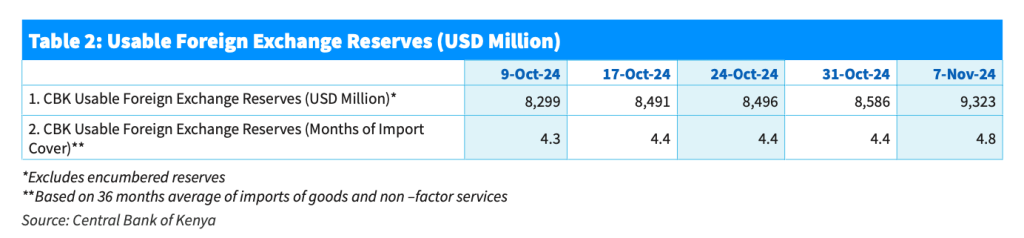

Kenya’s forex reserves have grown by US$1.97 billion in the last ten weeks with the Central Bank of Kenya (CBK) buying excess dollars amid increased supply of the greenback.

- •Last week, Kenya increased its reserves by a record US$737 million or 8.6% to bring the total to US$9.323 billion.

- •The jump comes just a week after the International Monetary Fund (IMF) approved the US$606 million disbursement under the US$3.6 billion medium-term programme with Kenya after months of delays.

- •The current reserves – the highest in 3 years – are enough to cover 4.8 months of imports, both falling above the 4 months statutory requirements and the EAC’s convergence requirement of 4.5 months of import cover.

“We have had a significant increase in foreign exchange, both from banks and diaspora remittances. In order to moderate the fluctuations and volatility in the exchange rate, we have indeed been buying forex and that is part of our role and business,” said Dr Thugge in a post MPC briefing in October.

The shilling remained stable, ranging within the KSh 129.19 to KSh 129.21 mark for weeks now amid a strengthening dollar – on the back of high foreign inflows from agricultural exports and the bulging remittances from Kenyans living and working abroad. Tourism has also boosted dollar inflows to Kenya as the peak season approaches.

The shilling’s stability has also been anchored by the CBK’s efforts to mop up excess liquidity from the market, limiting volatility.

In the past week, emerging markets currencies declined, just after Donald Trump’s victory in the US elections with the dollar recording its biggest single-day gain since 2022. The greenback strengthened against currencies of countries potentially affected by Trump’s high tariffs policy including the Euro, South African Rand, Chinese Yuan, Japanese Yen and the Mexican Peso.

The South African Rand plunged 1.7% on Wednesday with the Chinese Yuan sliding to a 3-month low.The Euro slid to a 4-month low, the Yen fell to a 3-month low with the Mexican peso plummeting to 2022 levels.

While Trump has advocated for a weaker dollar, his policies are likely to drive up inflation and economic growth, prompting the Fed to keep rates high, in turn boosting the dollar.