Kenya’s largest bank in terms of assets, KCB Group has made public its financial performance for the first six months of the year posting stagnant performance in almost every segment of its business.

Half Year 2017 Highlights compared to the same period a year ago;

- Interest income declined by 4% from Sh 31.61 Billion in H1 2016 to Sh 30.36 Billion while total operating income rose by 3% from Sh 33.71 Billion to Sh 34.64 Billion.

- Profit After Tax for the period was unchanged at Sh 10.3 Billion while Profit before tax fell by 1% from Sh 14.83 Billion to Sh 14.75 Billion.

- Net loans and advances to customers increased by 17% to Sh 348.7 Billion to Sh 406.98 Billion.

- The bank increased its holdings in government securities by 14% to Sh 115.8 Billion versus Sh 101.5 Billion posted in the same period a year ago.

- Foreign exchange income rose by 3% to Sh 2.65 Billion.

- Customer deposits rose by a slight margin of 1% from Sh 476.5 Billion to Sh 482.8 Billion.

- The lender’s total assets increased by 3% from Sh 610 Billion to Sh 630.6 Billion as Total Liabilities and Equity also increased by the same margin of 3% to Sh 630 Billion.

The bank also noted that 86% of its transactions were done outside the branches; M-benki, KCB M-Pesa, Mobi & Payments. Branches; 14%, POS 5% and Internet Banking 1%. As of June 2017, the bank had a network of 318 branches, 536 ATMs, 15 120 agents and 4915 Point of Sales/Merchants.

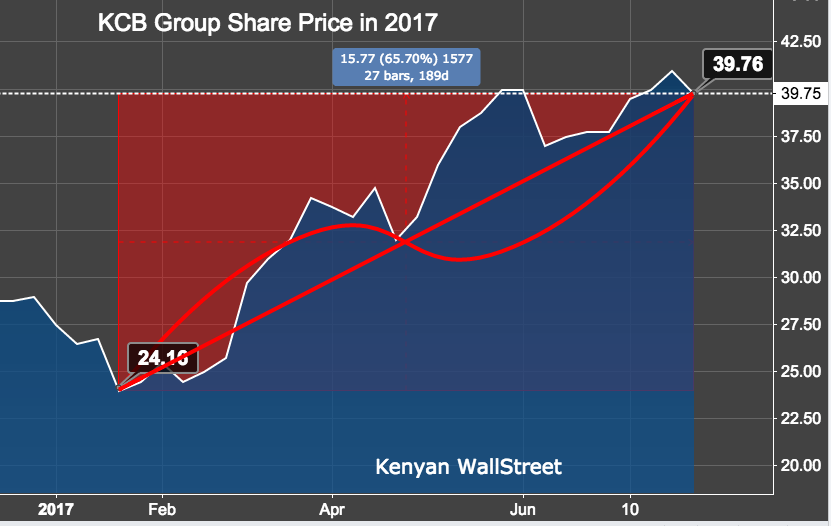

Share Price

The lender’s share price has gained by approximately 66% since January 24th on favorable market outlook.

Dividend

The Banks Board of Directors approved payment of an interim dividend of Sh 1.00 per share to be paid on or about, 31 October 2017, to shareholders registered at the close of business on 4 September 2017.