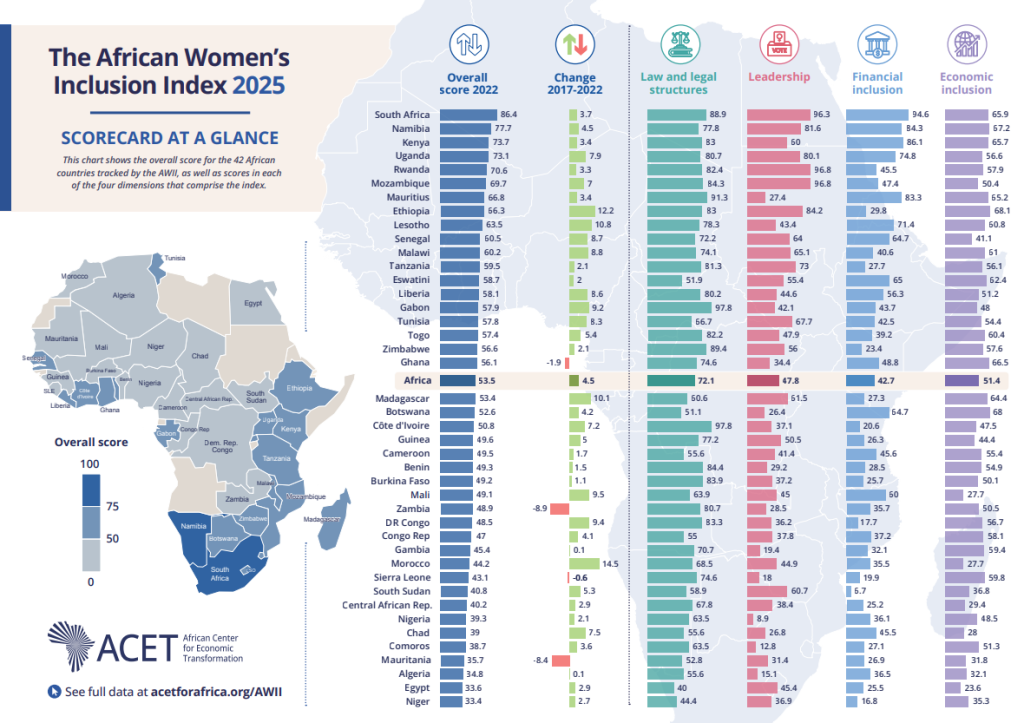

Kenya now ranks third in Africa for women’s financial and economic inclusion, according to the 2025 African Women’s Inclusion Index (AWII).

- •With a total score of 73.7, Kenya follows South Africa (86.4) and Namibia (77.7).

- •It leads East Africa and scores well above the continental average of 53.5.

- •The African Center for Economic Transformation (ACET) developed the index to track progress across four key areas: law, leadership, financial access, and economic participation.

Kenya scored 86.1 in financial inclusion, driven by its strong mobile money ecosystem. Programs like the Women Enterprise Fund and inclusive credit offerings have helped women access financial services. But since 2017, growth has slowed to just a 1.1-point gain. Many women, particularly in informal sectors, still struggle to access credit and digital banking tools.

Kenya scored 83.0 in the law and legal structures dimension, reflecting gender-equal policies on property rights and access to financial services. However, weak enforcement and traditional norms continue to limit impact—especially in rural areas.

| Dimension | Score (2022) | Change (2017–2022) |

|---|---|---|

| Legal Frameworks | 83.0 | 0.0 |

| Financial Inclusion | 86.1 | +1.1 |

| Leadership | 60.0 | +12.9 |

| Economic Inclusion | 65.7 | –0.5 |

| Overall | 73.7 | +3.4 |

In leadership, Kenya scored 60.0—showing progress but lagging behind top performers like Rwanda and Ethiopia. Women still hold few senior roles in government and corporate decision-making.

The biggest challenge remains economic inclusion. Kenya scored 65.7 here, but its performance dropped slightly in the last five years. Most women work in informal jobs, earn less, and lack workplace protections.

ACET warns that at the current pace, full financial and economic inclusion for African women will not happen until 2093. Kenya’s progress shows that policy and innovation can drive results. But without deeper change in leadership and formal employment, inclusion will remain uneven.