadership rating) in the 2022/2023 financial year to 73.56% (Good rating) in the 2023/2024 financial year.

- •The authority also noted that some of the listed companies failed to provide specific details and documentation on how their governance framework recognises equitable treatment and protection mechanisms for different types of shareholders.

“[Shareholders] involvement in scrutinizing policies and financial statements ensures transparency and accountability, ultimately enhancing the quality of investments considered by the company,” CMA notes in the Seventh Edition of the CMA Report on the State of Corporate Governance for Issuers of Securities to the Public in Kenya.

The annual publication outlines CMA’s independent assessment of how listed companies and issuers of corporate bonds are applying corporate governance practices. The average aggregate score for all listed companies on shareholder rights has been on the rise since FY 2017/2018 where the score was recorded at 59.15% to 79.6% score recorded in FY2022/23 before it dropped to 74.88% in FY2023/2024.

“Without undermining the need for protection of all shareholders, Issuers should disclose specific initiatives under its governance framework that ensures minority and foreign shareholders are treated in an equitable manner,” CMA said in the report, “Issuers with institutional investors must disclose specific initiatives to enhance their participation in company affairs.”

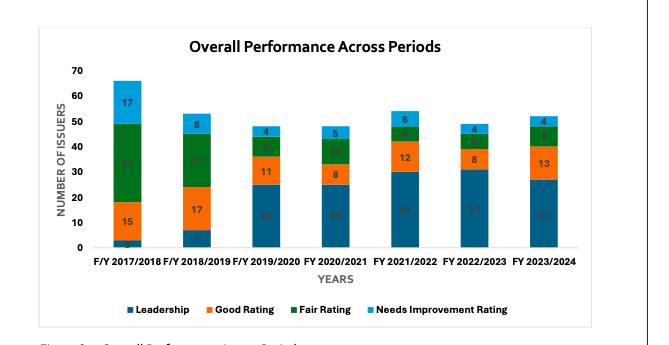

The Authority assessed fifty-two Issuers, and the performance was as follows: 27 assessed issuers securing a Leadership Rating, 13 issuers achieving a Good Rating, 8 Issuers demonstrating a Fair Rating and 4 within the Needs Improvement category.

The regulator attributed the decline in performance to several factors, including the mandatory nature of the corporate governance code, a failure by companies to provide details on awareness of the code, the secondment of non-executive directors to subsidiaries, and failure to disclose the tenures of external auditors.