Kenya’s private sector remained in good health at the end of the third quarter, with business conditions improving at a solid pace, according to the latest Purchasing Managers’ Index™ (PMI™) data released by Stanbic Bank and market research firm, IHS Markit.

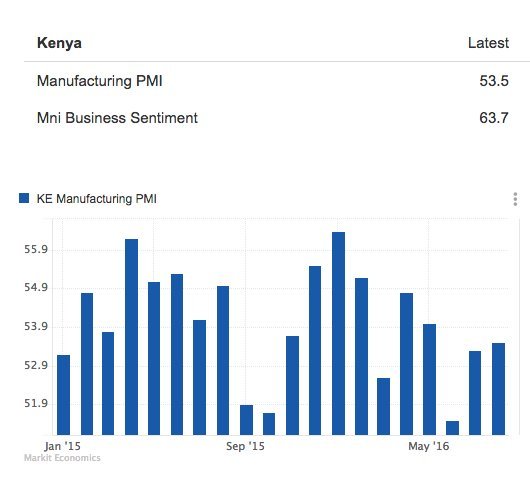

The seasonally adjusted index posted 53.5, barely changed from July (53.3) and August (53.5) but higher than the record low seen at the end of the second quarter (51.5). The latest figure pointed to a solid improvement in business conditions.

Expansions of output, new orders, employment and purchasing, all supported growth of the sector as a whole. In particular, activity rose at the fastest pace in seven months. This led in turn to substantial inventory building aimed at catering for current and future output requirements.

Commenting on September’s survey findings, Jibran Qureishi, Regional Economist E.A at Stanbic Bank said: “The Stanbic PMI continued to show an improvement in business conditions in September, although the average from the second quarter of the year remained unchanged at 53.4 in Q3. This sustained amelioration is largely on the back of a rebound from the tourism sector attributed to improved security conditions and subsequent hosting of high profile conferences.

“Furthermore, it’s important to highlight that new export orders rose owing to penetration into markets such as Namibia, Sudan and Ethiopia. This diversification of export markets will only serve to underpin the Kenyan private sector’s resilience.”

Improving demand were evidenced in latest survey numbers, as new business rose markedly again. However, the rate of expansion eased to a three-month low, and was muted in the context of historical data.

According to the survey, the amount of new export work rose for the second successive month in September. Anecdotal evidence highlighted expansion into new markets such as Namibia, Sudan and Ethiopia.

On the jobs front, Kenyan private sector firms took on extra staff in September. Moreover, the rate of hiring was at a four-month high. The rise in employment was insufficient to lift capacity pressures, however, as backlogs rose to the greatest extent in the series history. Some companies mentioned a lack of funding for ongoing projects.

Greater output requirements had the knock-on effect of increased purchasing, latest data showed. Buying activity increased sharply, as did stocks of purchases. The rate of inventory building was the second-sharpest on record.