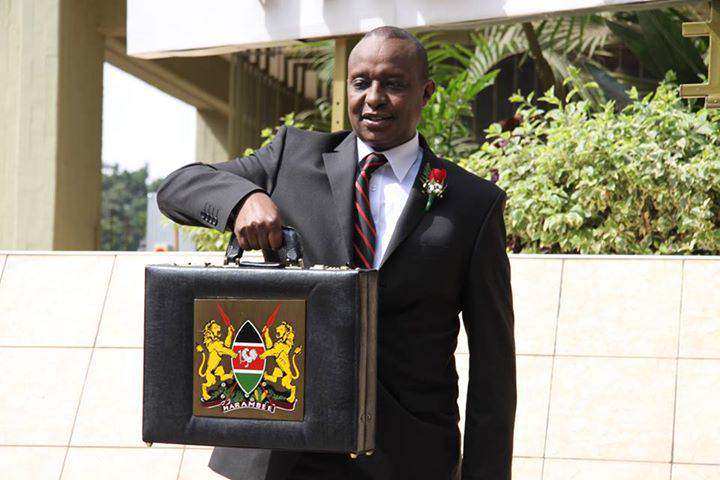

The Kenyan government is set to appeal the high court’s ruling to suspend the implementation of the excise duty introduced in the Finance Bill 2018 according to Treasury’s cabinet secretary Henry Rotich.

CS Rotich said the office of the Attorney General is expected to file the appeal on Friday or on Monday next week adding that the ruling will negatively affect government operations.

High Court judge Wilfrida Okwany issued the suspension last week after the Kenya Bankers Association (KBA) challenged the Robin Hood tax in court over ambiguity.

“I find that the fact that KBA has raised the issue of ambiguity in the law in question calls the attention of the AG and KRA to make a clarification on the issue so as not to leave it to the subjective interpretation of those supposed to implement it,” said the Judge adding that the AG and the KRA should file their responses within 14 days.

The Finance Bill 2018

The Finance Bill 2018 proposed various ways to increase tax collection in order to meet the budget needs for this financial year. One of these proposals, which came into law on July 1, is the tax of 0.05 per cent charged on transfers of Sh500,000 through banks or other financial institutions. Some banks had implemented this law before the ruling, causing uncertainty within the financial sector.

The Bill also increased mobile transaction charges from ten per cent to twelve per cent which mobile operators have already executed.

On other matters, CS Rotich said the African Development Bank (AfDB) has agreed to finance the overpass from Mombasa road to Westlands. The bank will also finance other projects such as roads and dams. Rotich was speaking in a meeting with AfDB’s president Akinwumi Adesina.