Kenya’s 14 microfinance banks (MFBs) have endured one of the toughest decades in the financial sector, with industry data from 2014 to 2024 revealing sustained decline across key indicators, as profitability has collapsed and balance sheets shrunk.

- •The sector’s total assets fell to KSh 57.9Bn in 2024, a 9.8% decline from the previous year and well below the 2019 peak of KSh 76.3Bn.

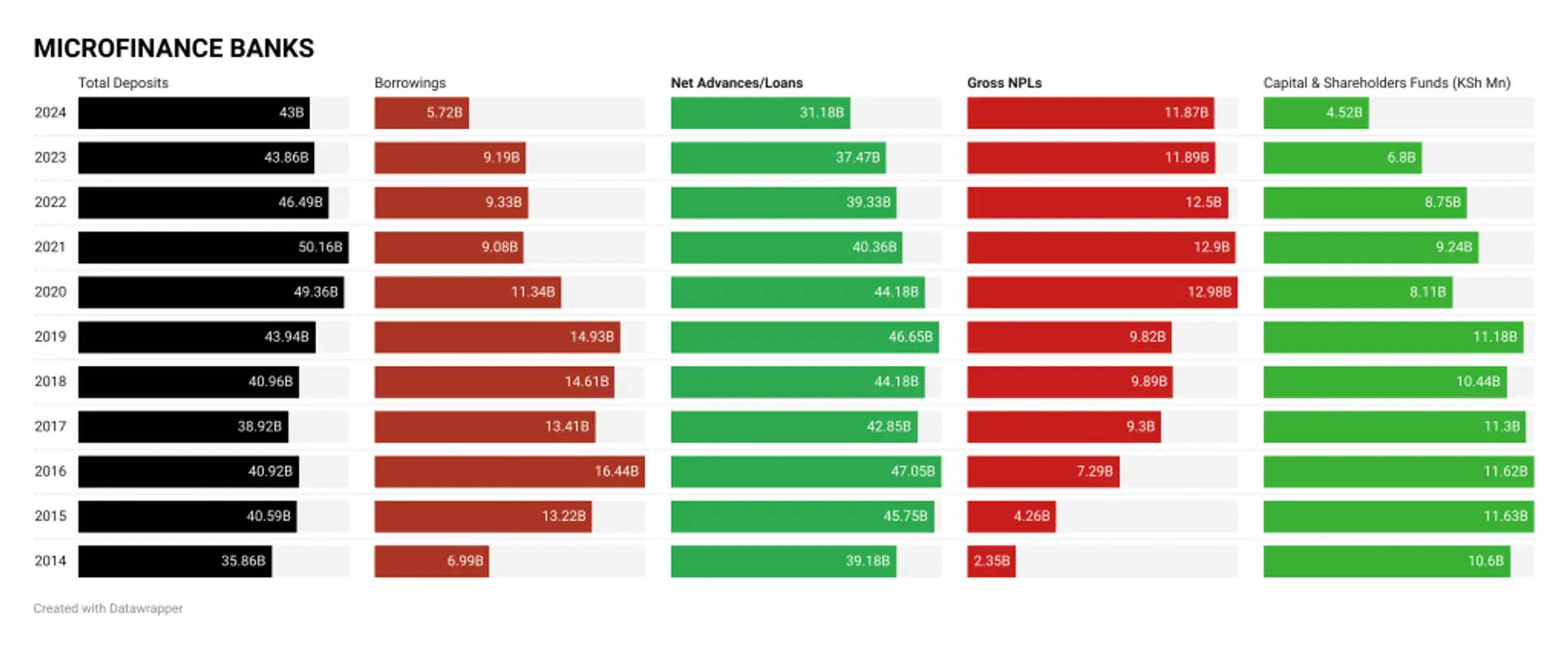

- •The sharpest drag came from loans, which contracted 20% over the decade, from KSh 39.2Bn in 2014 to KSh 31.2Bn in 2024, while gross non-performing loans (NPLs) surged fivefold in the same period, from KSh 2.3Bn to KSh 11.9Bn, pushing the NPL ratio above 35%.

- •Deposits, the main funding base, grew modestly over the decade, rising from KSh 35.9Bn in 2014 to KSh 43.0Bn in 2024, albeit itself a sustained reversal from a high of KSh. 50.16bn in 2021.

“The MFB subsector is highly concentrated. Three of the 14 MFBs account for 87.5 percent of total losses and only three of the recorded profits in 2024,” Central Bank of Kenya (CBK) says in the latest Financial Sector Stability Report.

Profitability and Capital

“Investors evaluate MFBs as risky due to their subdued performance, increase in competition and loss of deposit. The financial sector has also attracted new entrants such FinTech, telecommunication firms, Government, non- Governmental organisation and development finance institutions in the niche market for MFBs. This has brought competition to MFBs, driving them into losses,” the CBK added.

Profitability has been absent for nearly a decade. After small gains in 2014 and 2015, MFBs have posted nine straight years of losses. In 2024, the subsector recorded a combined loss before tax of KSh 3.5Bn, up from KSh 2.4Bn in 2023. KWFT, Faulu, and SMEP accounted for 88% of the losses, while only Caritas, Choice, and Sumac posted small profits. Return on assets fell to -6.1% in 2024, while return on equity deteriorated further to -78.2%.

Shareholders’ funds, which stood at over KSh 11.6Bn in 2015, have more than halved to KSh 4.5Bn in 2024, reflecting continued erosion of capital buffers.

CBK highlights that the sector requires a significant shift in business models. A pivot toward digital platforms, tailored products, and niche segments is necessary, but most MFBs lack the capital to invest in such transformation. Consolidation is presented as a viable path: mergers among MFBs or acquisitions by banks could provide stronger capital and deposit bases to buffer against shocks.