KCB Group has posted a KSh 32.33 billion profit after tax for the first half of 2025, an 8.05% jump from the same period last year, supported by a stronger loan book and cost control.

- •Net interest income grew 1.99% to KSh 70.57 billion, driven by a 6.10% expansion in the loan book to KSh 1.095 trillion.

- •Non-interest income declined 11.40% to KSh 29.53 billion due to softer trading income and reduced transactional fees.

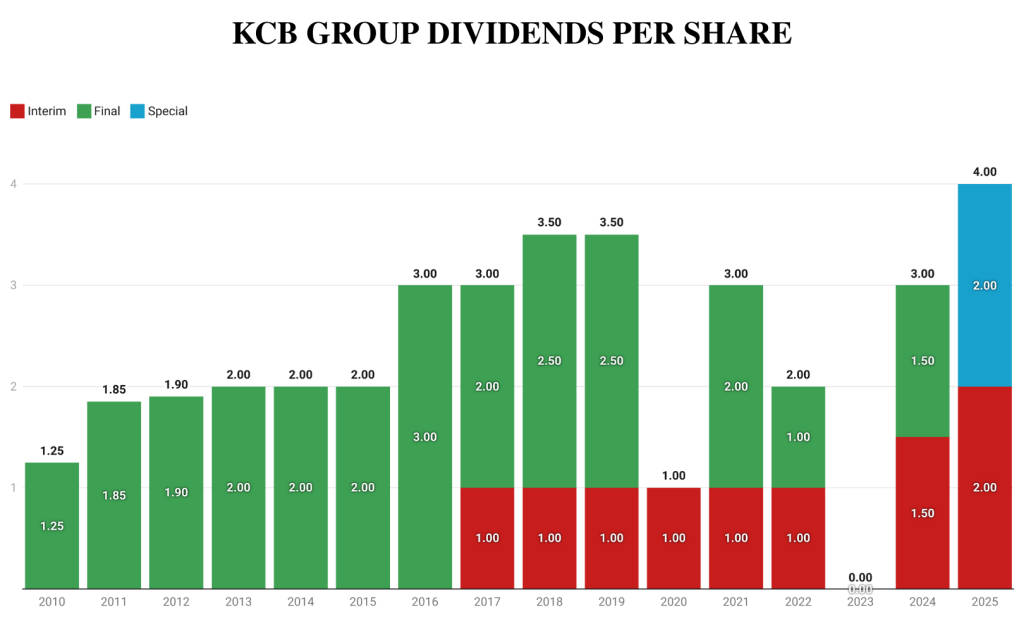

- •The lender has also declared a record mid-year dividend of KSh 4.00 per share, split equally between an interim and a special payout.

| Metric | H1 2025 | H1 2024 | YoY % |

|---|---|---|---|

| Net Interest Income | 70.57 Bn | 69.19 Bn | +1.99% |

| Non-Interest Income | 29.53 Bn | 33.33 Bn | -11.40% |

| Operating Expenses | 57.84 Bn | 56.51 Bn | +2.35% |

| Operating Income | 98.67 Bn | 94.62 Bn | +4.28% |

| Profit Before Tax (PBT) | 40.83 Bn | 38.11 Bn | +7.14% |

| Profit After Tax (PAT) | 32.33 Bn | 29.92 Bn | +8.05% |

| Total Assets | 1.969 Tn | 1.977 Tn | -0.40% |

| Total Equity | 306.83 Bn | 241.01 Bn | +27.31% |

| Customer Deposits | 1.486 Tn | 1.491 Tn | -0.34% |

| Loans and Advances (Net) | 1.095 Tn | 1.032 Tn | +6.10% |

| Gross NPLs | 221.071 Bn | 212.082 Bn | +4.24% |

| Earnings per Share (EPS) | 19.61 | 18.15 | +8.04% |

| Dividend per Share (DPS) | 4.00 | 1.50 | +166.67% |

Operating expenses increased 2.35% to KSh 57.84 billion, reflecting higher staff costs, inflationary pressures, and ongoing investments in technology. Despite these cost pressures, operating income rose 4.28% to KSh 98.67 billion as revenue growth outpaced expense increases. Profit before tax climbed 7.14% to KSh 40.83 billion.

Balance Sheet and Dividend

The bank’s total assets sit at KSh 1.969 trillion, a marginal decline of 0.40% year-on-year. Customer deposits have dipped 0.34% to KSh 1.486 trillion, reflecting tighter liquidity in some markets. Total equity surged 27.31% to KSh 306.83 billion, boosted by retained earnings and fair value gains.

Gross non-performing loans rose 4.24% to KSh 221.07 billion, with continued pressure in specific corporate and SME sectors. The NPL ratio remained manageable, supported by provisioning and recovery initiatives.

Subsidiaries outside KCB Bank Kenya contributed 33.4% of the overall Group earnings, and 31.4% of the balance sheet. PBT contribution from non-banking entities—KCB Investment Bank, KCB Asset Management and KCB Bancassurance Intermediary Limited was up to 2.1% from 1.8% a similar period last year.

The KSh 4.00 per share mid-year dividend is the largest in KCB’s history, comprising an interim KSh 2.00 and a special KSh 2.00. The NBK sale gain enabled the special payout and provided capital to strengthen KCB Tanzania, which is expected to support growth and meet regulatory capital requirements in that market.

KCB reaffirmed its focus on expanding its regional footprint, enhancing digital capabilities, and maintaining strong risk management practices. The bank plans to leverage technology to increase efficiency, grow fee-based income, and improve customer experience. It also aims to manage costs prudently while maintaining investment in strategic growth areas.