Nairobi Securities Exchange listed oil marketer Kenol Kobil PLC (Stock; KENO) has announced it’s Half-Year 2017 results for the 6 months ended 30th June, 2017.

The company posted an impressive revenue growth of 97% to Sh 72.64 Billion. This was mainly driven by increased prices of oil in the international market and volume growth of 80% which was spread across all its business segments.

Profit after tax rose by 20% to Ksh 1.422 Billion despite taking an impairment provision of Ksh 300 Million.

Finance cost declined by 16% from Sh 98 Billion to Sh 82 Billion in what the company said was due to “Better inventory management strategies and a reduction in the level of borrowing.” However, administration and operating costs grew significantly by 41% to Sh 1.4 Billion.

In the period under review, Kenol Kobil recorded a forex loss of Sh 25.6 Million versus a forex gain of Sh 39.3 Million in the first half of 2017. The company said the forex hit was due to a depreciation of local currencies in Kenya and Burundi markets.

Dividend

The company declared an interim dividend of Sh 0.30 per share, an increase of 50% from the last year’s Sh 0.15 per share. The dividend will be paid on or around 1st October while books close on 25th August 2017.

Share Price

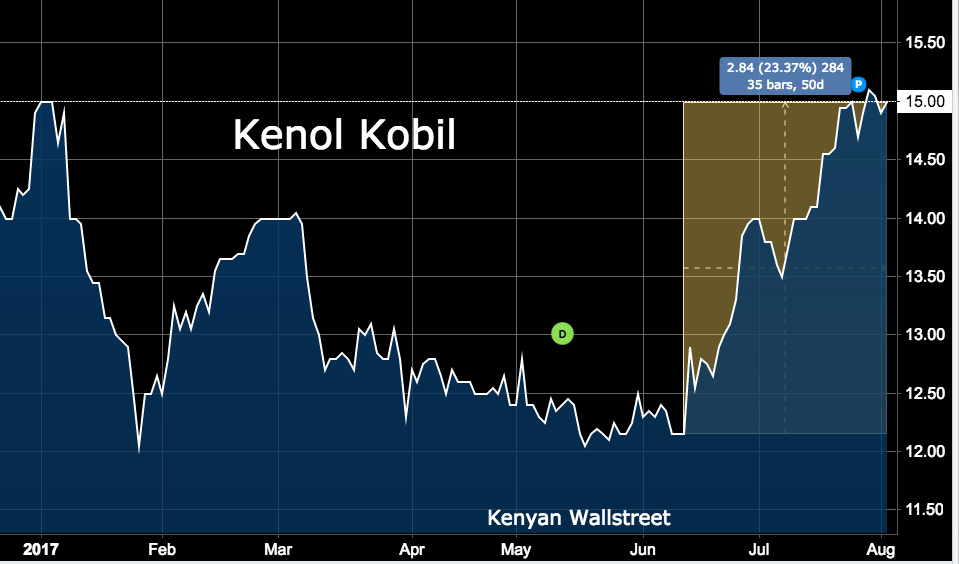

Over the last 50 days, Kenol Kobil’s share price has gained by 23% as shown in the chart below.

RELATED; Kenol Kobil takes lead in Petroleum Industry with 16.7% Overall Market Share