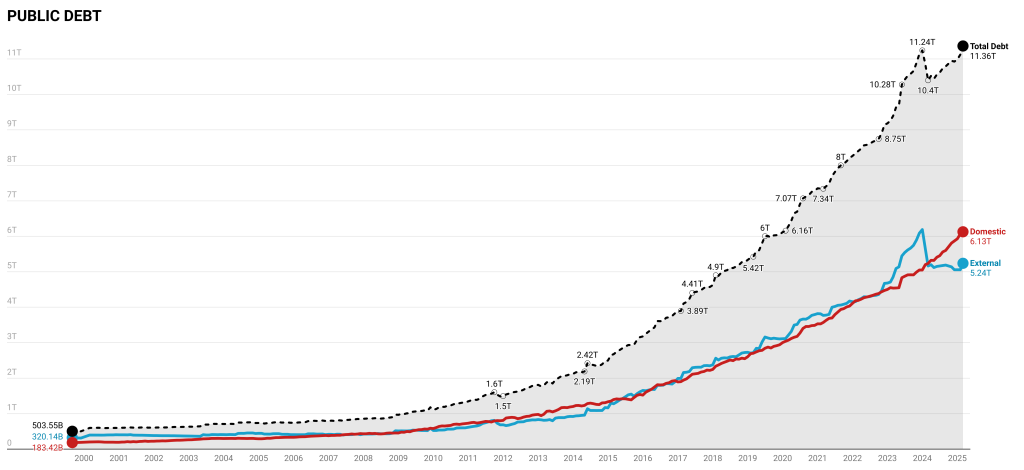

Kenya’s public debt has continued its upward march, hitting KSh 11.36 trillion by March 2025, a record high that underscores the country’s deepening fiscal pressures and the urgent need for sustainable debt management strategies.

- •The debt has expanded dramatically since it first crossed the KSh 1 trillion mark in April 2009.

- •Back then, the country’s borrowing was relatively modest compared to current levels, but fiscal deficits and infrastructure investment ambitions fueled an accelerated pace of borrowing over the years.

- •Kenya’s domestic debt has grown faster than external debt, standing at KSh 6.20 trillion by 23 May 2025having crossed the KSh 6 trillion milestone for the first time on 14 February 2025, marking a significant fiscal development — a testament to the country’s increasing reliance on short-term borrowing instruments.

The last seven years, in particular, have seen Kenya’s debt balloon at an alarming pace, driven by large infrastructure projects, pandemic-related expenditures, and rising debt service costs.

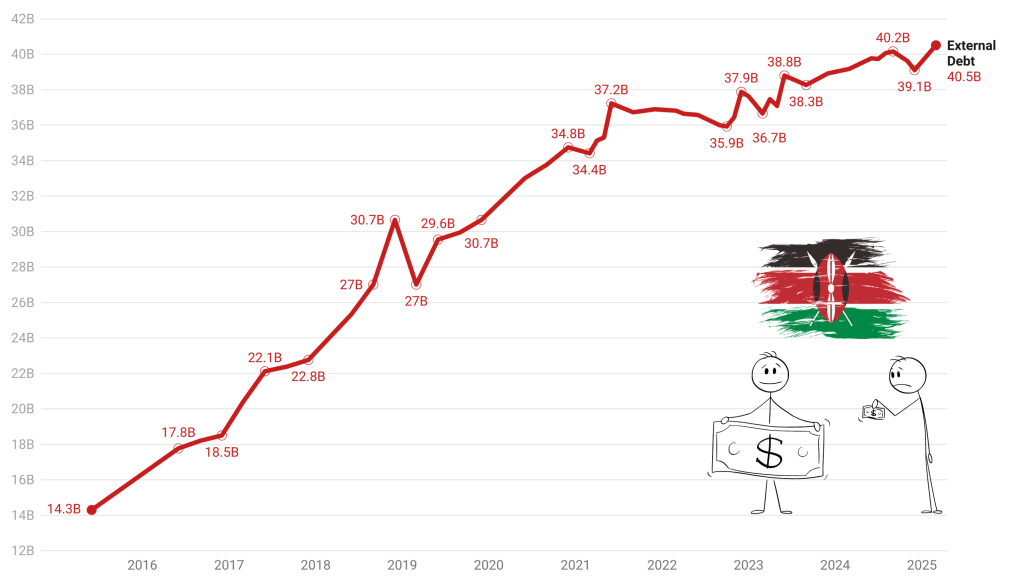

Kenya’s external obligations have eased somewhat in local currency terms thanks to a favorable exchange rate. This has offered some relief to the country’s debt service burden. However, in USD terms, the foreign debt load continued to rise, reaching a record high of USD 40.51 billion by March 2025.

The Growing Burden of Interest Payments

Debt servicing burden has also surged to unprecedented levels. In FY2023/24, debt servicing reached KSh 1.6 trillion — surpassing development spending by more than 1.5 times. By April 2025, the country has already paid KSh 1.25 trillion in debt interest for the current fiscal year (2024/25), raising concerns about fiscal sustainability.

| Fiscal Year | Total Borrowing (KSh Bn) | Debt Servicing (KSh Bn) |

|---|---|---|

| 2018/19 | 726.38 | 826.20 |

| 2019/20 | 858.55 | 707.89 |

| 2020/21 | 1,167.73 | 862.83 |

| 2021/22 | 1,116.65 | 1,042.24 |

| 2022/23 | 1,184.71 | 1,161.58 |

| 2023/24 | 1,500.73 | 1,596.64 |

| 2024/25 | 1,161.81 (as of April) | 1,254.00 (as of April) |

Debt servicing now absorbs nearly all new borrowing — and sometimes exceeds it — leaving little room for development and social investments.

The rapid buildup of domestic debt, especially in short-term Treasury Bills, has intensified the refinancing risk and debt service burden. Treasury Bills accounted for over 15% of total domestic debt as of May 2025 — the highest share in two years.

Heavy domestic borrowing also continues to crowd out private sector credit, constraining economic growth prospects.

Kenya’s debt trajectory highlights an urgent need for comprehensive fiscal consolidation, enhanced revenue mobilization, and effective debt restructuring. Without these measures, Kenya risks falling into a debt trap, where every new borrowing cycle fuels interest payments instead of development and growth.

As Kenya’s public debt crosses KSh 11 trillion and debt service payments head towards KSh 1 trillion annually, the country’s fiscal health remains fragile — requiring decisive and prudent policy action to avert a full-blown crisis.