Nairobi Securities Exchange listed Kenya Re-Insurance Corporation (Symbol; KNRE) has released its FY 2016 results posting a decline in Net Profit by 8 per cent to Sh 3.3 Billion compared to Sh 3.56 Billion posted in 2015. The decline was mainly as a result of a 39% increase in operating expenses to Sh 1.8 Billion on the back of increased forex losses during the year.

Total income grew by 4% to Sh 17.0 Billion while net earned premiums increased by 6% to Sh 12.7 Billion. Investment income and Gross written premiums were unchanged at Sh 3.1 Billion and Sh 13.2 Billion respectively.

Provision for doubtful debts increased by a huge 485% to Sh 665 Million as pre tax profits fell by 7 per cent to Sh 4.2 Billion.

Despite the decline in Earnings, the company declared a final dividend of Sh 0.80 per share, an increase of 6.67% when compared to a dividend of Sh 0.75 issued in 2015.

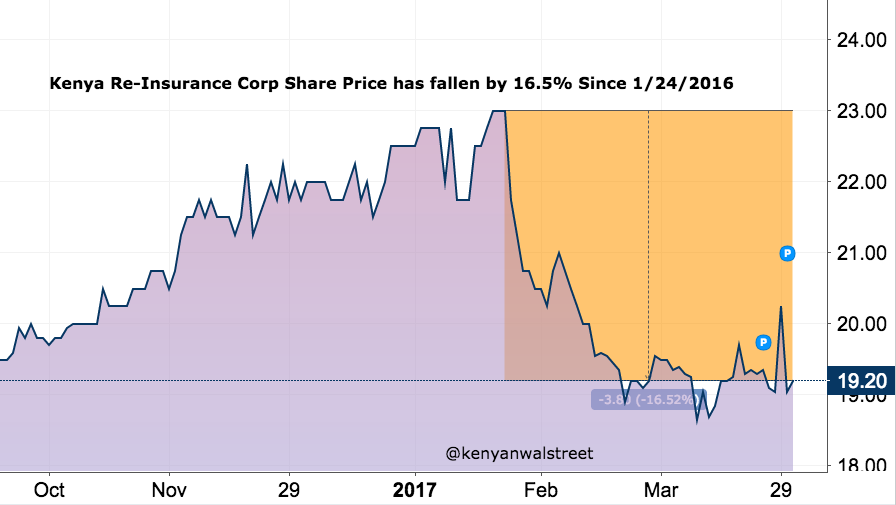

Share Price Movement

On Friday’s trading session, Kenya Re share Price closed the day at Sh 19.2, a decline of 16.5 per cent from a high of Sh 23 traded on 24th January as shown from the chart below.