Listed utility company KenGen has reported a 54% rise in profit after tax to KSh 10.48 Bn for the year ended June 2025, its third-highest annual earnings since listing on the Nairobi Securities Exchange.

- •The performance was driven by lower operating costs, reduced finance charges, and foreign exchange gains, despite broadly flat revenue at KSh 56.10 Bn.

- •The state-owned utility achieved record power generation of 8,482 GWh, up 1.2% from 8,383 GWh in 2024, the highest in its history.

- •The increase was supported by improved hydrological conditions, greater dispatch from Kipevu III, and the resumption of operations at the Muhoroni Power Plant.

KenGen has maintained its dominant position in the energy sector, supplying 59% of Kenya’s electricity consumption. Revenue has remained stable, reflecting lower geothermal and steam sales offset by growth in diversified income streams and higher pass-through recoveries.

- •Diversified revenue sources expanded by 235%, largely from the successful completion of geothermal consultancy work in Eswatini.

- •Operating expenses fell 11% to KSh 35.14 Bn due to efficiency initiatives and lower amortization charges.

- •Operating profit rose 43% to KSh 13.62 Bn, while finance costs declined 20% to KSh 2.25 Bn on reduced loan repayments. Total comprehensive income nearly doubled to KSh 10.73 Bn.

| Metric | FY 2025 | FY 2024 | YoY Change (%) |

|---|---|---|---|

| Revenue | 56.10 Bn | 56.30 Bn | 🔴 ▼ 0.35 % |

| Reimbursable Expenses | 9.647 Bn | 8.003 Bn | 🔴 ▲ 20.5 % |

| Revenue less Reimbursables | 46.45 Bn | 48.29 Bn | 🔴 ▼ 3.8 % |

| Operating Expenses | 35.14 Bn | 39.32 Bn | 🟢 ▼ 10.6 % |

| Operating Profit | 13.62 Bn | 9.551 Bn | 🟢 ▲ 42.6 % |

| Net Forex & Fair Value Gains | 1.453 Bn | (0.722 Bn) | 🟢 Reversal to gain |

| Finance Income | 4.110 Bn | 4.202 Bn | 🔴 ▼ 2.2 % |

| Finance Costs | 2.254 Bn | 2.806 Bn | 🟢 ▼ 19.7 % |

| Profit Before Tax | 15.47 Bn | 10.95 Bn | 🟢 ▲ 41.4 % |

| Profit After Tax | 10.48 Bn | 6.797 Bn | 🟢 ▲ 54.2 % |

| Total Comprehensive Income | 10.73 Bn | 5.891 Bn | 🟢 ▲ 82.1 % |

| EPS | 1.59 | 1.03 | 🟢 ▲ 54.4 % |

| DPS | 0.90 | 0.65 | 🟢 ▲ 38.5 % |

| Total Assets | 505.6 Bn | 491.3 Bn | 🟢 ▲ 2.9 % |

| Total Equity | 284.5 Bn | 278.1 Bn | 🟢 ▲ 2.3 % |

| Net Cash from Operations | 30.62 Bn | 36.85 Bn | 🔴 ▼ 16.9 % |

- •KenGen’s total assets increased 3% to KSh 505.6 Bn, and total equity rose 2.3% to KSh 284.5 Bn.

- •Cash generation from operations eased to KSh 30.62 Bn from KSh 36.85 Bn, impacted by higher tax and capital expenditure.

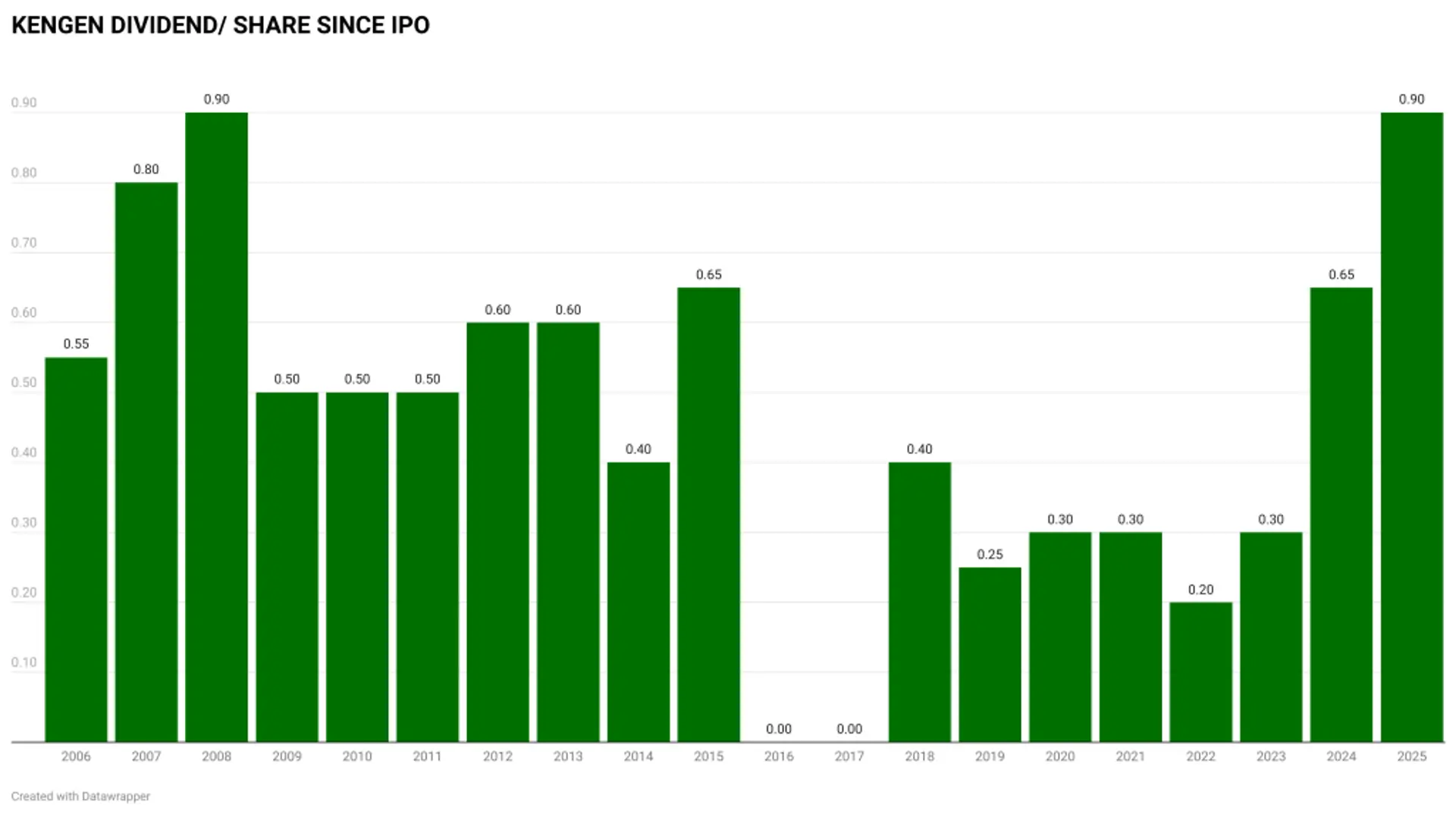

The board declared a final dividend of KSh 0.90 per share, matching the company’s 2008 record payout. At a market price of 9.18 on October 22, the dividend offers a 9.8% yield—the highest among NSE large-caps.

The register will close on November 27 2025, with payment expected around February 12 2026, subject to AGM approval.

Management Outlook

KenGen said its near-term renewable pipeline totals 252.82 MW, led by the 63 MW Olkaria I rehabilitation, 42.5 MW Seven Forks Solar, 8.6 MW Gogo Hydro upgrade, and 80.3 MW Olkaria VII Geothermal Project.

It also plans to expand regionally through the Ngozi Geothermal Drilling Project in Tanzania, reinforcing its position as Africa’s top geothermal developer.