[bctt tweet=”Based on the progress made so far, Kenya is certain to achieve universal access to formal financial services in the next three to four years. This is according to a report by Kenya Bankers Association (KBA), the industry’s lobby group.”]

While mobile money transfer and lending have facilitated many transactions, financial inclusion and universal access to formal financial services remain the banking industry’s rallying call as cash is still king.

While banks have increased lending to various sectors of the economy, much remains to be done to reduce the barriers to finance for vulnerable groups in the society, including women, youth and persons with disabilities.

Habil Olaka, CEO Kenya Bankers Association(KBA)

In its Kenya Banking Industry, 2019 Shared Value Report, the banking industry lobby group highlights some of the initiatives member banks have adopted to increase penetration of formal financial services.

The report notes that many people living in rural areas, including youth, women, and people with disabilities continue to be under-represented in the prudentially regulated financial services ecosystem.

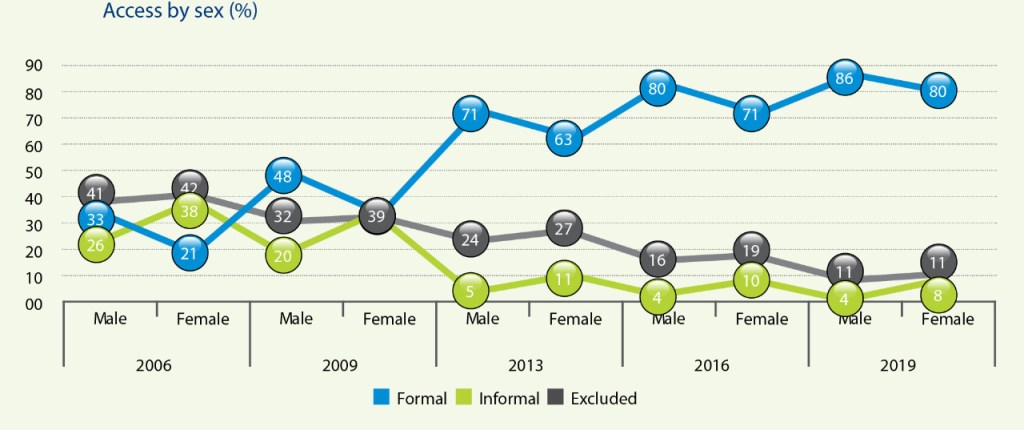

[bctt tweet=”Figures by the 2019 FinAccess household Survey show that the number of men with access to financial services in Kenya stood at 86 percent against 80 percent for women. The trend marks an improvement of 3 percent since 2016.”]

Overall, the 2019 FinAccess household Survey indicates that access to formal financial services increased from 75.3 percent in 2016 to 82.9 percent in 2019, while the percentage of the population excluded went down from 17.4 percent to 11 percent over the same period.

This positive trend is largely attributed to mobile banking offered by banks in partnership with mobile network operators (MNOs), application programming interfaces (APIs) and the integration of the two through platforms such as PesaLink launched in 2017 by KBA’s subsidiary Integrated Payments Services Ltd. (IPSL).

The untold story of Kenya’s financial inclusion success is how banks have underpinned the growth of mobile banking which has had a transcendent impact on deepening the country’s financial services sector.

To fill the capacity gap, KBA in October 2018 launched the Inuka Enterprise Programme.

[bctt tweet=”Together with the Kenya Institute of Management (KIM), Kenya National Chamber of Commerce and Industry (KNCCI), and the Kenya Association of Manufacturers (KAM), Inuka facilitates access to finance through training, networking and coaching opportunities.”]

To fortify these efforts, KBA has established an online platform (inukasme.co.ke) where entrepreneurs access valuable information on how to overcome challenges that may cripple their start-ups and small businesses.

[bctt tweet=”“I feel privileged to have gone through the Y-Bizna Programme. I am now a different person. I learnt how to keep up-to-date business records and to plan ahead. I was also guided on how to obtain a bank loan.”– Kevin Uduny, an urban farmer”]

Related: