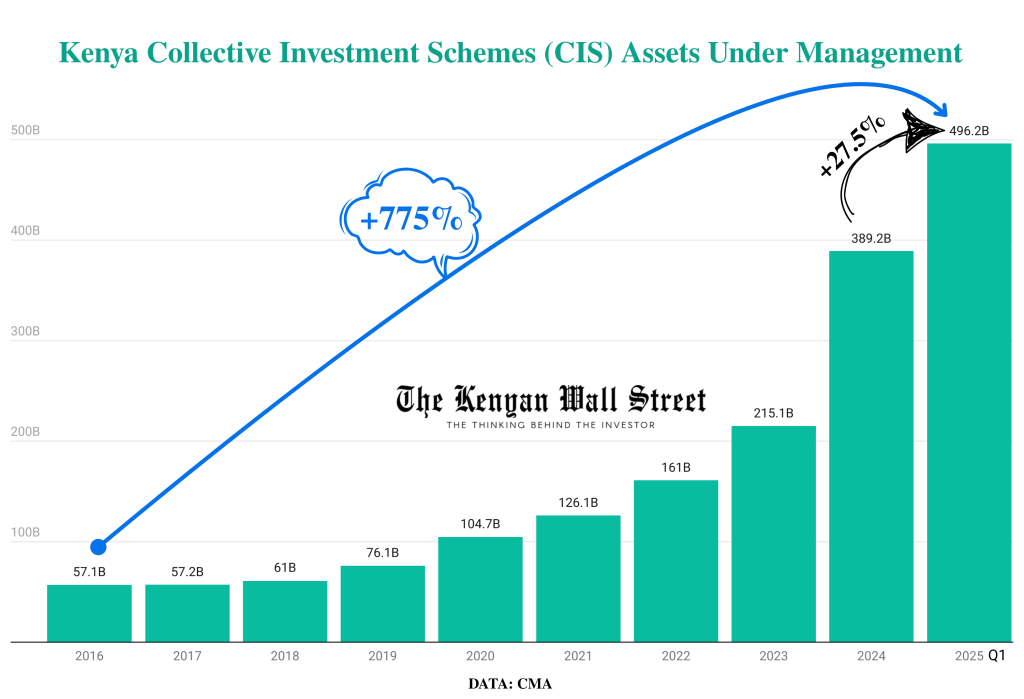

Kenya’s unit trust industry has entered 2025 at full throttle with Assets under management (AUM) smash every record, surging to KSh 496.2 billion in March—up 28% in just three months and nearly doubling in two years.

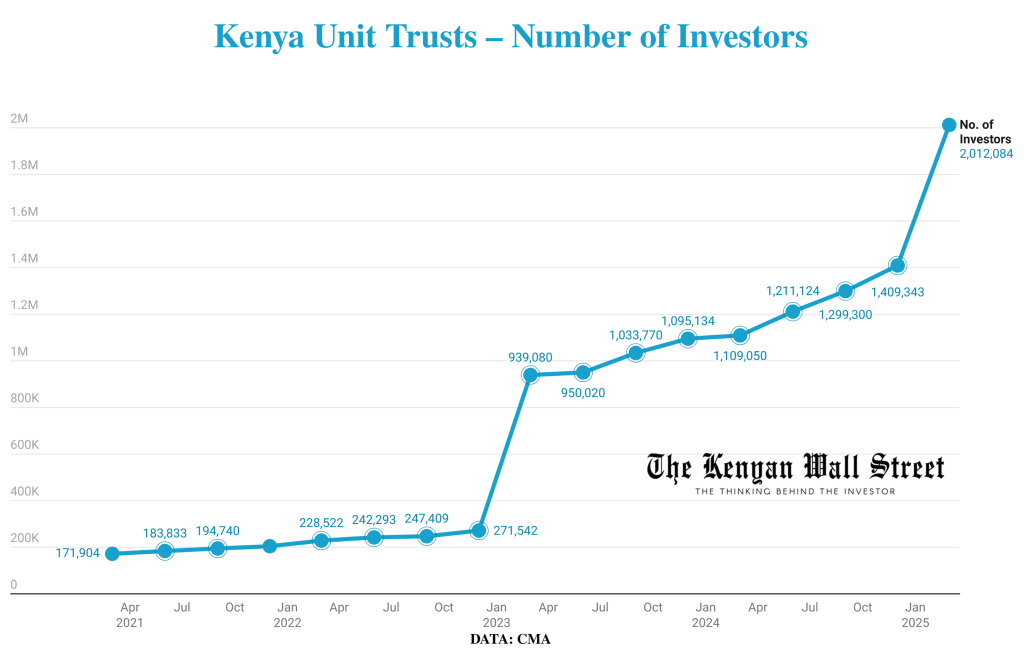

- •Over two million Kenyans are now invested in collective investment schemes (CIS), a number unthinkable just a few years ago.

- •In 2016, industry assets under management (AUM) stood at just KSh 57 billion.

- •Since then, the market has expanded almost ninefold, reaching KSh 496 billion by March 2025.

While the early years saw steady progress, the last two years have been transformative—AUM has more than doubled since 2023 alone, driven by aggressive fund marketing, digital onboarding, and the rapid entry of new retail investors.

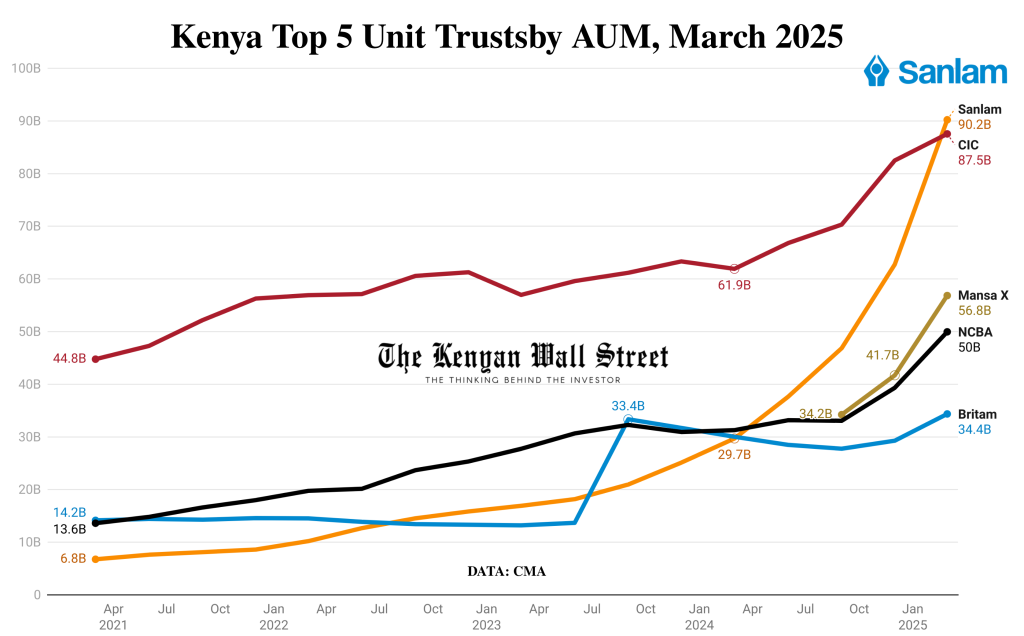

The headline story of Q1 2025 is Sanlam’s dramatic leapfrog of CIC to become Kenya’s largest unit trust manager.

In just four years, Sanlam’s AUM has skyrocketed from KSh 6.8 billion in Q1 2021 to KSh 90.2 billion—an extraordinary thirteenfold increase. This quarter alone, Sanlam’s AUM jumped 44% to outpace CIC’s KSh 87.5 billion, ending CIC’s long reign at the top for the first time since the modern CIS.

Perhaps the most dramatic change is the sheer scale of retail participation. Unit trust investor numbers soared to 2,012,084 by March 2025—an 81% jump in just one year.

Digital onboarding and financial literacy campaigns have made it easier than ever for ordinary Kenyans to put money to work in funds.

While all eyes were on the Sanlam-CIC rivalry, two disruptive entrants shook up the market. Mansa-X, Standard Investment Bank’s alternative fund, exploded from zero to KSh 56.8 billion in just two quarters—now the country’s third-largest. This marks a watershed moment for alternative and multi-asset products in Kenya, which have long struggled to gain mainstream traction.

Meanwhile, Ziidi by Safaricom posted the fastest growth of any fund—up 331% in one quarter. Ziidi leverages Safaricom’s digital reach, enabling millions to invest via their mobile phones in a few taps. Its meteoric rise is proof of the untapped demand for simple, accessible, mobile-first investment options.

A new trend also is the rise of dollar-denominated funds, which now account for over 11% of industry AUM (KSh 53.6B), up 28% in just one quarter. Kenyan investors are increasingly looking to hedge against shilling volatility and tap into global markets. But as global risks mount—U.S. tariffs, market corrections, or regulatory surprises—the safety of offshore assets can shift quickly.

| Period | Dollar Fund AUM (KSh Billion) | Share of Total AUM (%) | QoQ Growth (%) |

|---|---|---|---|

| Dec-24 | 41.8 | 10.7 | — |

| Mar-25 | 53.6 | 11.0 | +28.0 |

| Provider/Fund | AUM (KSh Billion) |

|---|---|

| Sanlam USD Fixed Income | 17.9 |

| Mansa-X USD | 8.2 |

| NCBA Dollar Fixed Income | 6.1 |

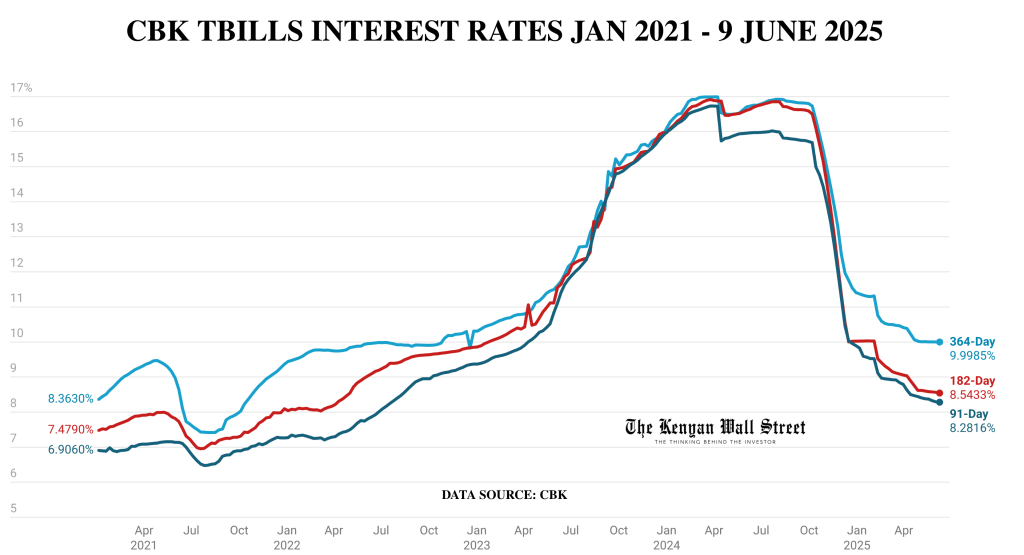

Returns on CIS: Outlook Grows Cautious as T-Bill Yields Fall

For much of the past year, Kenya’s unit trust boom has been propelled by double-digit T-bill rates. These high yields made money market and fixed income funds especially attractive, drawing in both retail and institutional investors. However, that environment is now changing.

At the most recent auction, yields fell sharply:

- •91-day: 8.28% (▼1bp)

- •182-day: 8.54% (▼2bp)

- •364-day: 9.99% (▼2bp; below 10% for the first time in over two years)

As a result, returns from “safe” products like money market funds are set to decline. Investors who became accustomed to the strong payouts of 2024 will soon face a new reality as funds roll over assets at today’s lower rates. Consequently, fund managers will need to manage expectations carefully.

Looking ahead, the industry faces a key question: will Kenya’s millions of new investors stay patient with shrinking returns, or will they seek out riskier alternatives in search of higher yields? Ultimately, the coming quarters will test how well both managers and investors adapt as Kenya’s “easy yield” era winds down.