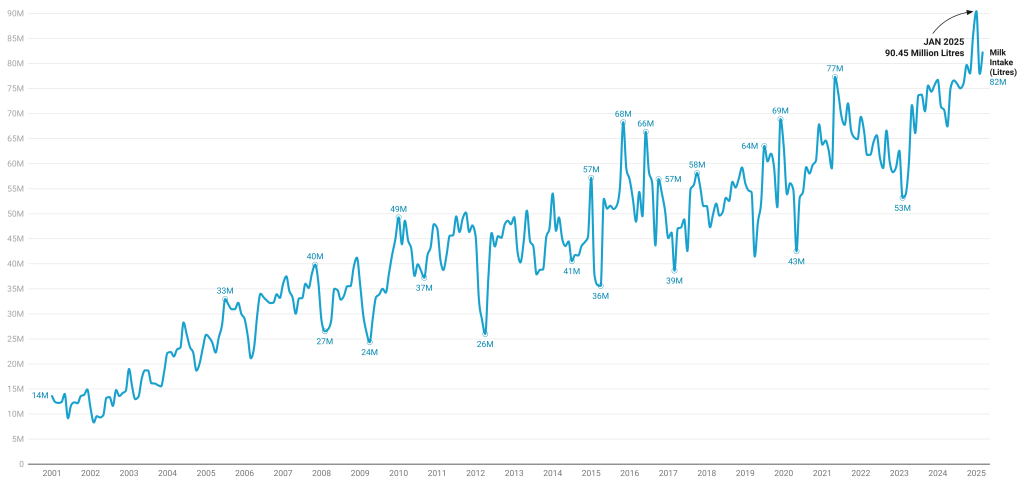

Kenya’s dairy industry has posted a historic Q1 2025, collecting 250.6 million litres of milk intake to formal processors—up 56% year-on-year.

- •Recent data from The Kenya Dairy Board shows that January 2025 delivered 90.45 million litres—the highest monthly intake to processors in Kenya’s history.

- •February followed with 77.94 million litres, and March reached 82.22 million with each month setting new records and outperforming long-term averages (2001–2024) by over 90%.

- •The surge sets the stage for a potential annual intake above one billion litres, driven by improved logistics, favourable climate, and formalization of milk supply chains.

Breaking Seasonal Norms and Long-Term Trends

From just 270 million litres in 2001 to 908 million in 2024, Kenya’s formal sector milk intake has grown at a compound annual growth rate (CAGR) of approximately 7.3% over the past 24 years. Traditionally, milk intake dips in January and February due to dry spells, with peaks observed during the long rains (April–June) and short rains (October–December).

2025 is defying this pattern. January, usually the lowest-intake month, became the highest in recorded history. This unusual trend reflects deeper systemic improvements—climate-smart fodder production, wider use of zero-grazing models, and sustained investments in milk chilling hubs and cooperative networks.

Analysis of monthly trends (2001–2024) reveals important seasonal patterns:

- •Peak Months: May, August, and October consistently register high intake volumes.

- •Trough Months: January and February average the lowest, often below 45 million litres.

- •Notable Surge Years: 2011, 2018, and 2021 showed above-average annual growth, often following strategic policy support or favourable climate events.