The Nairobi Securities Exchange (NSE) registered the highest returns among African bourses in dollar terms buoyed by a stronger shilling and higher blue chip stock prices.

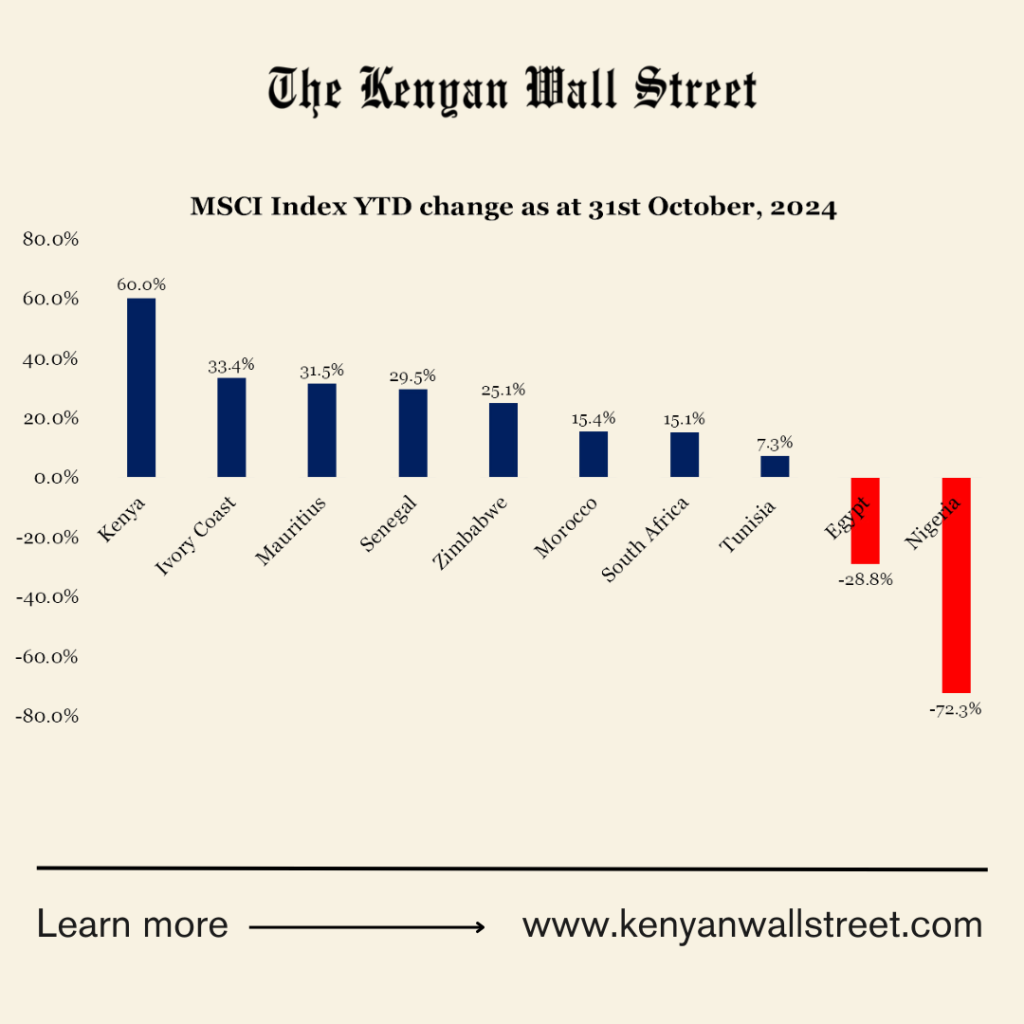

- •According to the Morgan Stanley Capital International Index (MSCI), which tracks performance of 10 African exchanges, NSE returns surged 60% in the ten months to October, bouncing back from a 43% loss in 2023.

- •The MSCI index – Kenya climbed 332 points from the beginning of 2024 to end October at 885.02. In October, the index rose 10.4% from 802.01 as at the end of September.

- •Following closely was Ivory Coast, rallying by 33.4%, Mauritius 31.5%, Senegal 29.5%, Zimbabwe 25.1%, Morocco 15.4%, South Africa 15.1% and Tunisia 7.3%.

In Kenya, the MSCI tracks 9 Kenyan blue chip stocks including Safaricom, KCB Group, Equity Group, East African Breweries, Co-operative Bank, British American Tobacco, Diamond Trust Bank, KenGen and Kenya Reinsurance. Of these, BAT and Kenya Re were the only losers year to date, plunging 41.5% and 12.5%, with the rest soaring above 17% from the beginning of the year.

Nigeria and Egypt declined by 72.3% and 28.8% respectively, on the back of weaker currencies, despite posting gains in local currency terms.

In June, Blackrock fronted plans of liquidating its US$400 million ishares ETF which had investments in countries including Kenya and Nigeria, citing currency issues, liquidity challenges and currency repatriation restrictions.

The Kenyan shilling has strengthened 21% since January, coinciding with other currencies in the continent grappling with devaluations and skyrocketing inflation, dimming the appeal for frontier and emerging markets destinations.

The Kenyan equities market has been bullish since the beginning of the year, as signaled by the 27.0% gain of the NSE All share Index (NASI) which closed the previous trading session at 116.99.

The Nairobi Securities exchange (NSE) market capitalization, which measures investor wealth, has been up since the beginning of 2024, increasing by KSh 419 billion to close at KSh 1.83 trillion in the previous trading session.

This month, the MSCI is expected to upgrade or downgrade any constituent companies and countries including their weighting. In the August review, MSCI upgraded 5 Kenyan firms with no downgrades, cementing the country’s position to foreign investors.