Kenya’s largest lender by Assets, KCB Group, released its third quarter 2017 results that saw its profit after tax rise by 5% to KES 15.1 billion compared to the previous period’s KES 14.4 billion.

Income

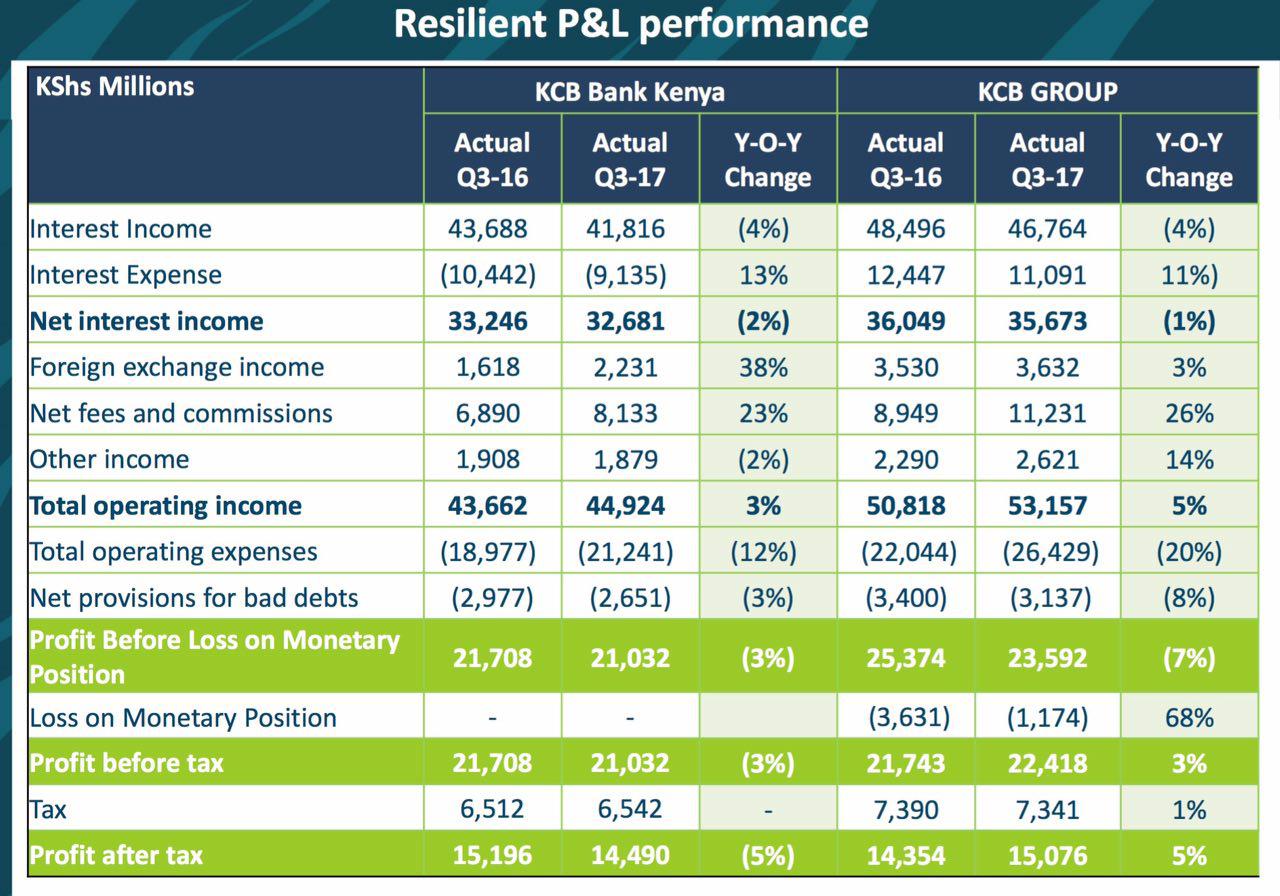

The bank’s Net interest income declined by a single percentage point to KES 35.7 billion compared to KES 36 billion in Q3 2016.

Non-Interest Income had positive results with foreign exchange income growing by 3% to KES 3.6 billion, Net Fees and Commission increased by 26% to KES 11.2 billion and other income rose by 14% to KES 2.6 billion year-on-year.

Total Group Operating Income came up by 5% to KES 53.2 billion versus KES 50.8 billion in Q3 2016.

Expenses

Operating expenses increased by 20% to KES 26.4 billion. A 68% saving on loss on monetary position was made where the loss incurred came to KES 1.2 billion compared to the previous period’s KES 3.6 billion.

Balance Sheet

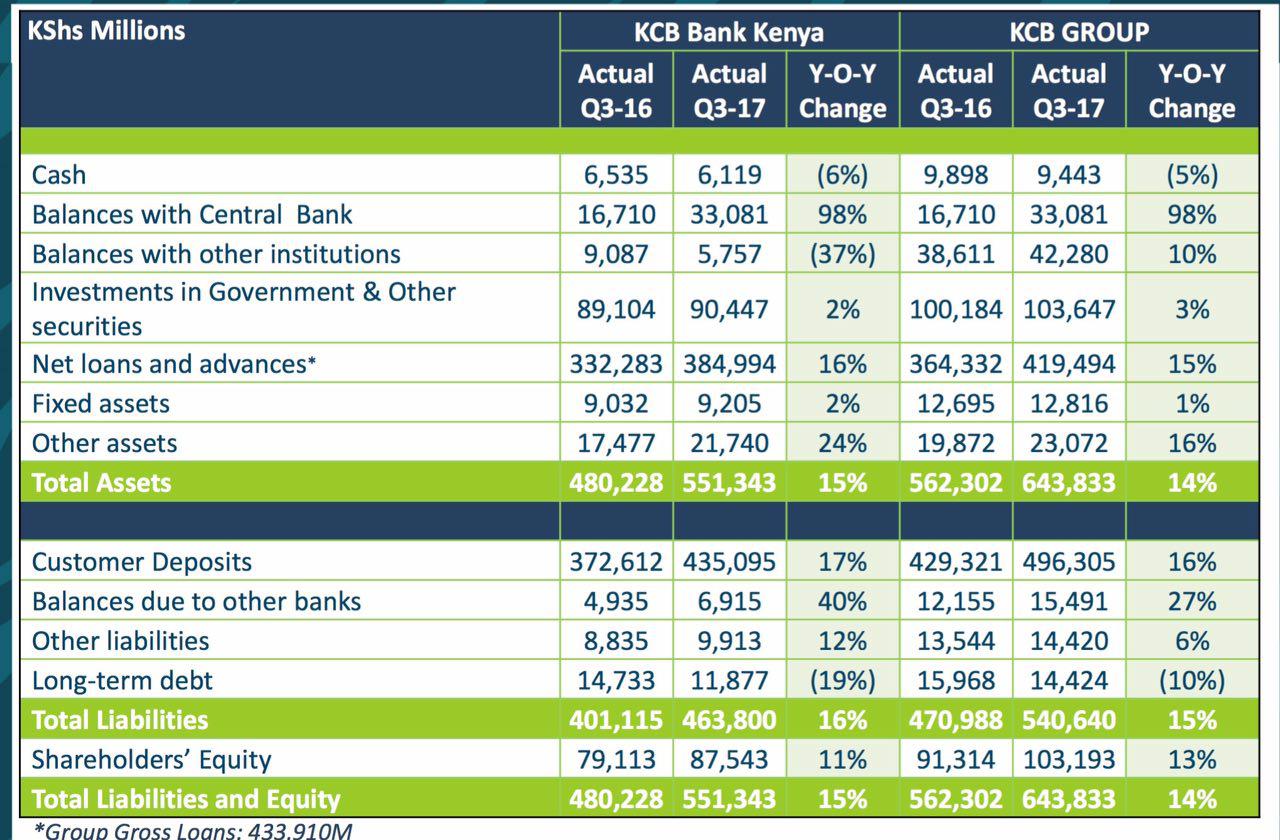

The bank’s total assets expanded by 15% to KES 643.8 billion compared to KES 562.3 billion in Q3 2016 which was driven by a growth in net loans and advances. Shareholders’ Equity grew by 13% to KES 103.2 billion.

Loan Book

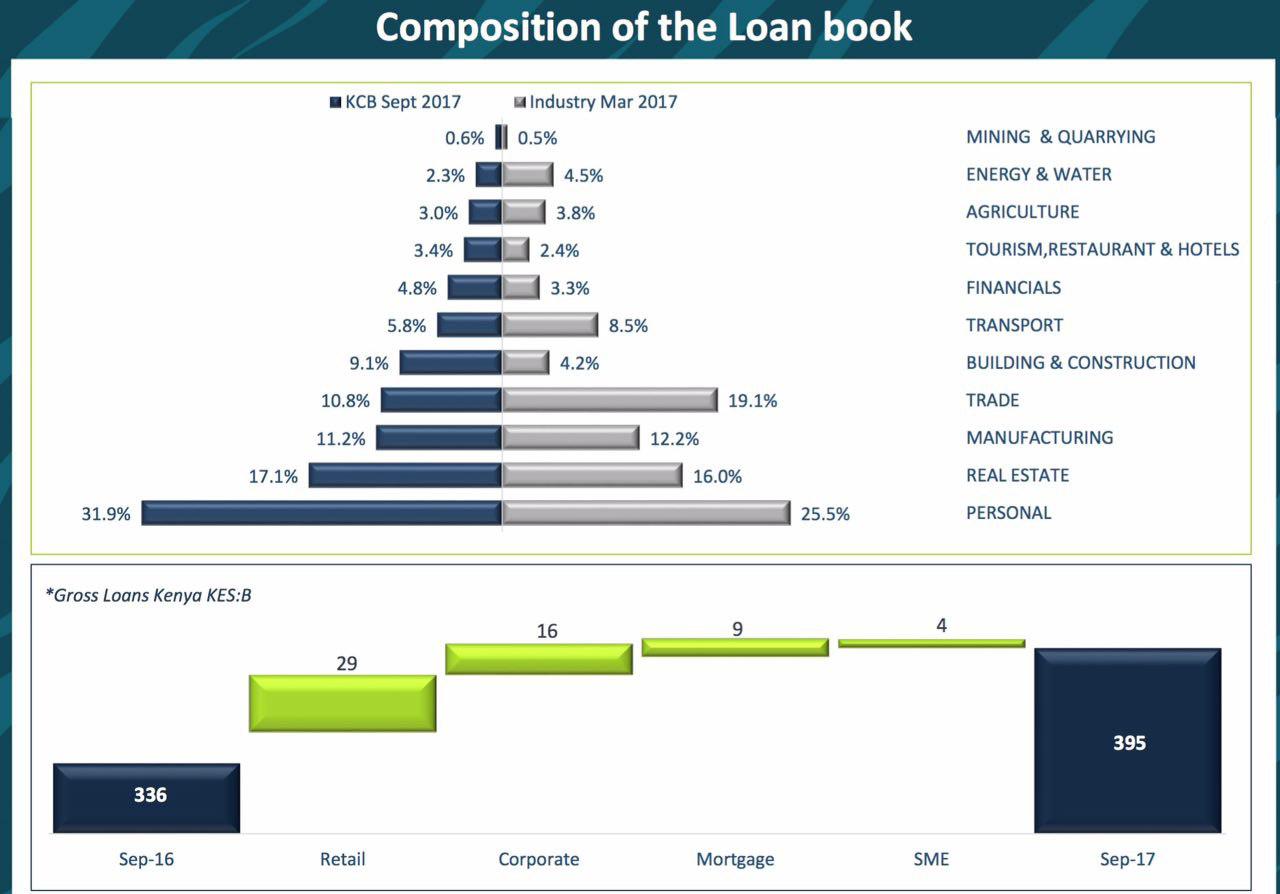

The lender revealed its loan book largely consisted of personal loans which comprise 31.9% of its loan book compared to the industry average of 25.5%. Real Estate followed comprising 17.1% of its loan book compared to an industry average of 16%.

Share Price

KCB closed Wednesday’s trading session unchanged at KES 40.75 per share. The lenders share price is firmly up by 41.7% on a year-to-date basis. The current 52 week trading range on the counter is KES 23.00 – KES 47.50.

Foreign Institutional Shareholders

Some of the top foreign institutional shareholders in the lender are:

- •Templeton Asset Management (89.48m shares)

- •Norges Bank Investment Mangement (79.04m shares)

- •Schroder Investment Management (28.74m shares)

Outlook

The CEO, Joshua Oigara, mentioned that “By 2020, it is our expectation that through our Fintech the contribution of non-interest income will grow towards 40% of the Group’s operating income.”

Source: KCB, NSE, FT, TKWS