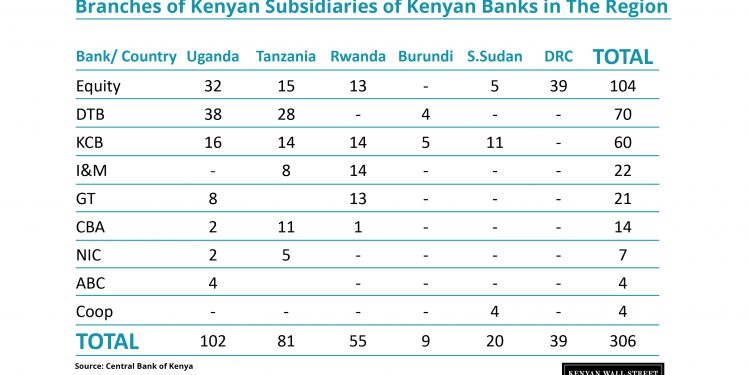

As at December 31, 2017, there were nine Kenyan banks with a total of 306 subsidiaries operating across the region, employing a total of 6,106 employees according to Central Bank of Kenya’s industry supervision report.

“The increasing number of branches demonstrates the potential for banking services within the region.” Central Bank states.

These banks included KCB Group, Equity Group, Cooperative Bank of Kenya Ltd, NIC Bank Ltd, Diamond Trust Bank of Kenya, I&M Bank Ltd, African Banking Corporation Ltd, Commercial Bank of Africa Ltd, and Guaranty Trust Bank Ltd.

Equity Group Holdings had the highest number of subsidiaries standing at 104, followed by Diamond Trust Bank at 70, and KCB Group at 60. KCB group reduced the number of its branches in South Sudan from 17 to 11 in 2016 due to security reasons and it could further reduce this number.

Some Kenyan banks have also expanded beyond the East Africa Community boundaries and ventured into countries such as the Democratic Republic of Congo (DRC), Malawi, Mauritius, and Botswana. For instance, I&M Bank Kenya holds 50 per cent shares in Bank One Limited in Mauritius, Equity Group has a 79 per cent share in ProCredit Bank in DRC, and Prime Bank Kenya holds 11.24 per cent shares in Botswana’s Capital Bank. Equity Group had 39 branches in DRC the year-end 2017.

Performance

The total assets of the subsidiaries stood at Sh526 billion compared to Sh445 billion in 2016. The increase was contributed “by Bank One Mauritius (Ksh.25.6 billion), Equity Bank Uganda Limited (Ksh.10.96 billion), ProCredit Congo (KShs.9.36 billion), Equity Bank Rwanda Limited (KShs.5.69 billion), I&M Bank Rwanda Ltd (Ksh.5.84 billion) respectively.”

Subsidiaries in Tanzania contributed to the highest share of the total assets by 28.59 per cent followed by Uganda at 21.23 per cent and Mauritius at 18.55 per cent.

Total gross loans of the subsidiaries rose from Sh286.6 billion compared to Sh242.4 billion in the previous year while gross deposits grew from Sh348.7 billion to Sh402.1 billion. However, profit before tax dropped Sh8.88 billion to Sh879 billion. The decrease was mainly recorded in Uganda and Tanzania. The number of employees working at the subsidiaries also decreased from 6,223 to 6,106.