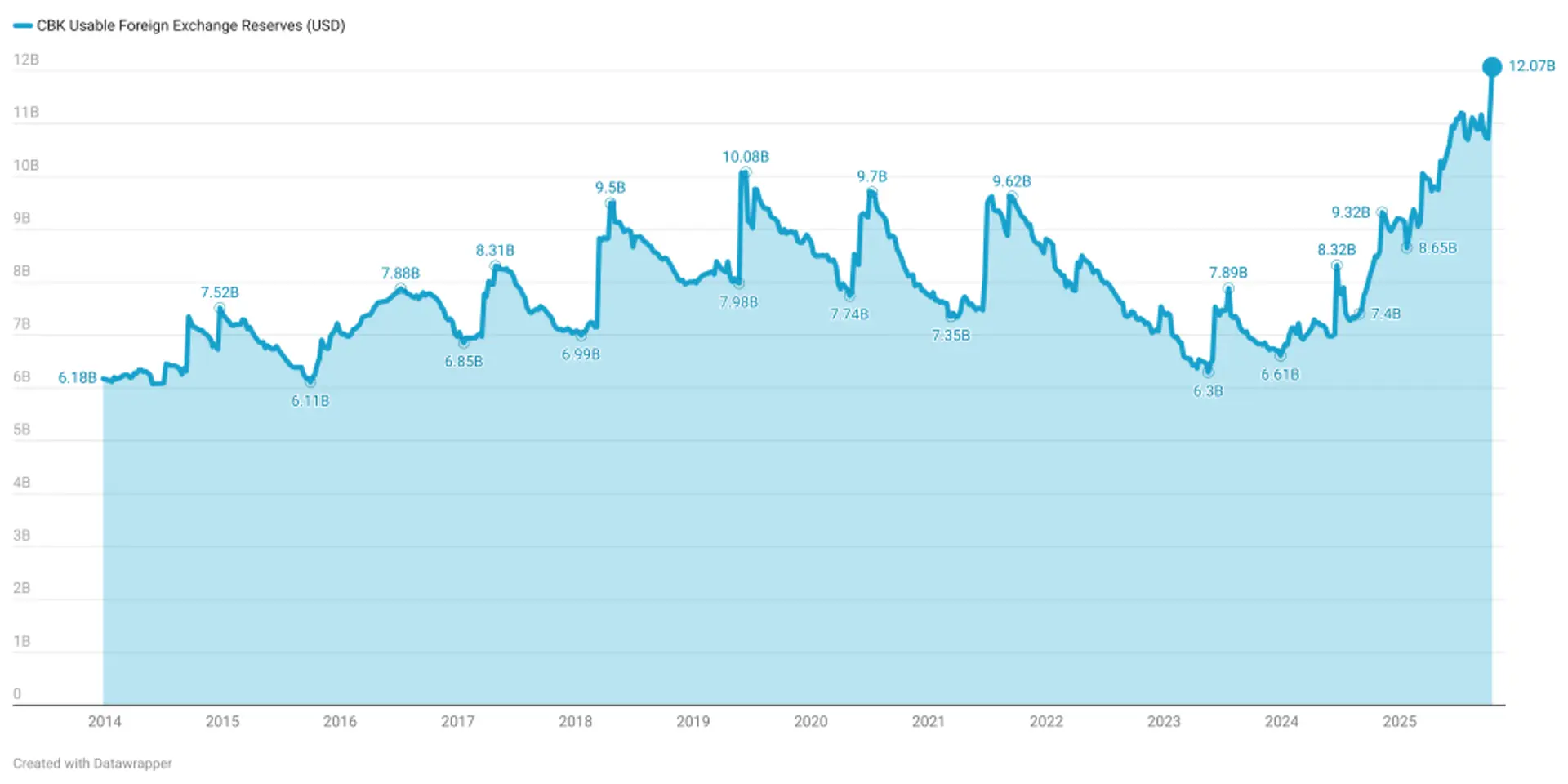

Kenya’s usable foreign-exchange reserves have risen to an all-time record of USD 12.07 billion (KSh 1.56 trillion), the highest level ever recorded since weekly disclosures began.

- •This is the first time FX reserves have crossed the USD 12 billion mark, following a USD 1.36 billion (KSh 176 billion) build-up in the first two weeks of October 2025, according to the Central Bank of Kenya.

- •CBK data show reserves stood at USD 10.72 billion (KSh 1.39 trillion) on October 2, rising to USD 11.23 billion (KSh 1.45 trillion) by October 8, and reaching USD 12.07 billion (KSh 1.56 trillion) by October 15, raising import cover from 4.7 to 5.3 months.

- •The increase marks a reversal from months of moderate drawdowns between July and September 2025, when reserves hovered near USD 10.8 billion (KSh 1.40 trillion).

Eurobond Proceeds Drive the Jump

The sharp rise coincides with proceeds from the government’s October 2025 Eurobond issuance, which raised USD 1.5 billion (KSh 194 billion) across seven- and twelve-year tranches.

The inflows were credited to CBK accounts during the first half of October, boosting the country’s official reserve position and improving external liquidity conditions.

No other significant inflows of comparable size were recorded in the period. Remittance receipts totaled USD 419.6 million (KSh 54.2 billion) in September 2025, broadly unchanged from a year earlier, confirming that the reserve gain was mainly linked to the Eurobond settlement.

CBK continues to report figures on a “usable” basis, excluding encumbered reserves tied to forward obligations.

Policy and Market Impact

The stronger reserve position provides a larger cushion for upcoming external debt-service payments in early 2026 and supports the shilling, which has held near KSh 129.20 per USD. Analysts say the improvement signals restored investor confidence after successful access to international markets.

Higher reserves also give the monetary authority more room to manage short-term currency volatility without drawing down holdings aggressively. The Bank last held more than five months of import cover in April 2022, before a gradual decline through 2023.

CBK’s October 17 Weekly Bulletin confirmed the record level and attributed the change to balance-of-payments inflows, with reserves now at their strongest in the Bank’s published history.