Kenya exported goods worth KSh 37.96 billion to the European Union (EU) between July and September last year, a marginal dip from KSh 38.34 billion in the preceding quarter – according to the latest KNBS figures.

- •In Q3 2023, total exports from Kenya to the EU stood at KSh 38.85 billion, signalling a -2.3% change.

- •In turn, the value of goods imported from the EU fell from KSh 56.79 billion in Q2 2024 to KSh 54.64 billion in the quarter under review.

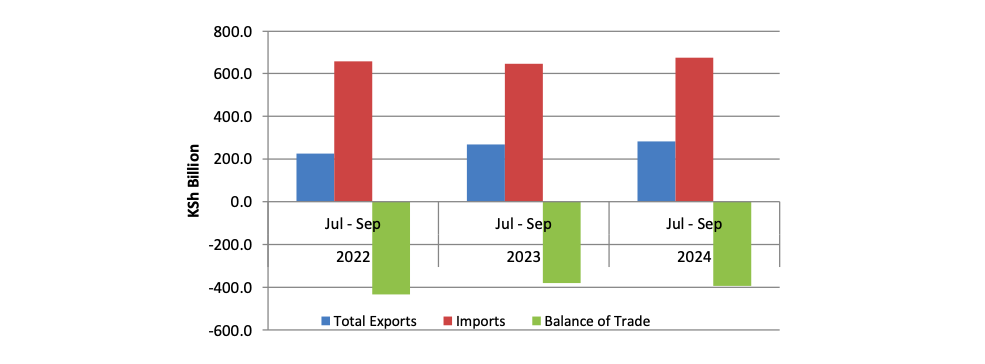

- •Overall exports from Kenya in Q3 2024 were valued at KSh 282.41 billion compared to KSh 275.74 billion in Q2 2024, a 2.4% improvement.

“Trade imbalance widened to a deficit of KSh 393.4 billion from a deficit of KSh 380.0 billion in the corresponding quarter of 2023. The deterioration was occasioned by a higher increase in imports compared to total exports,” KNBS said in the report.

The total value of imports rose from KSh 659.5 billion in Q2 to KSh 675.8 billion in the next quarter. The value of exported horticultural produce from Kenya in Q3 2024 stood at about KSh 50 billion compared to Q2 when it was slightly lower at KSh 46.24 billion. The value of tea produce, however, dipped from KSh 44.7 billion in Q2 to KSh 44.6 billion in Q3.

Agricultural exports remain invaluable to Kenya’s trade position, accounting for 44.1% of the domestic export earnings. In Q3 2024, revenue from these commodities slumped by 3.9% compared to the corresponding quarter in 2023.

“This decline was mainly occasioned by decreased earnings from domestic exports of commodities under primary food and beverage for household consumption; and processed food and beverage for household consumption which shrunk by 3.5 per cent and 11.7 per cent, respectively,” KNBS reported.

The East African Community (EAC) retained its importance as a viable destination of Kenyan exports, recording an increase in the value of goods they imported from KSh 77.99 billion in Q2 2024 to KSh 85.20 billion in Q3. Imports from the region decreased slightly from KSh 26.28 billion in Q2 to KSh 26.25.

Far East Asia as a source of many Kenyan imports was calcified by an increase of value from KSh 278.5 billion in Q2 to KSh 328.3 billion in Q3. Higher import volumes in Q3 2024 were driven by demand in industrial machinery, whose value rose from KSh 70.8 billion in Q3 2023 to KSh 86.2 billion in the review period.

Cement, Titanium and Petroleum Dip

The country’s export of titanium ores declined significantly, from KSh 4.4 billion in Q2 to KSh 713 million in Q3, after the Kwale-based Base Titanium wound up its operations after a decade of operations. The company was formally closed as the year began, marking an end of the lucrative taxes and royalties it supplied the government, as well as thousands of jobs.

Soda ash export values rose from KSh 1.9 billion in Q2 to KSh 2.07 billion in the quarter under review while cement exports declined from KSh 1.28 billion in Q2 to KSh 754 million in Q3.

“Other commodities that registered notable increases in import expenditure during the quarter under review were: plastics in primary and non-primary forms (21.2%); textile yarn, fabrics and related products (29.0%); chemical fertilizers (85.1%); and liquefied propane and butane (62.0%),” KNBS reported.

Comparatively, petroleum products were in less demand during Q3 2024, prompting a decline in import volumes. The value of its imports fell from KSh 142 billion in Q2 to KSh 134 billion in Q3.

“Conversely, import bill on commodities under food and beverage; and fuel and lubricants categories declined from KSh 94.1 billion and KSh 158.9 billion in the third quarter of 2023 to KSh 63.5 billion and KSh 150.4 billion, respectively, in the quarter under review,” the report added.