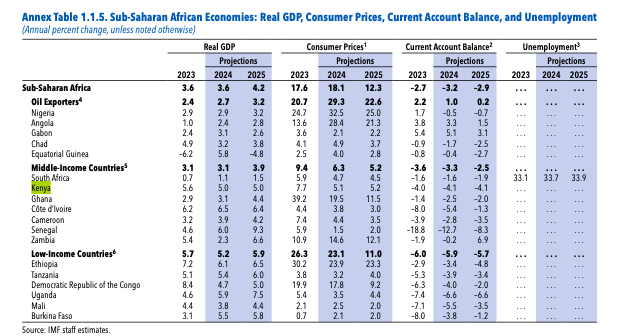

Kenya’s economic growth, as measured by Real GDP growth, will slow down from 5.6% in 2023 to 5.0% in 2024 and 2025 respectively, the International Monetary Fund has predicted in its latest economic outlook report.

- •Among middle-income countries on the continent, Kenya’s is the only economy that the Bretton Woods institution does not predict will recover in 2025.

- •It, for example, predicts 1.1% growth for South Africa this year, and 1.5% in 2025, and 3.1% for Ghana in 2024, 4.4% in 2025.

- •The IMF predicts that the rise in consumer prices, which was 7.7% in 2022 and 6.6% in 2023, will slow down to 4.5% in 2024, before rising to 5.3% by the end of 2025.

“In emerging market and developing economies, disruptions to production and shipping of commodities—especially oil—conflicts, civil unrest, and extreme weather events have led to downward revisions to the outlook for the Middle East and Central Asia and that for sub-Saharan Africa,” the IMF said in the report.

The Bretton Woods institution projects GDP growth for Sub-Saharan Africa from an estimated 3.6% in 2023 to 4.2% in 2025, as the adverse impacts of prior weather shocks abate and supply constraints gradually ease. It, however, revised its previous projection in April by 0.2% for 2024 and upward by 0.1% point for 2025.

Besides the ongoing conflict that has led to a 26% contraction of theSouth Sudanese economy, the revision reflects slower growth in Nigeria, amid weaker-than-expected activity in the first half of the year.

Demand for semiconductors and electronics, as the global race for artificial intelligence and significant investments in renewable energy, have boosted growth in Asia, offsetting the downward revisions for Sub-Saharan Africa, Central Asia, and the Middle East on the global scale. The IMF expects global growth to reach 3.1 percent in the next five years, a figure it terms “a mediocre performance compared with the prepandemic average.”