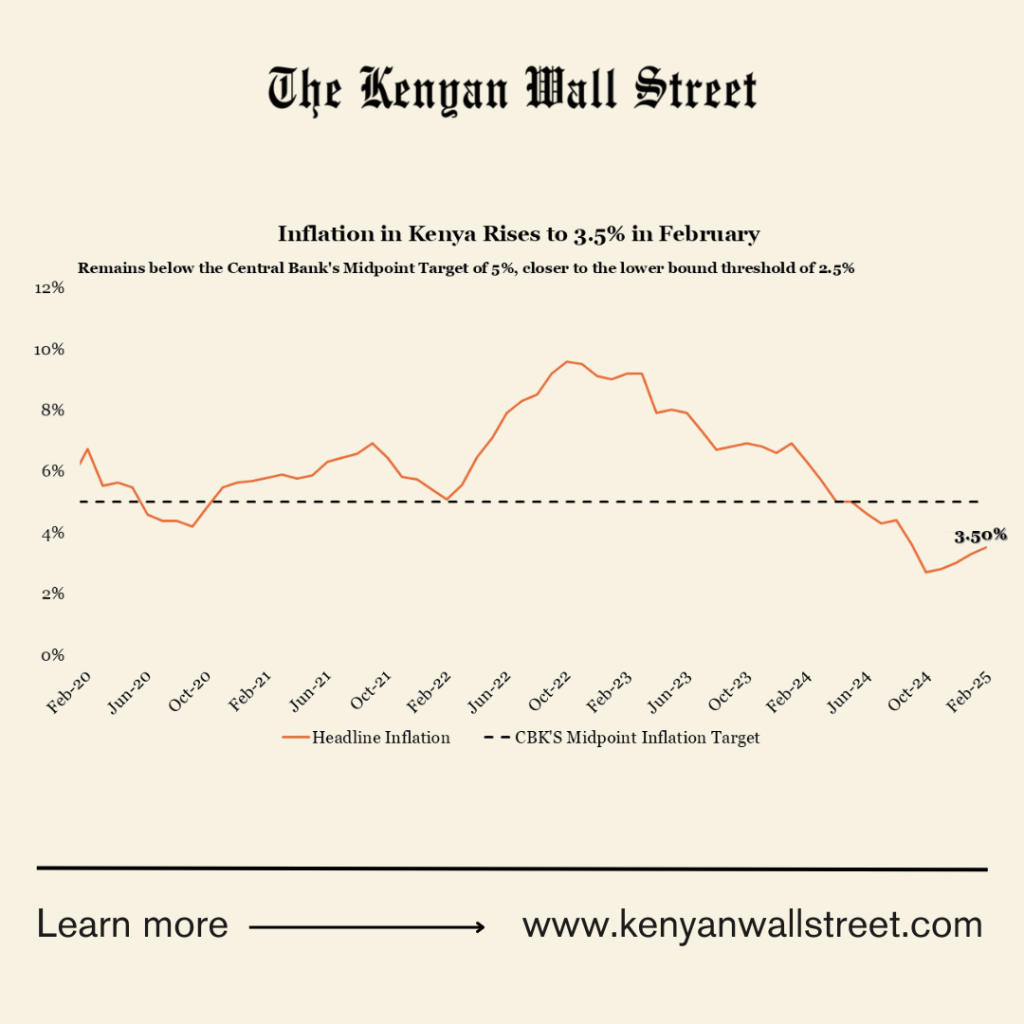

Kenya’s headline inflation rose to a 5-month high of 3.5% in February from 3.3% in January, driven primarily by an increase in food prices.

- •According to the Kenya National Bureau of Statistics, the increase was primarily driven by rising food and energy prices.

- •The 3.5% is still anchored below the Central Bank of Kenya’s (CBK) midpoint inflation target of 5% for the 9th consecutive month.

- •Monthly inflation was up 0.3% resulting from an increase in the overall index from 142.68 in January 2025 to 143.12 in February 2025.

Core inflation, which excludes highly volatile items from the basket, was static at 2.0% in February, reflecting muted demand pressures in the economy. Non-core inflation rose to 8.2% in February from 7.1% in January, reflecting higher prices of food crops and related items, particularly vegetables, on account of seasonal factors.

The food and non-alcoholic drinks prices rose 6.4% in February from 6.1% in January. Prices of sugar, cooking oil and tomatoes went up by 3.2%, 1.6% and 1.3% respectively, which was countered by decreases in prices of wheat flour and Irish potatoes.

Between January and February, LPG Gas prices increased by 0.6% with electricity prices declining by 1.4 percent for the 50kWh and 1.2% for the 200 kWh. Increases in prices for local flights by 4.8% prompted a 0.1% uptick in the Transport index as prices of petrol and diesel were unchanged in the period.

The CBK lowered its benchmark rate in February, bringing the total cut to 2.25% since the esing cycle began in August 2024 to 10.75% in February in a bid to spur economic growth and boost private sector credit growth.

“Overall inflation is expected to remain below the midpoint of the target range in the near term, supported by a low and stable core inflation, expected easing of energy prices, and the stable exchange rate,” CBK said in the Monetary Policy Statement in February.