Kenya’s private sector expanded slower in December 2024 than in the month before, with the growth supported by improved sales amid slower employment, the latest Stanbic Purchasing Manager Index (PMI) shows.

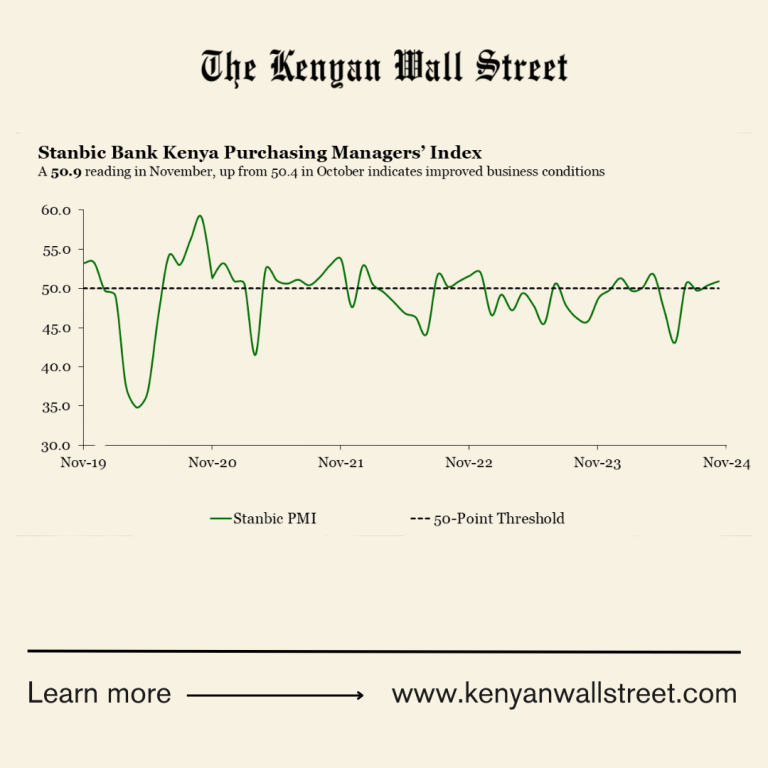

- •The index dropped marginally to 50.6 in December from 50.9 in November, reflecting sustained private sector expansion throughout the last quarter of 2024.

- •PMI readings above 50.0 signal improvement in business conditions while readings below 50.0 imply deterioration.

- •According to the report, a build-up of price inflation at the end of 2024 reflected a sharp increase in input costs prompting private sector firms to raise selling prices at the quickest rate since December 2023.

“Positively, this is the first quarter of expansion in output since Q4 2021, suggesting that the private sector is showing signs of turning around with new orders and employment also in expansionary territory,” Christopher Legilisho, Economist at Standard Bank commented.

Kenyan firms passed on the increased production costs to consumers, prompting an acceleration in the average selling prices in December – the fastest pace in 2024. Higher taxes coupled with increased demand for goods and services, mainly in the agriculture and manufacturing sectors quickened input and purchase price pressures.

“Kenyan businesses reported increased pass-through of purchase prices, and therefore raised their selling prices in December to protect their profit margins,” Legilisho added in the report.

December was marked by improved customer purchasing power – the sharpest recorded since September 2022 – with new bookings and successful advertising campaigns. Meanwhile, businesses offloaded stocks to avoid wastage, leading to the first decline in inventories for five months.

Confidence in the business outlook for 2025 remained weak despite sustained stability in the macroeconomic space including a stable exchange rate, slower inflation and a notable decline in interest rates for government securities.