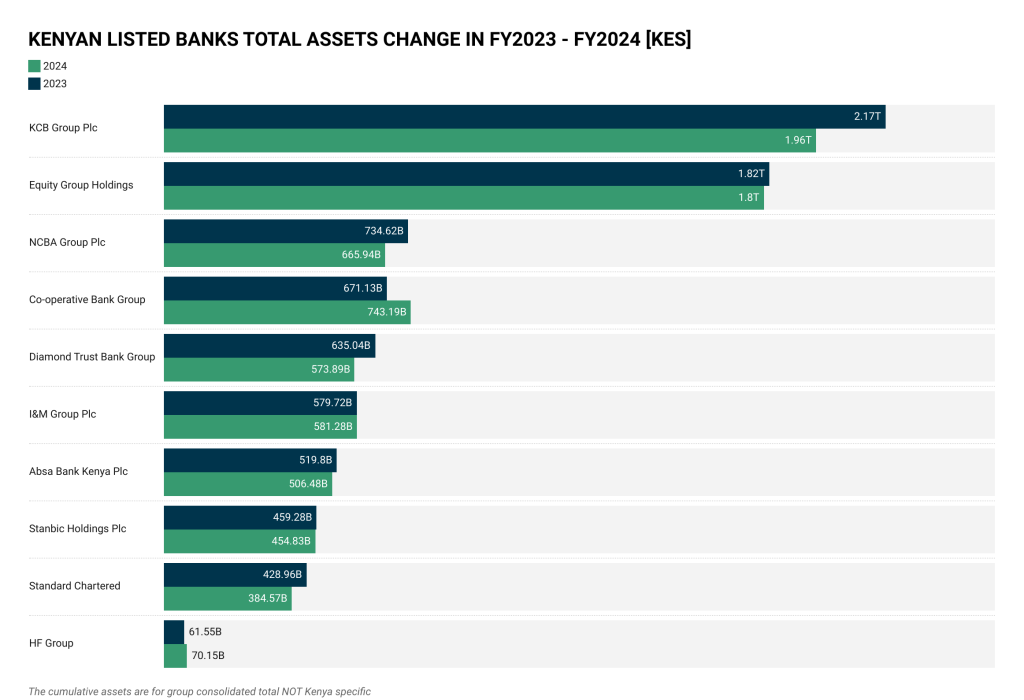

The banking industry in Kenya has been growing at a steady rate for two decades, with the total asset base of the current 10 listed banks rising from KSh 376.57 billion in 2004 to an all-time peak of KSh 8.08 trillion in 2023. However, in 2024, the sector experienced its first decline in asset value in decades, with the total asset value of listed banks-excluding Bank of Kigali-falling to KSh 7.75 trillion, a 4.15% drop.

The Decades-Long Growth Story

Since 2004, Kenya’s banking sector has witnessed consistent double-digit growth, fueled by financial inclusion, digital transformation, and regional expansion. Key milestones over the years include:

- •2008 (+39.28%) – Rapid expansion driven by increased bank penetration and economic growth.

- •2010s Boom – The rise of mobile banking, fintech innovations, and agency banking.

- •2023 Peak (+27.82%) – A strong post-pandemic recovery amid rising credit demand.

This uninterrupted growth came to an end in 2024, as the sector recorded its first annual decline in two decades.

KCB Group’s Significant Contraction

KCB Group led the asset decline in the sector, shedding KES 208.6 billion. Key drivers of this contraction include:

A KES 105.5 billion reduction in net customer loans. Read KCB FY24 Results!

- •A KES 131 billion drop in deposits held with foreign banks.

- •KCB’s balance sheet contraction accounted for nearly 50% of the total sector decline.

High Interest Rates & Inflation Impact

The Central Bank of Kenya (CBK) maintained a tight monetary policy, with the Central Bank Rate (CBR) reaching a decade-high of 13% in February 2024. This led to:

- •Increased lending rates, discouraging borrowing.

- •Higher loan default risks, with Non-Performing Loans (NPLs) at 16.5% as of September 2024, reflecting economic strain.

Several banks experienced asset contractions in 2024, including:

- •NCBA Group: Assets dropped by KES 68.7 billion (-9.35%) to KES 665.94 billion, mainly due to reduced net loans and interbank placements.

- •Diamond Trust Bank (DTB): Declined by KES 61.9 billion (-9.63%), closing at KES 573.88 billion, driven by lower customer deposits and slowed asset growth strategies.

- •Standard Chartered Bank Kenya: Fell by KES 44.4 billion (-10.35%) to KES 384.57 billion, linked to reduced lending and foreign currency deposit adjustments.

Despite the overall decline, some banks saw notable asset growth:

- •Co-operative Bank led the growth, increasing by KES 72.1 billion (+10.74%) to reach KES 743.2 billion, overtaking NCBA as the third-largest bank by assets. Read Coop FY24 report.

- •HF Group recorded a KES 8.6 billion (+13.97%) growth, reaching KES 70.15 billion.

- •I&M Group posted a modest increase of KES 1.6 billion (+0.27%), closing the year at KES 581.28 billion.