Kenya’s economy expanded by 4% in the third quarter of 2024, a slowdown from 6% recorded in the same period in 2023 and the slowest in four years, dragged by notable contractions in key sectors such as construction, mining, and quarrying.

- •The Kenya National Bureau of Statistics (KNBS) attributed the deceleration to a general decline in growth in most sectors with contractions in the construction, mining and quarrying sectors.

- •The growth, which compares to 4.6% recorded in the second quarter of 2024, was the slowest since the first quarter of 2021, below the central bank’s forecast of 5.2%.

- •Overall growth was supported by resilient performance from sectors including agriculture, forestry and fishing which expanded by 4.2% albeit slower than the 4.8% recorded in Q2 constrained by a decline in tea production.

The construction sector was hard hit, recording a 2% contraction compared to a 4% growth in 2023 and 2.9% in the second quarter of 2024, triggered by higher costs of building materials and government budget cuts towards construction projects.

“The decelerated growth was largely due to a general decline in growth in most sectors of the economy. The growth was constrained by contractions in Construction and Mining and Quarrying activities,” KNBS noted in the quarterly report.

Similarly, credit to the construction sector declined by 13.6% to KSh 129.2 billion from KSh 149.6 billion in the same period in 2023 owing to the high non-performing loans. Mining and quarrying contracted 11.1% in the period with cement consumption declining by 10%.

Favourable weather conditions throughout the period supported growth in the agriculture sub sectors with substantial increases in the sugarcane and milk production.

Transportation and Storage activities expanded 5.2% from 5.2% in 2023. The growth was fueled by an increase in consumption of light diesel and port throughput, coinciding with a decline in diesel prices over the period. However, passenger numbers at the Standard Gauge Railway declined by 7.2% in Q3 2024.

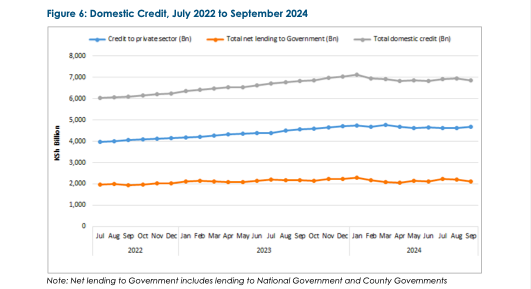

The tourism industry expanded 13.7% in the period from 34.5% in 2023 buoyed by increased tourist arrivals. The financial and insurance services grew 4.7%, compared to 15.5% in 2023 as the cost of credit rose amid the apex bank efforts to nudge rates lower.

The third quarter of 2024 was marked by spillover effects from the deadly protests in June through July, partly corrupting consumption and output levels. On the upside, the moderating inflation towards the target range coupled with the stable shilling during the period counterbalanced, buoying recovery in the subsectors.

In a post monetary policy meeting brief in December, Central bank Governor Dr. Kamau Thugge said the apex bank estimates overall GDP growth of 5.1% in 2024 and 5.5% in 2025.

Two months earlier, the International Monetary Fund (IMF) had lowered its predictions of Real GDP growth for the country from 5.0% in 2024 and 2025. This made Kenya the only middle-income country in Africa that the Bretton Woods institution did not predict would recover in 2025.