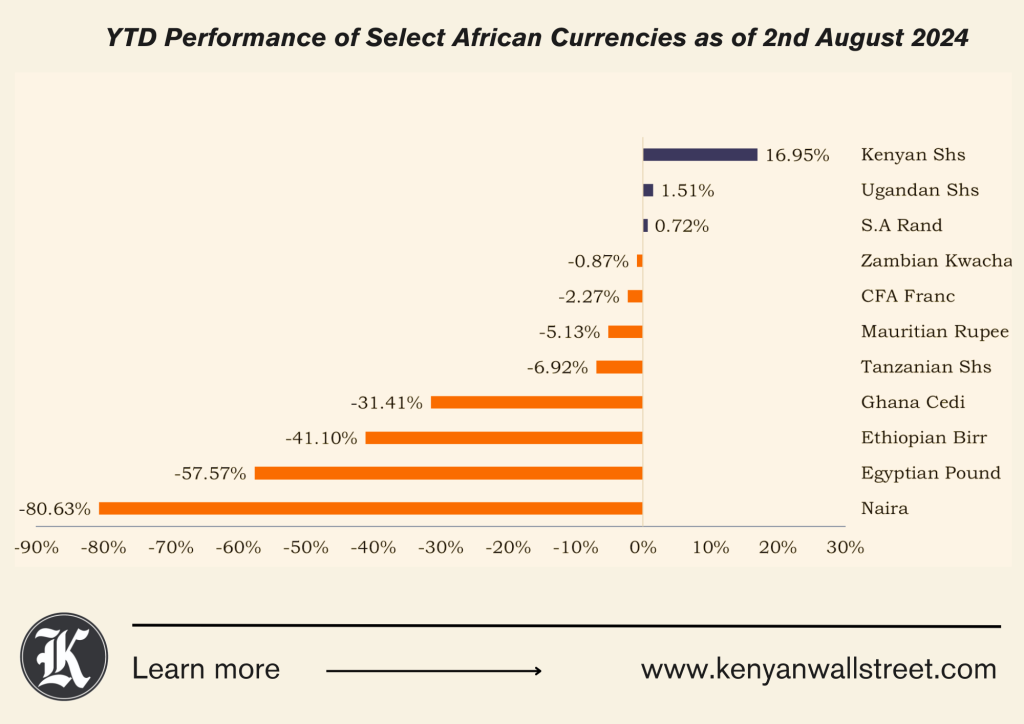

In the first seven months of 2024, the Kenyan Shilling remained the best performing currency in the region, with a year-to-date gain of 16.95 per cent.

- •African currencies continue to weaken against the US Dollar, prompting some governments to recalibrate or relaunch their currencies to contain the pressures.

- •The shilling has been bullish against the greenback since February owing partly to the settled sovereign maturity coupled with improved Foreign Direct Investments stemming from attractive yields on government securities.

- •However, the currency remains prone to global shocks and shifts in market sentiments with the Central Bank of Kenya keen on mitigating potential extended risks.

A stronger currency has many benefits to a country and plays a huge role in attracting foreign investments and reducing the price of imports.

The Naira weakened the most with a year-to-date loss of 80.63% on the back of the Central Bank of Nigeria currency devaluation for the second time in 2024, new forex rules, elevated inflationary pressures and the tight liquidity of foreign currency.

Similarly, the Egyptian pound weakened the 2nd most following a currency devaluation by the Central Bank of Egypt, deliberately allowing the pound to weaken by more than 38 percent in March.

Additionally, the apex bank in Egypt increased interest rates to all-time highs of 27.35 percent following the International Monetary Fund’s (IMF) consistently advocating for a tighter monetary stance to address the escalating inflation and the foreign exchange shortage.

The IMF reportedly postponed two reviews for Egypt’s existing loan as a result of conditions that need to be met.

Notably, the Ethiopian Birr was floated last week, prompting an extended loss of about 30 percent in a single day and consequential looming inflation. The move to liberalize the Ethiopian currency came in months after talks with the IMF and the World Bank.

In 2023, Ethiopia defaulted on a US$ 33 million Eurobond obligation, prompting reliance on the Bretton Woods institutions in a bid to secure external funding.

The Ghanaian Cedi has been on a bearish run for the first seven months of 2024, depreciating 31.4 percent against the dollar, on the back of foreign currency shortage.

Further, uncertainty surrounding the debt restructuring with external creditors following Ghana’s US$30 billion default on sovereign bonds a year ago.

“Weaker currencies push up public debt. About 40 percent of public debt is external in sub-Saharan Africa and over 60 percent of that debt is in US dollars for most countries. Since the beginning of the pandemic, exchange rate depreciations have contributed to the region’s rise in public debt by about 10 percentage points of GDP on average by end-2022, holding all else equal.” read an analytical note from the IMF’s regional outlook for Sub-Saharan Africa.

The currency trends across the region present complexities in the African economies even as governments rally to protect their currencies from external shocks. The depreciations point to elevated interest rates in the major economies, pushing investors away from the ‘risky’ African continent.

Additionally, Budget deficits continue to pinch in turn putting pressure on the exchange rates by driving high the demand for foreign currency. This underscores the need for fiscal management across in the higher-for-longer regime.

See Also: