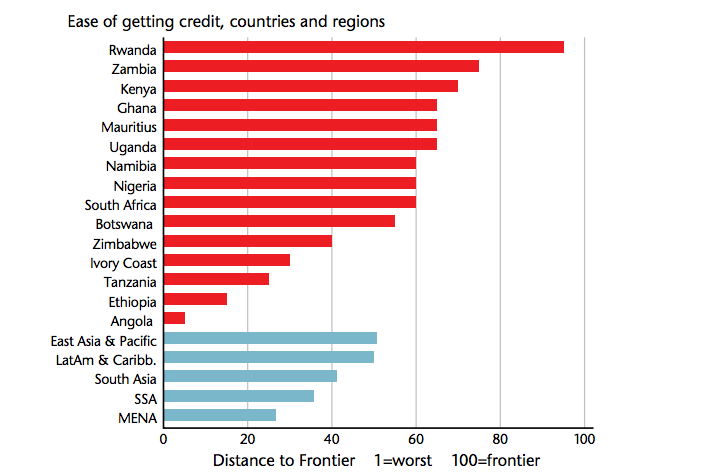

According to the latest report produced by the Oxford Economics in partnership with the Institute of Chartered Accountants in England and Wales (ICAEW), Kenya is ranked third among Sub-Saharan Africa’s top three nations in regards to ease of access to credit.

The report ranks Rwanda as the best in Sub-Saharan Africa in terms of getting credit, followed by Zambia, Kenya, Ghana, Mauritius and Uganda. It notes that Kenya & Rwanda have particularly made reforms aimed at facilitating easier access to credit through strengthening borrowers’ and lenders’ collateral laws.

Kenya recently adopted a law aimed at capping interest rates so as to protect borrowers against higher rates as well as spur economic growth through cheaper financing. The law prohibits banks from lending at rates of not more than 4% above the Central Bank Rate.

Generally, the Sub Saharan African region performs poorly in terms of accessing finance compared to other regions of the world, – only the Middle East and North African region does worse. Nigeria and South Africa have strong financial and banking markets; but in Nigeria, insufficient foreign exchange and maturing debt obligations pose a risk to accessing credit according to the report.

Compared to the West African region, the East African region’s borrowing costs are relatively much lower mainly supported by lower inflation rates and the diversified economies which are less dependent on commodities. The report also revealed that Kenya enjoys lower borrowing costs compared to Uganda.