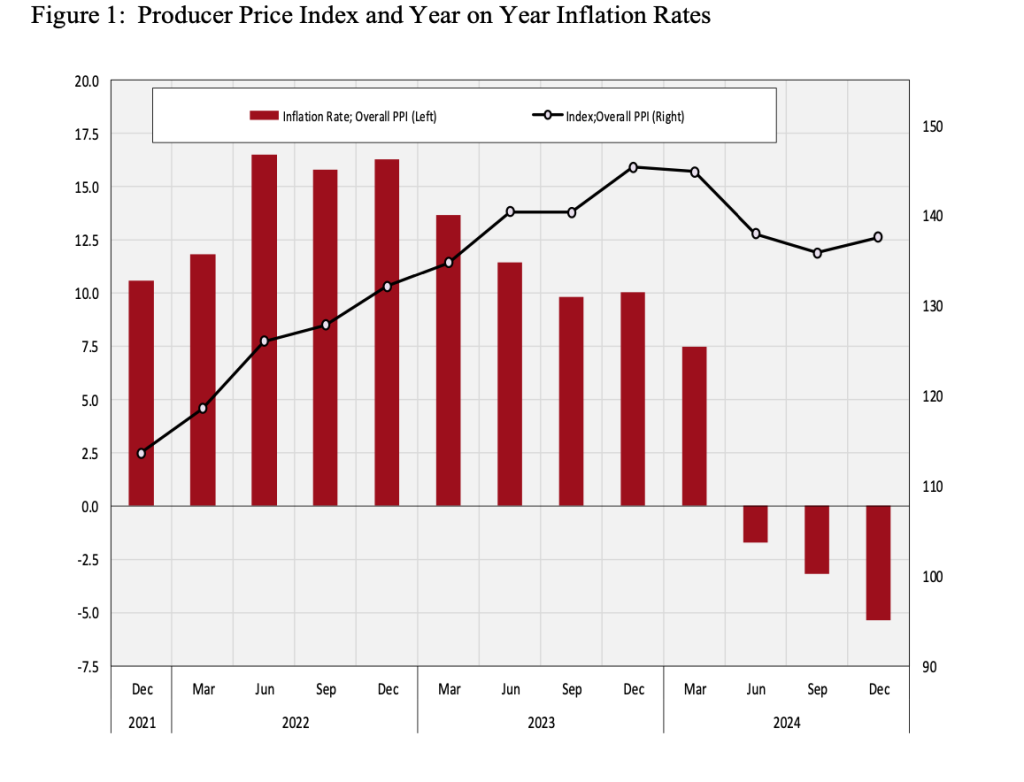

Average wholesale prices charged by factories for their goods fell further in the 3 months to December 2024, reversing the inflation trend witnessed just over a year ago, according to data from the Kenya National Bureau of Statistics.

- •The year-on-year producer inflation stood at -5.34% in the 4th quarter of 2024 as compared to 10.03% recorded in the same period in 2023 and -3.2% in the 3 months to September 2024.

- •The quarter-on-quarter average cost of production went up 1.26% to 137.56 in the 3 months to December 2024 from 135.85 in September 2024.

- •The producer price index, which measures price changes for goods and services at factory level, decreased to 137.56 in December 2024 from 145.32 in December 2023.

Food production prices – which carries the most weight in the basket – were 9.61% lower than in December 2023, pointing to favorable climate conditions in the review period.

When producer prices go up, consumer prices tend to go up as well.

However, for the post-pandemic period between Q4 2021 and Q4 2024, wholesale prices increased by 21.1%.

The manufacturing sector saw a 1.6% increase in production prices in the quarter ending December 2024. Electricity costs saw a 9.7% year on year contraction on the back of reduced cost of fuel coupled with the strong shilling.

“Over the year ending December 2024, the industrial sectors namely: Mining and Quarrying; Manufacturing; Electricity, Gas, Steam and Air Conditioning Supply recorded reduction in production prices while Water Supply, Sewerage, Waste Management and Remediation Activities recorded an increase,” KNBS noted in the report.

The highest price decline over the last one year, however, was recorded in the manufacture of metal ores at 22.43%. Over the 12 months to December 2024, the highest price increases were in manufacture of non-metallic mineral products and manufacture of beverages at 12.9% and 11.1% respectively.

What this Means

Kenya’s Producer price index has been in the negative territory for the past 3 quarters, suggesting a slowdown in the economy and a sustained ease in consumer prices. The decline is expected to be transmitted in the coming weeks as goods get distributed to the consumer market, which will likely lead to the continued downward path for headline consumer inflation.

Consumer prices have been declining in the final quarter of 2024, anchored well within CBK’s lower bound target range of 2.5% – 7.5% with the latest figure showing 3% compared to 6.6% in December 2023.The shilling has stabilized at the 129 mark against the greenback with all factors pointing to further cuts by the Central Bank.