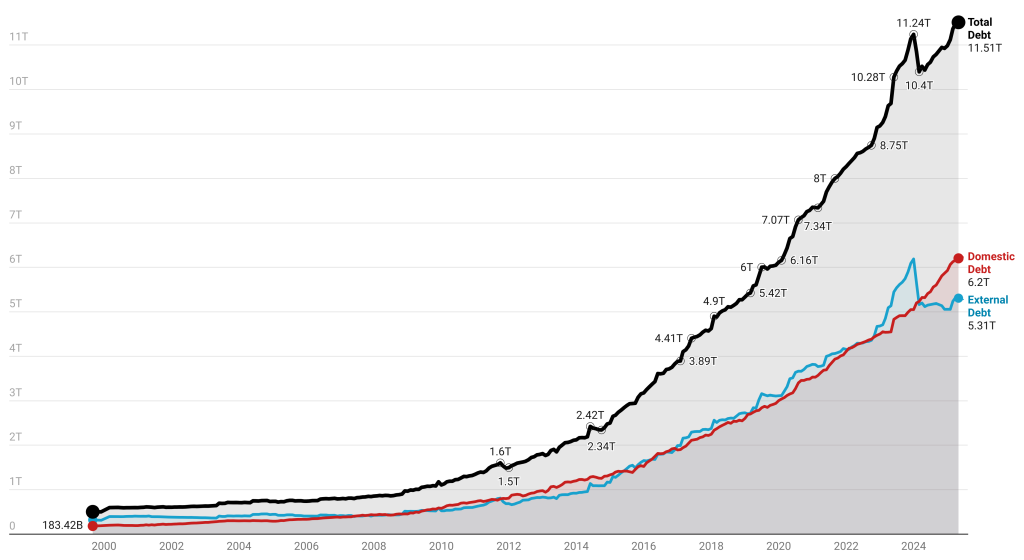

Kenya’s public debt burden hit a new record high of KSh 11.51 trillion as of May 2025, according to the latest official figures from the National Treasury and Central Bank of Kenya.

- •The increase reflects mounting fiscal pressures as the government continues to lean heavily on domestic markets to bridge budget gaps amid challenging economic conditions.

- •The bulk of the recent debt growth is attributable to domestic borrowing, which crossed KSh 6.31 trillion by July 2025, up from KSh 6.20 trillion in May.

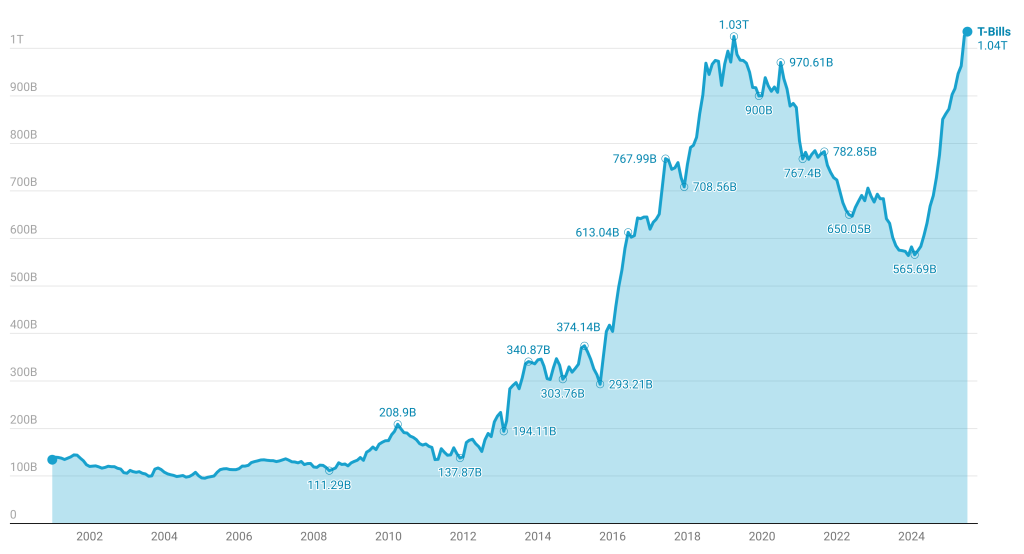

- •Treasury Bills (T-Bills) have expanded rapidly, surging to KSh 1.036 trillion as of July 4, 2025, marking a new all-time high, surpassing the previous record set in April 2019.

- •T-Bills now account for 16.85% of total domestic securities, up from just 11.75% a year earlier.

- •Kenya’s reliance on short-term T-Bills remains high, with the latest July 21, 2025 auction raising over KSh 24 billion at yields of 8.13% (91-day), 8.43% (182-day), and 9.73% (364-day), reflecting continued refinancing pressures.

- •Meanwhile, Treasury Bonds (T-Bonds) debt stock rose to KSh 5.11 trillion in July 2025, up from KSh 4.63 trillion in June 2024, marking a 10.4% year-on-year increase. T-Bonds now account for 83.1% of total domestic securities, slightly down from 88.2% a year ago due to the faster growth in T-Bills.

External Debt Soars in KSh Terms

Kenya’s external debt stood at USD 41.07 billion in May 2025, up from USD 39.77 billion in June 2024. Due to the weaker shilling, the burden rose to KSh 5.31 trillion from KSh 5.05 trillion.

Recently, within just a fortnight, CBK held two bond reopenings, raising KSh 71.64 billion in late June and KSh 66.65 billion on July 14, 2025. The latest reopening featured FXD1/2018/020 (20-year) and FXD1/2018/025 (25-year) bonds, with accepted average yields of 13.90% and 14.35% respectively.

These consecutive reopenings point to sustained institutional demand for long-term paper, even as short-term debt levels remain elevated. This trend bodes well for the National Treasury’s KSh 635 billion net domestic borrowing target for FY2025/26.

Debt Service Consumes Most Revenues

Interest and principal repayments are consuming an ever-larger share of public finances. Latest Treasury data shows that KSh 1.448 trillion was spent on debt servicing in the eleven months to May 2025, including over KSh 1 trillion in interest payments alone. The debt service-to-revenue ratio remains elevated at around 69-70%, well above the IMF’s recommended threshold of 30% for developing economies.

Credit ratings remain cautious. Moody’s affirmed Caa1 Positive in January 2025. Fitch maintained B− Stable, while S&P Global kept a B− rating with no explicit outlook.