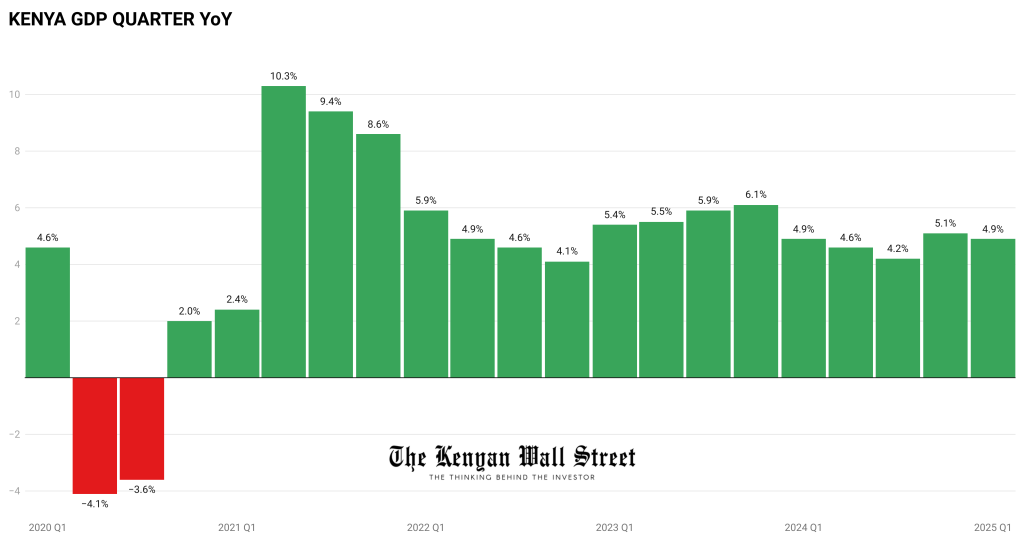

Kenya’s real GDP expanded by 4.9% in the first quarter of 2025, maintaining the same pace recorded in Q1 2024, according to the Kenya National Bureau of Statistics (KNBS).

- •The steady growth reflects broad-based sectoral performance, led by agriculture, mining, information and communication, and financial services.

- •Inflation eased to 3.45% in Q1 2025, down from 6.29% a year earlier, while the Kenyan Shilling strengthened notably against major currencies, gaining 13.6% vs USD, 16.3% vs EUR, and 14.2% vs GBP.

- •The mining and quarrying rebounded strongly after five consecutive quarters of contraction, including a sharp -16.1% decline in Q1 2024, to a +10.0% growth rate.

Sector Growth Overview (YoY, Constant 2016 Prices)

- •Agriculture, Forestry and Fishing: +6.0%

Agriculture posted the highest Q1 real output on record at KSh 1.11 trillion. Key gains included a 14.5% rise in milk deliveries (250.6 million litres), a 73.8% surge in coffee exports (16,894.4 metric tonnes), and growth in sugarcane production (+2.3%). Exports of cut flowers and vegetables also rose by 18.5% and 7.2%, respectively. However, tea production declined by 18.9%. - •Information and Communication: +5.8%

Growth was supported by a 14.8% increase in domestic voice traffic and a 38.1% rise in mobile money transactions, totaling 873.9 million. - •Financial and Insurance: +5.1%

The sector remained resilient, though slower than the 9.6% recorded in Q1 2024. - •Accommodation and Food Services: +4.1%

The pace of growth slowed considerably from 38.1% in Q1 2024, with visitor arrivals rising just 0.5%.

Additional Indicators

- •The Central Bank Rate declined to 10.75% in February and March, from 11.25% in January.

- •The NSE 20 Share Index rallied 27.1% YoY to close March at 2,227 points.

- •The current account deficit widened to KSh 66.6 billion, up from KSh 42.1 billion in Q1 2024.