In the first half of 2024, Kenya’s financial markets saw a significant surge with the shilling and Nairobi Securities Exchange (NSE), outpacing global peers.

Data compiled by The Kenyan Wall Street shows that the shilling surged 17.2%, becoming the best-performing currency worldwide, while bond market turnover doubled to KSh 781.8 billion. The NSE posted an impressive 50.4% growth in dollar returns, buoyed by a robust stock market rally and a significant increase in foreign investor participation, which rose to 65.6%.

Currency

At the dawn of 2024, the highly volatile shilling fell further, touching all time lows of above 160 against the greenback on the fear of looming defaults. The government made a move in early February to buy back 72.3% of the June Eurobond maturity with the balance cleared on 21st June, just days before the maturity date.

Generally, the strong performance was buoyed by the long term transitory effects of the tightened monetary policy in the hindquarter of 2023, the Eurobond buyback in February and the IFB1/2024/8.5 bond issued in February 2024 which attracted dollar denominated inflows with a whooping 412.4% subscription rate.

Stock market

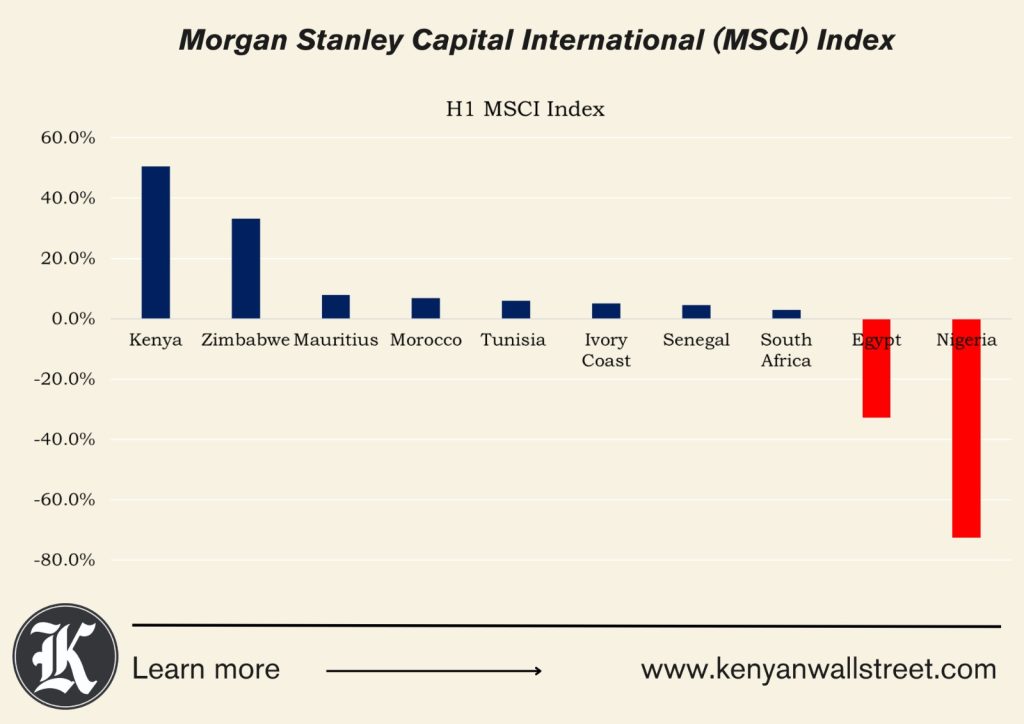

The Nairobi Securities Exchange (NSE) outperformed African bourses in dollar returns , growing 50.4% in the first half of the year, according to data from Morgan Stanley Capital International (MSCI).

Market capitalization, which measures investor wealth, shot up 18.4% to KSh 1.7 trillion at the close of the first half of 2024 signaling recovery. Consequently, activity across the equities market surged with the total turnover clocking KSh 47.5 billion.

The equities market, as signaled by the NSE All Share Index (NASI), gained 18.9% in H1, on the back of stronger FY ’24 results especially from the banking sector coupled with the gaining shilling that boosted investor confidence in the country.

Foreign participation was up 65.6% in the 6 months to June as compared to 35.9% in the same period in 2023. Foreign investors have been attracted to the NSE following the gaining shilling and supply of US dollars in the local market, boosting their returns and making it easy to liquidate their positions.

“We continue to witness significant improvements in investor sentiments and confidence within the market registering positive net investors inflows for three consecutive months,” NSE CEO Frank Mwiti said at a recent event.

Fixed income market

Trading volumes in the bonds market doubled in the six months to June to KSh 781.8 billion up from KSh 309.9 billion recorded in the first half of 2023, partly attributed to the infrastructure bond issued in February 2024 which attracted dollar denominated inflows.

The bond turnover falls marginally short of the Ksh I trillion mark milestone buoyed by increased investor sentiments in the first half.

Interest rates on government securities have been sustainably high, with investors riding the tide whilst the government keen on preventing locking in high borrowing costs over the long term.

Treasury bills were more attractive to investors for the 6 months pointing to attractive yields currently offered, all trailing above the 15.95% mark.

Additionally, the bond index, a benchmark for listed government bonds, was up 3.4% year to date to 1037.3.

Derivatives

Volume traded in the first half of 2024 surpassed the full year 2023 total turnover to clock KSh 81.7 million. The derivatives market has grown steadily since its launch in July 2019 with investors keen on hedging against the prevailing market risks.

Inflation

Price pressures eased steadily during the 6 months, with the latest reading showing 4.6% compared to 7.9% in June 2023.

The cooling pressures stemmed from the falling fuel prices on the back of a strengthening shilling during the period coupled with CBKs “higher for longer” approach.

Business environment

According to the Stanbic PMI, business conditions remained stable, trailing between the expansion and contraction territory clocking an average of 49.9, dropping to 47.2 in June, the sharpest drop in seven months.. PMI readings above 50.0 signal improvement in business sentiment while a reading below 50.0 signal deterioration.

This is largely attributed to the abating inflationary pressures and the gaining shilling pointing to the prolonged CBKs hawkish monetary stance.

What’s Next in the 2nd Half of 2024

This half of 2024 presents a mix of escalated geopolitical tensions and simmering global risks, posing uncertainties in the broader economic landscape. With easing inflation across the board, interest rate cuts from both major and frontier economies are on edge. Locally, the scrapped Finance Bill has led to looming budget cuts, increasing the risks of increased deficits and liquidity risks.

“Markets will take cues from fiscal developments, even as Parliament makes legislative amendments to the FY25 budget starting later this month,” Churchill Ogutu, an n Economist at IC Group, told The Kenyan Wall Street.

“For markets, revised domestic borrowing targets will be keenly monitored, as an indicator as to where rates should be. Further to this, inflation and currency performed favorably in the first half, and the focus this second half will be the start of the easing cycle. On the baseline, we think CBK will tread carefully with a first cut in October, although there is wiggle room to cut in August in the best-case scenario,” Ogutu added.