Kenya Airways’ (KQ) share price almost doubled in the first week of its return to trading at the Nairobi Securities Exchange (NSE), to become the best stock in capital gains so far this year.

- •Trading of KQ shares resumed at the NSE on Monday 6th, after a nearly 5-year freeze from trading in July 2020, closing at KSh 3.83 per share.

- •The suspension was lifted on 5th January 2025, owing to the carrier’s improved financial performance and the government’s withdrawal of plans to nationalize the airline.

- •Just a week after trading resumed, KQ’s stock price jumped 49.6% to KSh 6.30 per share – a 7 year high- but still far below its September 2006 all-time high of KSh 570.96.

KQ ended a decade-long loss-making streak in 2024, making KSh 513 million in profits after tax in the first six months, mainly supported by a notable decline in finance costs but tempered by a significant surge in operating costs.

The turnaround was buoyed by the government’s move to take on US$641 million in foreign currency debt owed to Exim bank, granting relief to the ailing airline. The dollar denominated facility had pushed the finance costs higher following the appreciation of the dollar coinciding with the momentum depreciation of the Kenyan shilling.

The half year profits were also supported by a 22% surge in revenue to KSh 91 billion on the back of a 10% increase in passenger numbers, totalling KSh 2.54 million.

“We are not there yet, but this is a significant milestone that indicates our intention to continue transforming this organization into a fully stable and sustainable airline, so this is something we want to celebrate,” Chief Executive Officer Allan Kilavuka said in August.

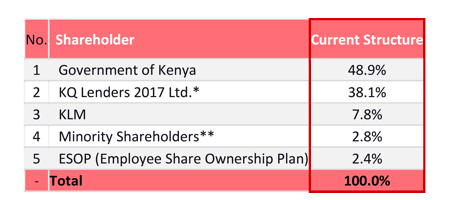

The national carrier, which is 48.9% state owned, said it has plans to mobilize up to US$1.5 billion in fresh capital to revive the company.

Kenya Airways joins Kenya Power – also state backed- in substantial capital returns in the recent months after years of dormancy at the Nairobi bourse.

The growth has boosted the market cap at the NSE to a two-year high of KSh 2.04 trillion as several other stocks edged higher towards 52-week highs in the sustained bullish market. Among the capital gainers in 2025, Kenya Airways, Kenya Power and HF Group have led with 49.6%, 44.3% and 28.6% gains respectively.