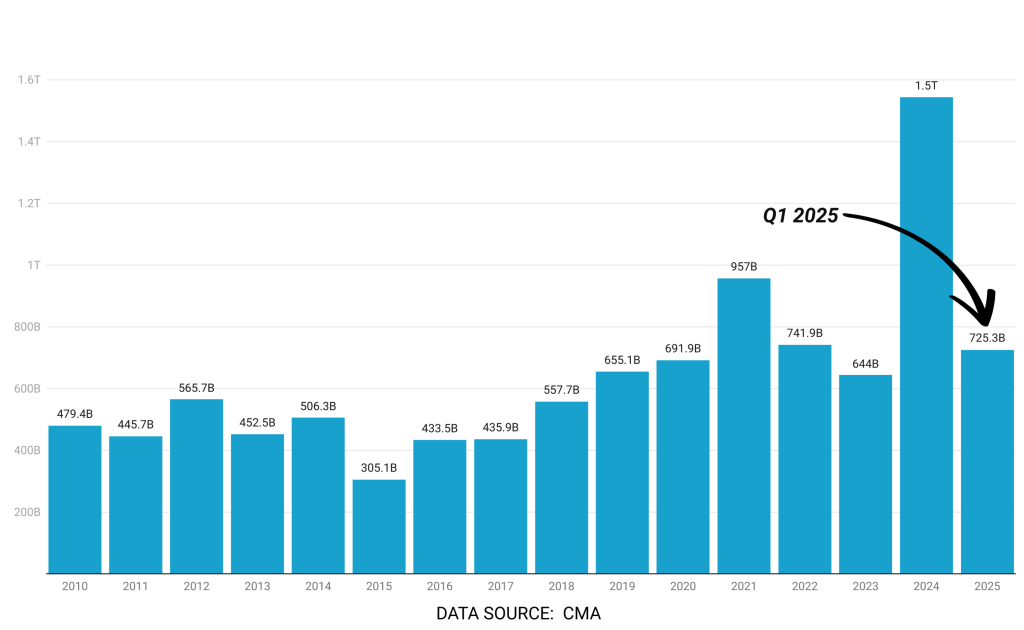

Kenya’s secondary bond market had a great start to 2025, with trading volumes that highlight increased investor interest and better market liquidity.

- •The market’s turnover increased significantly from Q4 2024 to Q1 2025, from KShs 371.52 billion to KShs 725.34 billion, a 95.23% increase according to the Capital Markets Authority’s (CMA) Quarterly Statistical Bulletin.

- •The turnover already accounts for a sizable amount of the KShs 1.54 trillion total amount recorded for the entire year 2024.

- •A significant share of secondary market activity in Q1 2025 was driven by trading in Infrastructure Bonds (IFBs) and reopened fixed coupon bonds.

.

Among the infrastructure bonds that drove the growth, IFB1/2024/8.5, issued in February 2025, emerged as the most actively traded bond in the quarter.

Older IFBs such as IFB1/2022/014 and IFB1/2023/017 also recorded considerable volumes in the secondary market. Their tax-free status and attractive yields have continued to appeal to investors seeking both income and liquidity.

The strong secondary market activity was supported by robust issuance in the primary market during the quarter.

Infrastructure bonds featured prominently in this issuance. IFB1/2024/8.5 was particularly successful, receiving KShs 288.66 billion in bids and accepting KShs 240.96 billion, reinforcing the bond’s liquidity in subsequent secondary trading.

In addition, fixed coupon bonds were re-opened, tapped, and bought back to provide further investment opportunities.

Meanwhile, Kenya’s corporate bond market remained relatively stable, with KShs 19.5 billion outstanding across five issuers, including EABL PLC, Family Bank, and Kenya Mortgage Refinance Company.

| Category | Details |

|---|---|

| Targeted Amount | KShs 175.00 billion |

| Bids Received | KShs 356.00 billion |

| Amount Accepted | KShs 264.63 billion |

| Acceptance Rate | 151.22% |

| Notable Issue | IFB1/2024/8.5 |

| IFB1/2024/8.5 Bids Received | KShs 288.66 billion |

| IFB1/2024/8.5 Amount Accepted | KShs 240.96 billion |

| Other Issues | Fixed Coupon Bonds (Re-openings, Tap Sales, Buybacks) |