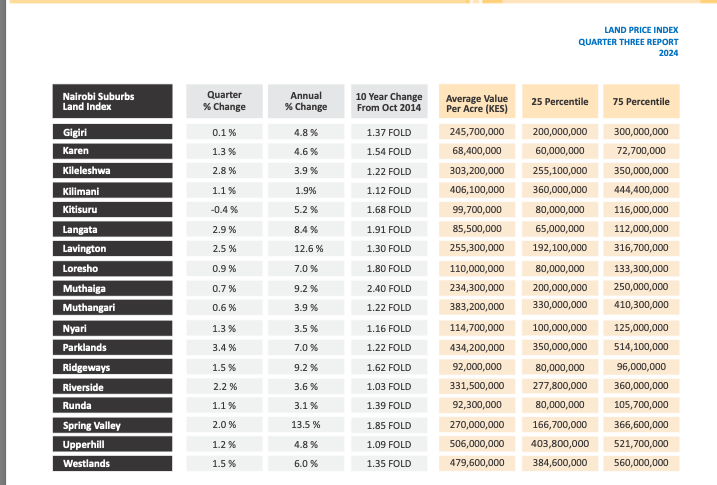

The value of land in Ruaka, one of Nairobi’s fastest growing satellite towns, now rivals prime areas in the capital city’s surbubs such as Loresho and surpassing areas such as Karen, Runda, Ridgeways, Kitisuru and Langata.

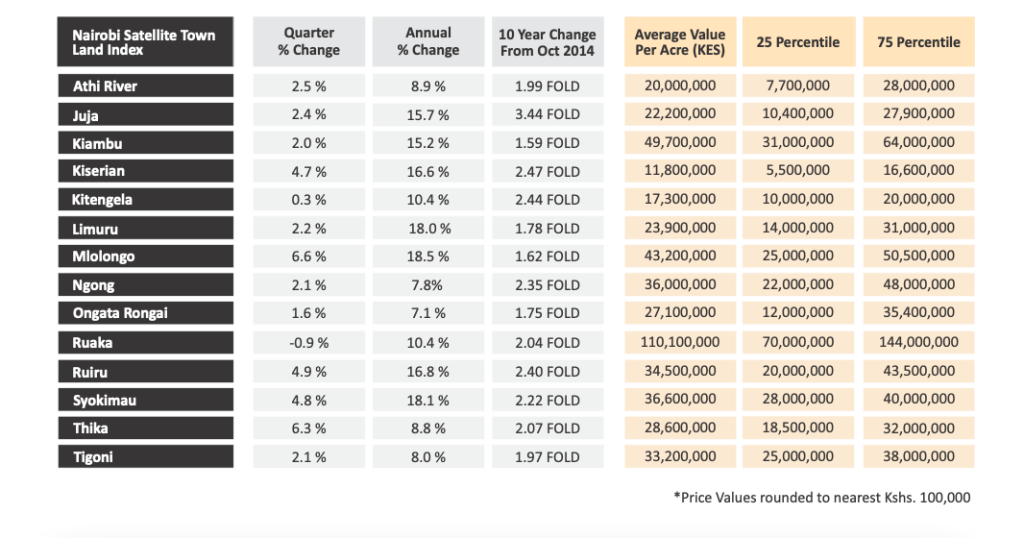

- •In the Q3, Hass Consult’s Land Price Index says an average value of an acre in Ruaka sells at Sh 110,000,000, more than double price of a similar piece of land in other satellite towns and above Kitisuru where a similar portion goes for Sh99,700,000.

- •According to the report, Kitisuru had the lowest quarterly increase in land price among the Nairobi surbubs (-0.43% over the last quarter), among the satellite towns, Ruaka is also listed as towns with the lowest quarterly increase in land price (-0.87% over the last quarter).

- •Upperhill remains the most expensive area to get a piece of land in the city with an acre averaging at Sh506,000,000 followed by Westlands at Sh479,60,000 for the same piece of land.

“The leading suburbs in quarterly land price growth have emerged as the city’s hotspots for apartment and mixed-use developments, hence the demand driven price increase,” said Ms. Sakina Hassanali, Head of Development Consulting and Research at HassConsult.

Hass Land price indices for the third quarter of 2024 shows land prices in Nairobi City’s suburbs rising by 1.6 percent during the period, while prices in Nairobi’s satellite towns rose by 3.02 percent. The positive price movement showed resilience of land as an asset in a period of economic difficulties, characterized by high interest rates and uncertain political environment

Hass also notes that the price growth was supported by rising land demand for new developments, as the real estate sector continued its recovery from a prolonged slump. In the city’s suburbs, land prices have now gone up by more than one percent, in each of the last four quarters, breaking the prior run of 26 straight periods of sub-one percent growth.

Parklands, which has had a surge of development activity – for both commercial and residential developments in the last two years, led the market with land price increases of 3.4 percent to average Ksh434.2 million per acre. Langata and Kileleshwa also made a strong showing with gains of 2.9 percent and 2.8 percent respectively, indicating that demand is shifting back to areas that can support multi dweller units in a market that still remains price sensitive in a tough economy.

Satellite Towns

In Nairobi’s satellite towns, Mlolongo (6.6 percent), Thika (6.3 percent) and Kiserian (4.7 percent), recorded impressive price growth in the second quarter, driven by a mix of attractive pricing levels and upcoming infrastructure development.

Mlolongo continued to enjoy the benefit of easier access to the city via the Nairobi Expressway, with the areas mix of residential and land industrial developments helping sustain demand for land.

In Thika, the Kiambu County government’s recent announcement of a new masterplan to transform the town into an industrial smart-city, has seen developers race to take up land in anticipation of a potential jump in demand for housing and commercial outlets in the area.

The county plan envisages additional roads that will open up the outlying areas of Thika for commercial development, creating new jobs that will attract demand for residential units.

“Prices are more dynamic in satellite towns compared to suburbs, due to evolving development plans and impact of new infrastructure on buyer behavior,” Ms Hassanali added.

Land in the Nairobi satellite towns has also been growing at an annual rate that rivals the returns from other competing asset classes such as bonds and shares at the Nairobi Securities Exchange (NSE).

Prices in Syokimau, Limuru and Mlolongo went up by between 18 and 18.5 percent in the year to September with bond returns expected to fall as the Central Bank of Kenya (CBK) cuts its rate, the attractiveness of land as an investment asset will continue to increase.