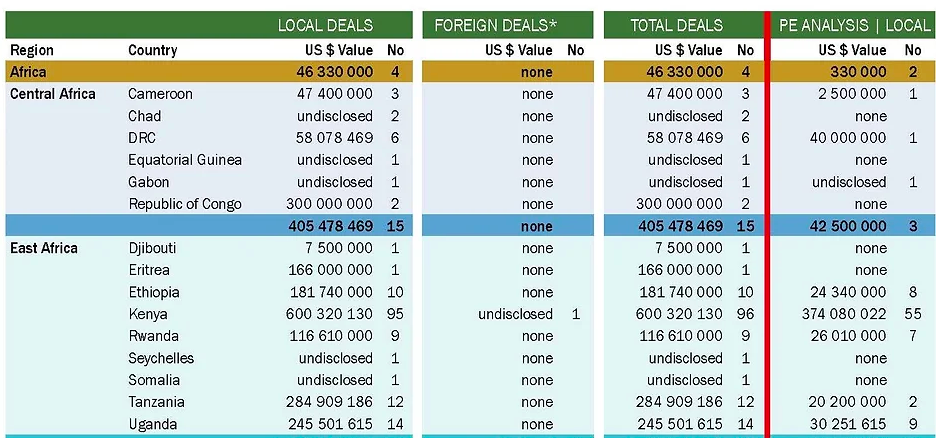

Kenya led East Africa in deal activity in 2023, with a total of 96 deals worth US$ 600.3 million, followed by Tanzania at 12 deals worth US$ 285 million, and Uganda with 14 deals worth US$ 245 million.

According to the 2023 DealMakers AFRICA Annual report:

- •The value of deal activity recorded in Africa was US$ 11.2 billion, a 36% decline on the previous year, and 28% down on the pre-COVID numbers of 2019.

- •East Africa edged its way back to the top to claim the most activity per region, recording 144 deals, followed by West Africa (136 deals) and North Africa (107 deals).

- •The power houses of their regions, Kenya and Nigeria recorded the most deals at 96 and 82 respectively.

In terms of deal value, it was Southern Africa which stood out, and more specifically, Zimbabwe, with total deals valued at US$5.8 billion, reflecting the size of several mining transactions announced during the year.

As a percentage of the total deal value, private equity transactions continue to increase and have, for the past few years, constituted 50% of the deal flow.

East Africa Deals of the Year 2023

1. Disposal of James Finlay (Kenya) to Browns Investments and Kipsigis Highlands

Scottish multinational James Finlay (Finlays) announced its partial exit from the Kenyan market last year. The company will be acquired by B Commodities ME, a subsidiary of Browns Investments (85%) – a strategic investment arm of Sri Lanka’s LOLC Holdings. Browns Investments and James Finlay have mutually agreed to offer 15% of the shares for sale to Kipsigis Highlands Multipurpose Cooperative Society.

The deal is valued at US$ 23.6 million.

Finlays has, however, retained ownership of the Saosa tea extraction facility, to be rebranded as Finlays Extracts Kenya.

2. Disposal by Bamburi Cement and Cementia of Hima Cement (Uganda)

Ugandan conglomerate, Sarrai Group and regional investment firm Rwimi Holdings are to acquire Bamburi Cement’s 70% stake in the Ugandan and Rwandan operations, with the remaining 30% being acquired from Cementia Holding (also part of the Holcim Group).

The deal is valued at US$ 120 million, subject to adjustments post-transaction completion.

For Bamburi, the sale is a strategic move that will unlock capital and enable it to focus on the more lucrative operations in Kenya.

3. East Africa Device Assembly Kenya Joint Venture

East Africa Device Assembly Kenya (EADAK), a project to set up Kenya’s first electronics device assembly plant, is a joint venture between local telecommunications operators Safaricom, Jamii Telecommunications, Industrial Technology Training Company , and Chinese device dealer, TeleOne Technology.

The assembly plant is expected to produce 1.2 million smartphones in its first year, and has the capacity to produce 3 million per year, though this would require some 300 staff working around the clock in shifts.

The factory is projected to generate up to 500 direct jobs.

East Africa Private Equity Deals of the Year 2023

1. Ascent Capital Africa’s Exit of its Stake in Guardian Health

Through its Ascent Rift Valley Fund (RVF), Ascent Capital Africa has exited its six-year investment in Ugandan pharmacy, Guardian Health, selling it to Kenya-based pharmacy and personal care e-commerce company, MYDAWA. Guardian health founder and CEO, Anthony Natif also disposed of his stake, giving MYDAWA full control of the retail pharmacy chain.

The online health platform announced the acquisition in July 2023, after raising US$ 19.9 million from London-based private equity investor, Alta Semper Capital, representing the largest single investment the platform has received to date.

Ascent’s US$ 80 million ARVF acquired a controlling interest in Guardian Health for an undisclosed sum in 2017. The fund injected working capital into the business, growing the pharmacy from a footprint of five stores to a chain of 19 stores in six districts, with a workforce of over one million.

2. Exit by Finnfund of its Stake in Lake Turkana Wind Power to BlackRock

In March 2023, Finnish development financier and impact investor, Finnfund announced the exit of its stake in Lake Turkana Wind Power (LTWP) in Kenya, an investment it has held from the initial construction phase of the wind farm in 2014.

Other investors also exiting LTWP are Danish turbine manufacturer, Vaestas (12.5%), and the Danish Climate Investment Fund, managed by IFU (6.25%).

BlackRock will acquire the 31.25% stake through the Climate Finance Partnership (CFP). In addition to CFP, ownership of the wind farm now includes entities such as Anergi Turkana Investments, Milele Energy, and Sandpiper.

The fund plans to invest at least 25% of its assets under management in Africa, and this investment by CFP is its first in Kenya.

The Lake Turkana wind farm was connected to the national grid in 2018. It comprises 365 wind turbines, each with a capacity of 85 kilowatts, translating into a wind power facility with a 310 MW capacity, serving 1.2 million homes.

3. Exit by Maris and Nvision of a Majority Stake in Equator Energy to IBL Energy and STOA

In February 2023, Maris (an African-focused investment company) and Nvision (an African-focused solar company) announced the exit of a majority stake in Equator Energy to a Consortium comprising IBL Energy and STOA.

Financial Details were not disclosed.

Equator Energy was launched by Maris and Nvision in 2016, and operates the largest commercial and industrial solar power portfolio in East Africa, mainly in Kenya and Uganda, with smaller operations in Zimbabwe, Somalia, Gambia, and South Sudan, and subsidiaries in Bulgaria, Kenya, Mauritius, and Uganda.

Equator Energy’s portfolio currently stands at 35MW of solar plants in operation, with 17MW in procurement. The solar provider aims to develop 300MW of solar projects over the next five years.

“It is evident from African M&A activity during the period that international players are taking note (and capitalising) on many of these opportunities on the continent. Faster growth prospects, less competition and “cheaper” acquisition opportunities compared with those in their home markets may continue to drive international interest in African companies. In addition, potential game changing initiatives such as the African Continental Free Trade Area (AfCFTA) and related agreements and protocols are also expected to spur M&A on the continent, both from within and outside of Africa.” SaKhaya Hlophe-Kunene and Johann Piek, Directors at PSG Capital said.

See Also: