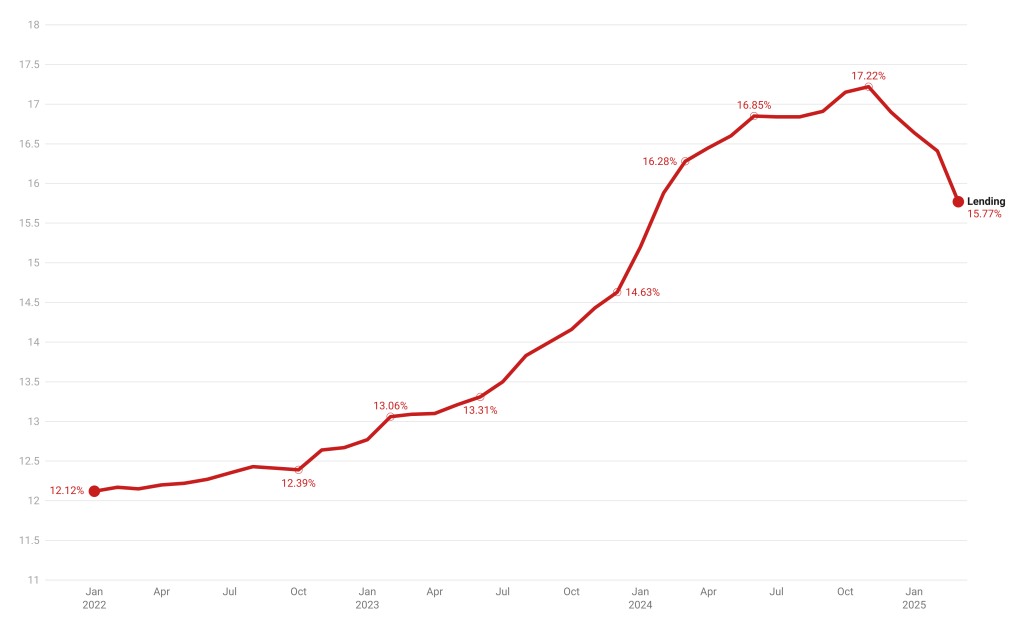

Kenya’s commercial banks’ average lending rate eased to 15.77% in March 2025 — the lowest level recorded in over a year — marking a turning point after months of elevated borrowing costs.

- •Data from the Central Bank of Kenya (CBK) shows that throughout 2024, commercial banks’ average lending rates stayed stubbornly above 16%, peaking towards the year-end as banks priced in elevated risk and the high Central Bank Rate (CBR).

- •This decline follows a period of tight monetary conditions, where commercial banks’ average lending rates surged to a peak of 17.22% in November 2024.

- •The drop brings welcome relief to borrowers and businesses alike, after a year of grappling with high credit costs.

From January 2025, the commercial banks’ average lending rates began to soften:

- •January 2025: 16.64%

- •February 2025: 16.41%

- •March 2025: 15.77% (lowest since February 2024)

This marks a cumulative drop of 1.45 percentage points from the November peak.

The decline comes in the wake of the CBK’s decisive monetary policy easing:

- •Since October 2024, the CBK has reduced the Central Bank Rate (CBR) five times to reach 10.00% in April 2025, down from a peak of 13.00%.

- •The cuts have been driven by easing inflation — which stood at 4.1% in April 2025, within the target range — and the need to boost credit uptake and economic growth.

This transmission of lower CBR into average lending rates marks a key success for the CBK’s ongoing easing stance.

Disparities Among Banks

While the overall commercial banks’ average lending rate dropped to a 13-month low in March 2025, wide disparities remain across individual banks.

Some lenders have already passed on the benefits of lower Central Bank Rates (CBR) to borrowers, while others continue to price loans at elevated levels.

Here are the top 5 banks with the cheapest and most expensive average lending rates over the past six months, highlighting the contrast within Kenya’s banking sector:

Top 5 Cheapest Banks

| Bank | Oct-24 | Nov-24 | Dec-24 | Jan-25 | Feb-25 | Mar-25 |

|---|---|---|---|---|---|---|

| Citibank N.A | 18.34% | 17.16% | 15.33% | 13.34% | 12.78% | 11.14% |

| Stanbic Bank | 17.44% | 17.14% | 13.97% | 13.86% | 12.76% | 12.76% |

| Consolidated Bank | 13.46% | 13.45% | 13.46% | 13.34% | 13.31% | 13.34% |

| Ecobank Kenya | 13.49% | 13.49% | 13.38% | 13.29% | 13.28% | 13.21% |

| Guardian Bank | 14.49% | 14.61% | 15.06% | 14.17% | 13.88% | 13.64% |

Top 5 Most Expensive Banks

| Bank | Oct-24 | Nov-24 | Dec-24 | Jan-25 | Feb-25 | Mar-25 |

|---|---|---|---|---|---|---|

| Middle East Bank | 21.19% | 21.19% | 22.00% | 22.01% | 21.62% | 20.63% |

| Access Bank (Kenya) | 20.23% | 20.30% | 20.27% | 20.90% | 20.79% | 20.50% |

| CIB Kenya | 20.20% | 20.30% | 20.20% | 20.90% | 20.70% | 20.30% |

| Credit Bank PLC | 20.49% | 20.34% | 20.17% | 20.08% | 19.89% | 19.82% |

| HFC Limited | 19.99% | 20.14% | 20.14% | 20.10% | 19.77% | 19.45% |

These figures underscore the reality that while monetary easing has brought down average borrowing costs, the market remains fragmented. Some banks have aligned swiftly with falling CBR rates, while others — particularly smaller and risk-focused lenders — maintain much higher rates, often exceeding 20%.

This wide gap has fueled fresh debate over Kenya’s loan pricing models, with the Central Bank of Kenya (CBK) pushing for a shift from risk-based lending to a more standardized CBR-linked formula, a proposal facing stiff opposition from the banking industry.

- •Risk-based pricing, introduced after the removal of interest rate caps in 2019, allows banks to adjust rates based on borrower profiles. However, critics argue this leads to opacity and weakens monetary policy transmission.

- •In response, the CBK has proposed a CBR-linked lending model — where commercial banks’ lending rates would be anchored to CBR plus a fixed premium — to standardize loan pricing and ensure rate cuts flow through to borrowers.

- •The proposal faces resistance from the Kenya Bankers Association (KBA), which argues that it may reintroduce de facto rate controls and limit credit to riskier segments.