According Stanbic Bank July’s survey of Kenyan private sector, firms indicated a further deterioration in business conditions, although at a slower and modest pace.

The overall contraction of the private sector was driven by declining output, albeit a slower fall than in June. New orders and employment rose, but only marginally. Purchasing activity and inventories observed renewed gains. Despite facing higher cost burdens, firms offered discounts amid reports of intense competitive conditions.

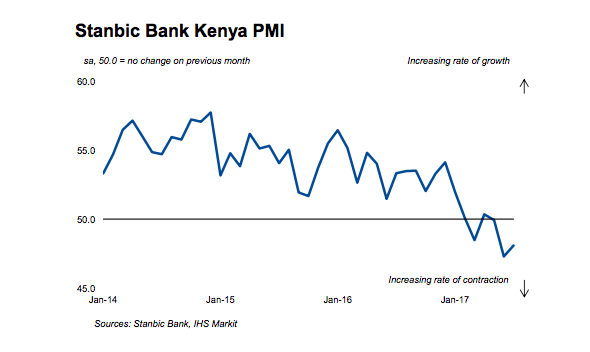

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI™). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration. The seasonally adjusted PMI rose from a survey-record low of 47.3 to 48.1 in July.

This was indicative of a modest contraction of the private sector in July, but was still the second-lowest in the series to date. The PMI has now been registered below the neutral 50.0 threshold for the third consecutive month, the longest sequence of decline recorded since the inception of the series in January 2014.

Commenting on July’s survey findings, Jibran Qureishi, Regional Economist E.A at Stanbic Bank said: “Elevated political temperatures and a lack of access to credit for firms and households, kept the Stanbic PMI in contractionary territory for the third consecutive month. Contingent on a relatively peaceful election in August, the private sector could begin to very gradually show some signs of improvement. However, in the event that the interest rate capping law remains in place for longer, economic activity is unlikely to improve meaningfully over the near to medium term.”

The main findings of the July survey were as follows:

- Output fell for the third consecutive month, contributing to the overall downturn in the private sector. That said, the rate of decline slowed, and was only marginal. Where a decrease was registered, firms widely linked this to the upcoming election, customers facing money shortages, high inflationary pressures and weak demand.

- Having stagnated at the end of the second quarter, new orders rose in July. The rate of increase was only marginal, however. A number of surveyed firms attributed new client wins to promotional activities.

- In contrast, new export orders expanded at a solid pace, but one that remained weaker than the average of the current 12-month period of growth. Panellists commented on greater demand from key international export markets.

- Backlogs rose in the Kenyan private sector during July. The rate of increase eased to the weakest in the current 21-month sequence of growth, however. New customers and cash flow constraints were reported to be the key reasons behind greater capacity pressures. As a result,employment continued to rise in July, albeit only marginally.

- The falls in purchasing activity and inventories registered in June proved short-lived, as the survey signalled renewed rises in both in the latest period. Panellists linked expansions in purchasing and stocks to expectations of future improvements in demand. On the price front, underlying data indicated further pressure on companies’ margins, as firms faced higher cost burdens but continued to offer discounts amid intense competitive conditions

(Markit Economics)