Kenya exported 10.76 GWh of electricity in March 2025, setting a new monthly record primarily driven by Tanzania’s return to importing Kenyan power, ending a six-year absence that had left Uganda as the sole consistent export market.

- •For the first time since January 2018, Tanzania became Kenya’s leading buyer, taking in 7.53 GWh, while Uganda imported 3.23 GWh.

- •While March’s export performance was historic, Kenya remained a net importer of electricity throughout the first quarter of 2025.

- •Imports rose significantly — from 289.94 GWh in Q1 2024 to 390.90 GWh in Q1 2025 — a 34.8% year-on-year increase with inflows from Ethiopia, Uganda, and Tanzania.

In comparison, exports over the same period nearly tripled, highlighting Kenya’s increasingly complex position in the regional power market: both as a growing supplier and a structurally import-dependent grid.

| Month | Total Exports (GWh) | Total Imports (GWh) |

|---|---|---|

| Jan 2024 | 3.41 | 135.54 |

| Feb 2024 | 3.38 | 94.67 |

| Mar 2024 | 3.86 | 59.73 |

| Apr 2024 | 3.80 | 59.97 |

| May 2024 | 3.85 | 55.87 |

| Jun 2024 | 3.94 | 39.87 |

| Jul 2024 | 3.63 | 32.66 |

| Aug 2024 | 3.74 | 49.93 |

| Sep 2024 | 3.72 | 67.02 |

| Oct 2024 | 3.55 | 68.13 |

| Nov 2024 | 3.67 | 138.70 |

| Dec 2024 | 4.45 | 128.14 |

| Jan 2025 | 8.09 | 146.02 |

| Feb 2025 | 6.87 | 124.12 |

| Mar 2025 | 10.76 | 120.76 |

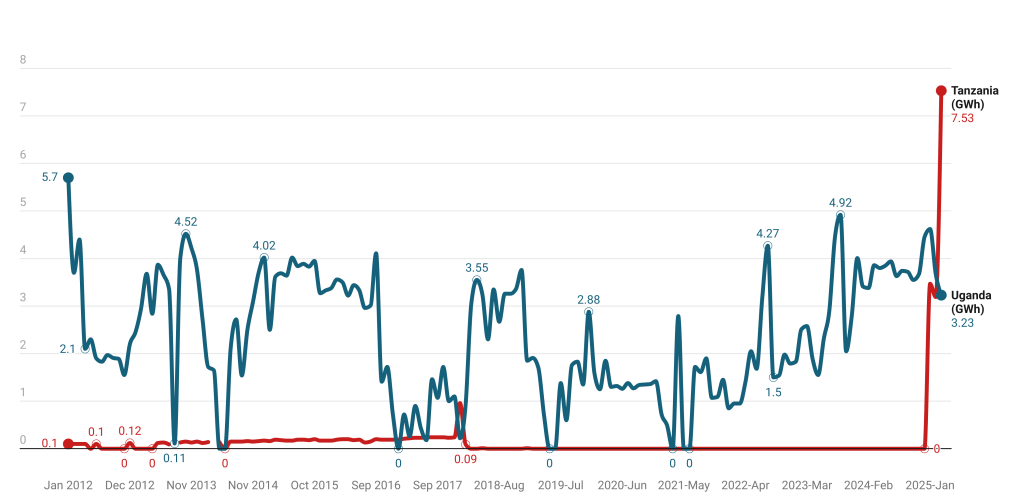

From 2012 to 2023, Uganda consistently absorbed nearly all of Kenya’s electricity exports. Tanzania, meanwhile, played a marginal role — and from 2018 onwards, disappeared entirely from the trade. In 2016, Uganda imported an average of 3.1 GWh/month, while Tanzania averaged just 0.17 GWh.

Between 2018 and late 2024, Tanzania recorded zero or negligible imports, due to a lack of infrastructure and unfinalized agreements. During this period, Uganda remained dominant, sometimes importing nearly 4 GWh/month.

Why Tanzania Left — and Why It Returned

Tanzania halted power imports after 2018 due to:

- •Infrastructure gaps: A functional cross-border transmission line with Kenya did not exist or was inactive.

- •Bilateral delays: Agreements between Kenya Power, TANESCO, and KETRACO remained unsigned, stalling electricity trade.

- •This changed in December 2024, when Tanzania resumed power imports after the commissioning of the Isinya–Singida 400kV transmission line — a 507.5 km project co-funded by the African Development Bank.

The resumption followed the signing of three key agreements:

- •A power exchange deal between Kenya Power and TANESCO

- •A transmission access agreement with KETRACO

- •A joint grid maintenance framework for operational reliability

Kenya’s simultaneous rise in exports and imports illustrates its dual role in the regional energy ecosystem. It is now both a major supplier to neighbors like Uganda and Tanzania, and a strategic importer—particularly of cheaper hydropower from Ethiopia.

The March 2025 export record affirms Kenya’s progress in grid generation and regional diplomacy. But the parallel surge in imports highlights the continued need for reliable interconnection, diverse sources, and strategic balancing.