Kenya’s January private sector growth improved slightly in the month of January, underpinned by a sharp expansion in new work which was supported by a steep increase in new export orders, according to the Purchasing Managers’ Index survey released by Stanbic Bank and HIS Markit.

Firms raised their payroll numbers slightly, while there were signs of ongoing pressure on operating capacity. Output increased at a modest pace that was the weakest since mid-2016. On the price front, charges rose for the fourth successive month amid a further increase in input costs.

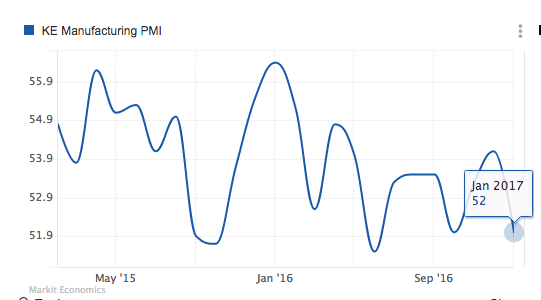

At 52.0, the seasonally adjusted PMI was consistent with a modest improvement in the health of the Kenyan private sector at the start of 2017. The respective index slipped back from the eight-month high of 54.1 in December and was below the series average (54.5).

“The Stanbic Bank PMI fell to a 3-month low in January starting the New Year more sluggishly after a solid close in 2016. In fact, since the legislation to cap interest rates came into effect in September 2016, we can now see signs of distress within the private sector as presented by lament about cash shortages. A further slowdown in private sector credit growth and poor weather conditions will most likely lead to a downward trend in the PMI over the coming quarter, more so as costs for firms will most probably rise,” said Jibran Qureishi, Regional Economist E.A at Stanbic Bank.

Having accelerated in the previous two months, output growth softened to a moderate pace in January. Anecdotal evidence linked the increase to improved market demand. However, growth was reportedly restricted by cash shortages.

Capacity pressures

Firms raised their staffing levels in January, but at the weakest rate in six months. Concurrently, capacity pressures continued to build, with backlogs accumulating for the fifteenth successive month. A number of companies indicated that greater workload was the primary factor behind the latest increase in outstanding business.

On the price front, higher raw material costs were reported to be the primary factor behind another steep increase in overall input costs, with wage inflation softening in January. Average prices charged rose for the fourth month running’