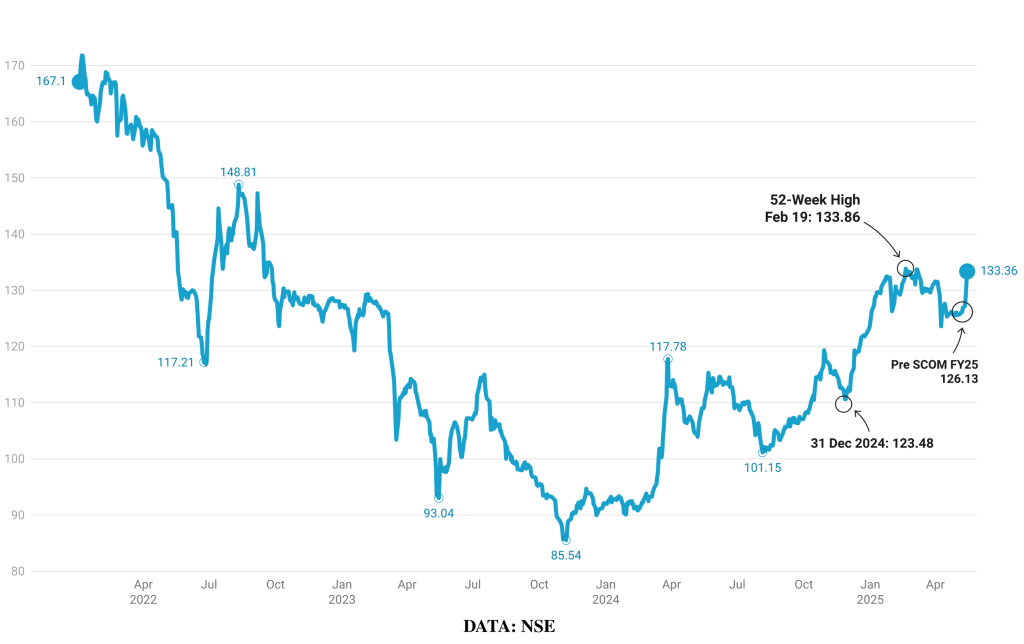

The bulls have charged back at the Nairobi Securities Exchange (NSE), pushing a 5.7% rally of NSE All Share Index (NASI) in just 5 trading days — from May 8 to May 15.

- •The index rose from 126.13 to 133.36, just 0.4% shy of its 52-week high of 133.86, boosting total market capitalization by KSh 113 billion and total investor wealth above KSh 2 trillion.

- •The positive market sentiment was primarily triggered by Safaricom’s earnings release, where the telco crossed US$3bn in revenue.

- •Overall, the upward changes in key indices indicates renewed interest in blue-chip stocks.

The rally has been broad-based across key indices:

| Index | May 8 | May 15 | % Change |

|---|---|---|---|

| NASI | 126.13 | 133.36 | +5.7% |

| NSE 10 | 1,277.94 | 1,361.20 | +6.5% |

| NSE 20 | 2,092.00 | 2,182.60 | +4.3% |

| NSE 25 | 3,379.56 | 3,563.46 | +5.4% |

Safaricom FY2025 Results Drive Sentiment

Despite forex pressure from Ethiopia, investors have focused on M-PESA growth, robust cash flow, and resilient Kenyan operations. On May 15, Safaricom hit an intraday high of KSh 20.25, its new 52-week high, and closed at KSh 19.90.

Investor confidence on Safaricom stock has also improved sharply. Foreign flows — which were negative on May 9 at -KSh 160M — have rebounded to +KSh 139M in just a week. This indicates renewed interest in blue-chip stocks.

| Date | Foreign Buys (KES Mn) | Foreign Sales (KES Mn) | Net Foreign Flow (KES Mn) |

| May 9 | 27.91 | 188.53 | -160.61 |

| May 12 | 184.68 | 132.77 | +51.91 |

| May 13 | 560.66 | 457.72 | +102.94 |

| May 14 | 80.83 | 94.60 | -13.77 |

| May 15 | 415.76 | 276.82 | +138.95 |

The NASI now boasts a +8.0% year-to-date gain as momentum continues to build, the market looks poised for a potential breakout beyond the 52-week high. This raises hopes for a sustained mid-year rally.