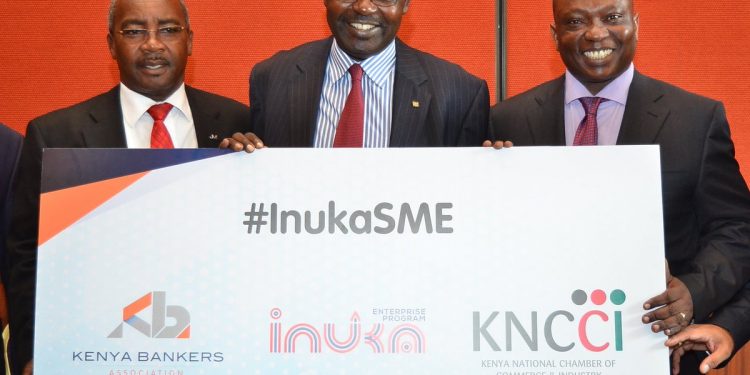

The Kenya National Chamber of Commerce Industry(KNCCI) has partnered with Kenya Bankers Association (KBA) in a deal aimed at promoting the growth of SMEs. The partnership also seeks to advocate for a favourable operating environment for SMEs and enable easy access to credit from banks.

Richard Ngatia, the outgoing KNCCI – Nairobi Chapter Chairman said that the signed Memorandum of Understanding would help SMEs in the country understand each other’s dynamics well and leverage on their strength to support enterprise development.

“We have about 4.1 million SMEs registered, out of those, about 400,000 drop out because of lack of finance or payment,4 million are unable to continue because government has not paid their dues,” he said.

KNCCI vice chair James Mureu said that the corporation will support SMEs and the banking industry to improve enterprise development.

“The SMEs sector needs a concerted effort from all fronts to thrive and we are proud to engage with commercial banks to achieve this end,” Mureu said.

The signing of the MoU comes at a time when the Banking lending to SMEs recorded a decrease by 5.7 percent, an equivalent of Sh13.8 billion in eight months.

Kenya Bankers Association chief executive Habil Olaka noted that the Central Bank of Kenya (CBK) should come up with initiatives such as raising the cash ratio and government support by easier resolution in case of debt defaulting.

“Government support and commercial banks’ initiatives to support SMEs through attractive financial products in the year will give Parliament evidence that an amendment can change the situation,” Olaka said.

KBA will support KNCCI through its Inuka SME program by making it easier for SMEs to access credit.