KenGen the largest power producing company in Kenya announced its full year results for the period ending 30 June 2016.

The following are the major highlights from their FY16 results:

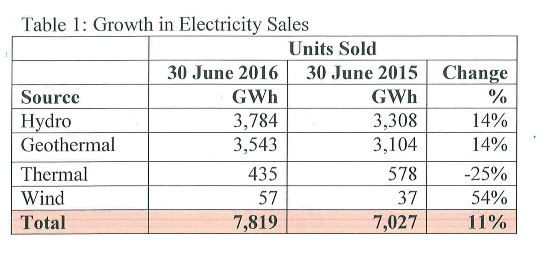

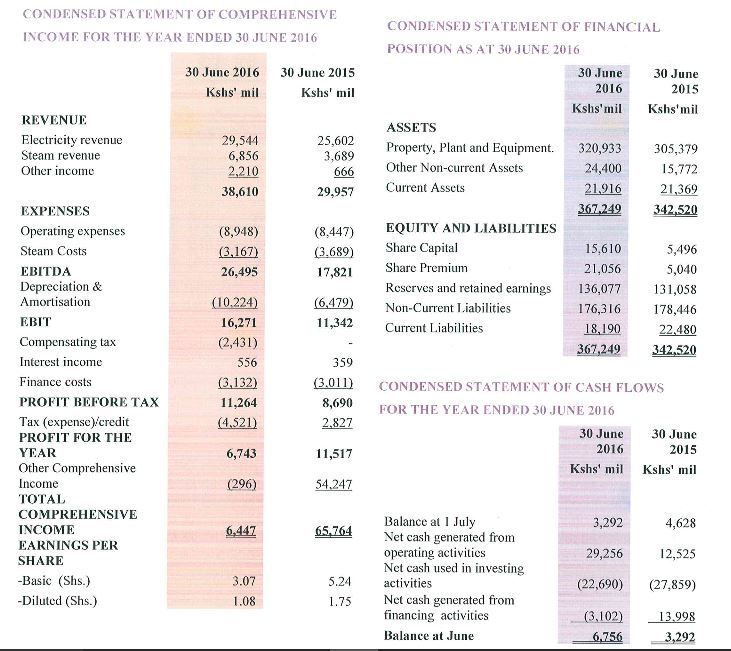

- Total Revenues grew by 28.9% from KES 29.9 Billion to KES 38.6 Billion. The main revenue catalysts were due to an increase in Hydro and Geothermal capacity.

- Operational Expenses increased by a modest 6% from KES 8.4 Billion in 2015 to KES 8.9 Billion in 2016. The company attributes this increased expenditure due to ‘increased operational scope and capacity building.’

- EBITDA (Earnings Before Interest Tax Depreciation and Amortization) was up by 49% from KES 17.8 Billion in 2015 to KES 26.5 Billion in 2016.

- Profits before tax was up by 30% from KES 8.7 Billion in 2015 to KES 11.3 Billion in 2016.

- Profits After Tax slumped by 41% KES 11.5 Billion in 2015 to KES 6.7 Billion in 2016. The drop is due to a tax charge incurred in the current year as opposed to a tax credit of KES 2.8 Billion in 2015 awarded to the company due to investment allowances following the completion of Olkaria 280MW plants.

- The company did not declare any dividends. The company plans to use the funds in various strategic projects leading to an additional capacity of 706MW by 2020.

In the markets KenGen closed at a share price of KES 6.85. Have a look at the year-to-date chart below:

Download: KenGen FY16 Results

Sources: (KenGen, Kenyan Wall Street, Financial Times)