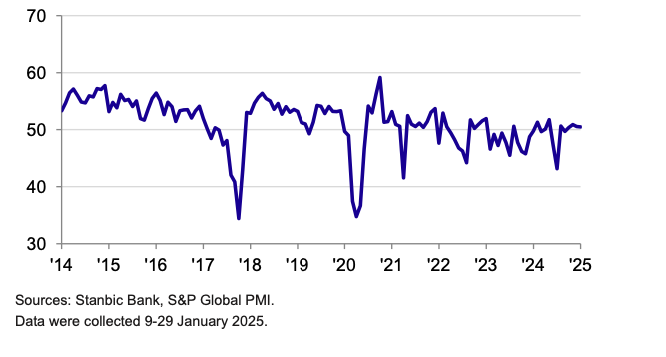

Kenya’s private sector expanded for a fourth consecutive month in January albeit at a slower rate compared to the preceding two months, the latest Stanbic Purchasing Manager Index (PMI) shows.

- •The index dropped marginally to 50.5 in January from 50.6 in December, reflecting sustained private sector expansion throughout the last quarter of 2024 spilling over to 2025.

- •PMI readings above 50.0 signal improvement in business conditions while readings below 50.0 imply deterioration.

- •Kenyan firms experienced sustained increases in output and new orders supported by new client referrals, increased marketing, improved cash flow and an easing of inflationary pressures.

“The Purchasing Managers Index (PMI) expanded for a fourth month running in January but at a slightly weaker pace than in the two preceding months, reflecting the ongoing resilience of the private sector at the start of this year,” Christopher Legilisho, Economist at Standard Bank commented.

Kenyan firms passed on the higher input and purchasing costs to consumers, prompting an acceleration in average selling prices in January. Higher taxes on imported material prices drove up prices of commodities, however, the price inflation eased to the slowest in 3 months.

Production increased in January – the slowest growth rate in 2 months – with increases attributed to higher sales, greater marketing and firmer stock levels.

Purchasing activity witnessed a mild uptick with companies increasing their stocks purchased and inventories held to cover higher sales and potential supply chain disruptions.

“Price pressures remained solid, but moderated from December’s 11-month high. Firms responded by increasing their selling charges further, whilst staffing numbers dropped for the first time since last August,” Stanbic said in the PMI Report.

Payment delays led to increased backlogs of work in January as salaries and wages remained relatively unchanged. While employment levels dropped for the first time since August, most firms maintain their staffing levels stable from 2024.

Despite the moderate growth, optimism levels across the private sector economy for the next 12 months remained weak, with only 6% of the firms giving positive projections leaning on new products and increased marketing activity.