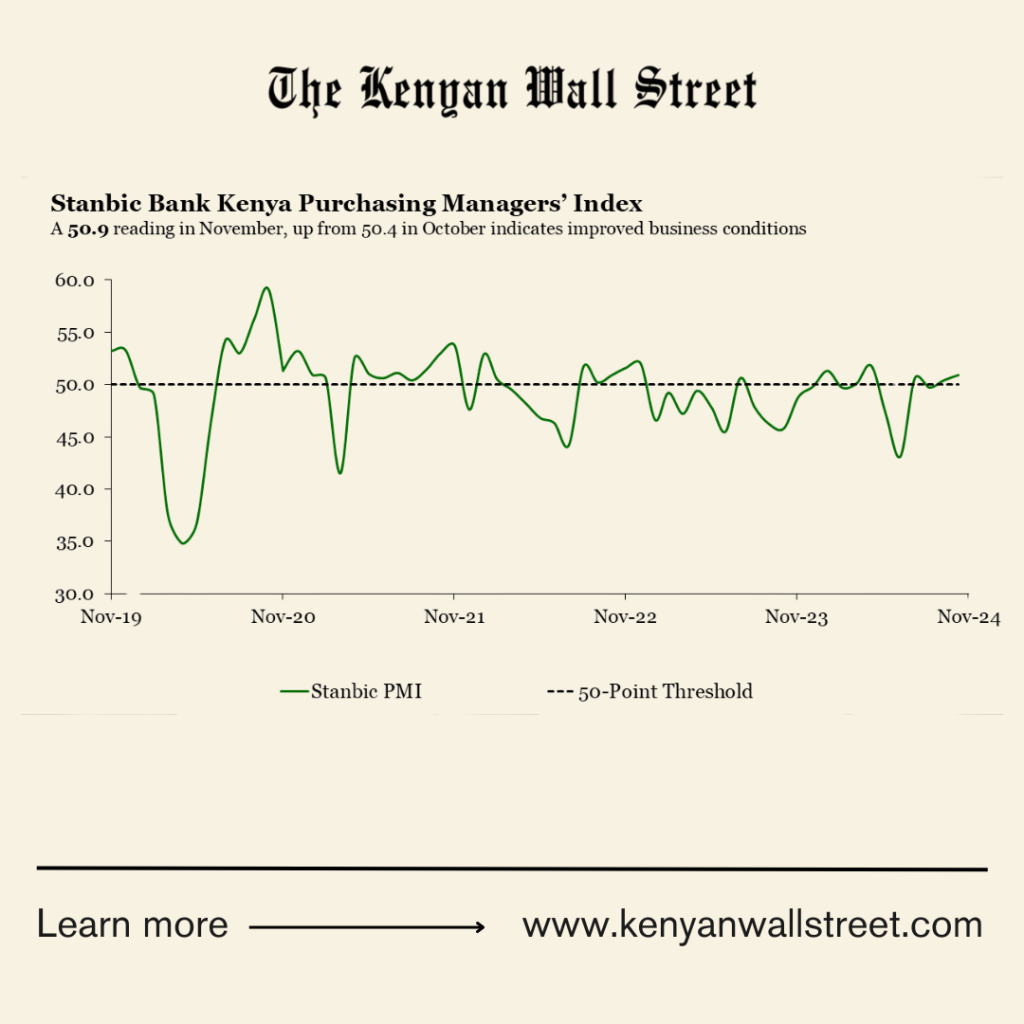

Kenyan firms saw improvement in business conditions in November, marked by improved sales as demand for goods and services increased amid stable employment, the latest Stanbic Purchasing Manager Index (PMI) shows.

- •The index rose to 50.9 in November – the highest reading since May – from 50.4 in October, reflecting a marginal upturn in operating conditions.

- •A PMI reading above 50.0 signals improvement in business conditions while a reading below 50.0 implies deterioration.

- •The faster growth in sales prompted an increase in output leading to an expansion in the overall private sector activity.

“With positive economic momentum, input and output cost pressures increased due to higher taxes and increased outlays by firms to support higher sales volumes,” Christopher Legilisho, Economist at Standard Bank, said in the report.

According to the survey, new orders grew at the fastest pace in 6 months underpinned by an improvement in customer spending and increased travel, driving sales higher especially in the wholesale and retail and services sectors. However, the increase was tempered by declining orders in the agriculture, manufacturing and construction sectors.

While some businesses hired more staff to temper the higher workloads and greater marketing budgets, job creation across the economy slowed down in November.

The average selling prices increased across the sectors – the strongest pace in nine months – fueled higher costs and stronger customer demand. Both input and output costs increased driven by higher taxes and increased spending by firms to forfeit the increased volumes in sales.

Growth in production climbed above the series average in October, supported by accelerated purchasing activity – the fastest since September 2022.

Supply chain conditions remained marginally positive with firms uplifting their stock on the back of improved competition among vendors and better material supply that led to shortened supplier delivery times.

Confidence regarding activity in 2025 remained relatively weak, with just 8% of firms expecting activity to rise over the next 12 months, citing new marketing strategies, digital technologies and branch openings as the expected drivers of growth.

“Despite the notable improvement in current conditions in November, firms remain gloomy about the outlook,” Legilisho added.