Kenya’s economy in 2024 has been a story of shifting tides: a blend of economic pressures and growth prospects, policy recalibrations, and an evolving investment landscape.

While the first half of the year showed a slowdown in key growth indicators, it also underscored the resilience and adaptability of Kenya’s monetary policy and its effects on the broader economy.

Here’s a look at the economic highlights of 2024 and what they mean for investors.

Slowing GDP Growth but Signs of Stabilization

Kenya’s GDP growth decelerated to 4.6% in Q2 2024, compared to 5.6% in the same quarter of 2023.

- •This slowdown brought the total GDP growth for the first half of 2024 down to 4.8%, from 5.5% during the same period last year.

- •The deceleration was widespread across nearly all sectors, with the mining and construction industries being hardest hit, contracting by 2.7% and 2.4% respectively.

- •This decline is more than just numbers—it reflects a nation navigating a series of challenges such as heavy rains in April and May that led to severe flooding, disrupting agriculture and infrastructure.

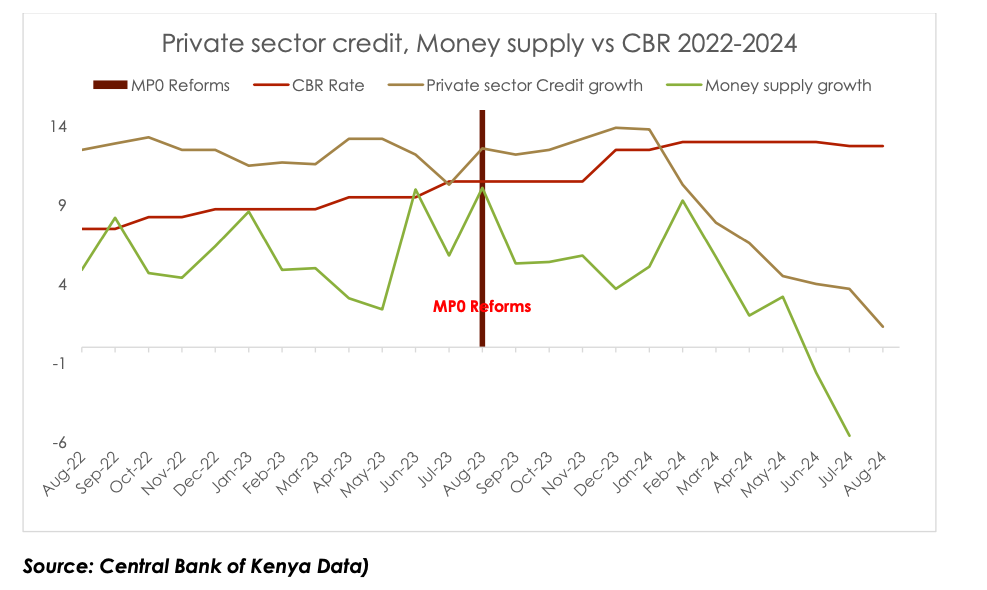

The CBK maintained a tight monetary policy stance to counter inflationary pressures from 2023, which, although effective in controlling prices, tightened credit access for the private sector. This was compounded by political unrest over government tax policies, which saw widespread protests and resistance from citizens and businesses alike.

Some bright spots emerged amid the slowdown. Inflation moderated significantly, bringing a welcome reprieve to consumers, while the Kenyan shilling gained strength against major currencies, and the current account deficit narrowed, signaling some stability in Kenya’s external position.

A Shift in Monetary Policy: From Tight to Loose

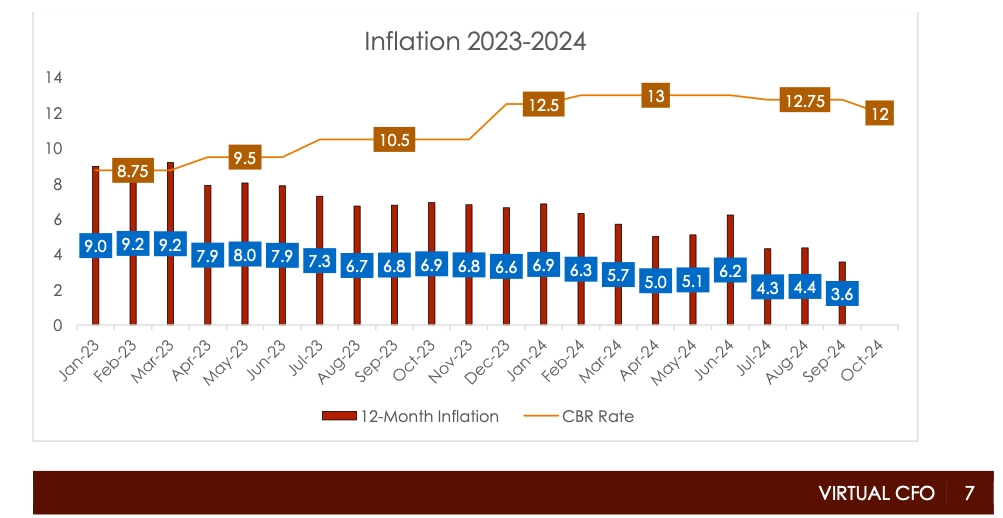

Recognizing the need to rejuvenate economic activity, the CBK pivoted from its tight monetary stance, easing the Central Bank Rate (CBR) from 13.00% in August to 12.75%, and further to 12.00% in October. This shift represents more than just interest rate adjustments; it’s part of a broader strategy to stimulate growth, as inflation dropped from 6.9% in January to 3.6% in September.

This policy shift is anticipated to improve credit flows to businesses and households, support sectoral recovery, and stabilize GDP growth moving forward. It aligns with trends in advanced economies, where central banks are also lowering rates as inflation cools. The CBK’s easing path is a balancing act—it must avoid undermining the gains in inflation control while providing sufficient stimulus for economic recovery.

Reforms Boost Monetary Policy Transmission

One of the most significant stories of 2024 has been the CBK’s reforms to improve the effectiveness of monetary policy transmission into Kenya’s financial markets. Reforms from August 2023 to June 2024 focused on modernizing the monetary policy framework, including introducing an interbank interest rate corridor and adopting a market-based approach to foreign exchange rate reporting.

These reforms have led to more reliable control over inflation, better liquidity management, and increased currency stability. The impact has been tangible: inflation now responds predictably to CBR adjustments, private sector credit flows are stabilizing, and the Kenyan shilling has shown resilience.

For investors, this means Kenya’s economy and financial markets are more predictable and transparent—essential elements for a stable investment climate.

Opportunities and the Road Ahead for Investors

The expected recovery of private sector credit as monetary policy continues to ease offers investors a chance to capitalize on a more dynamic lending environment. As inflation stabilizes and the political landscape becomes clearer, Kenya’s markets are likely to become increasingly attractive.

“Kenya’s 2024 Economic Journey: Challenges, Reforms, and Investment Opportunities” By Virtual CFO (PDF)

For investors, the changes in 2024 open up new opportunities.

- •With lower interest rates and better liquidity, sectors such as real estate, infrastructure, and manufacturing are becoming attractive as financing costs decrease.

- •The strengthened shilling and narrowing current account deficit further enhance Kenya’s appeal for capital inflows, especially as international investors seek stable returns in emerging markets.

- •Private sector lending, which had been constrained, is expected to pick up pace as the policy easing continues.

Additionally, as inflation stabilizes and the political environment gains clarity, the prospects for growth improve, creating a favorable environment for long-term investments.

While challenges remain, the CBK’s responsive monetary policy and recent reforms position the country on a pathway toward recovery and growth. For investors, this period marks a promising entry point into Kenya’s markets, with well-founded optimism that as policy changes take effect, they will unlock new growth opportunities across key sectors.

As Kenya stands at this economic crossroads, those who understand the changing landscape and adapt to it will likely benefit the most in the years ahead.

Ruriga Kimani is a seasoned Business Analyst and Consultant specializing in economics and finance which expertise in financial analysis, strategic planning, and effective risk assessment. His email address is dominicruriga[at]gmail.com.

Editor’s Note: This is an abridged version of a full analysis accessible here (PDF).