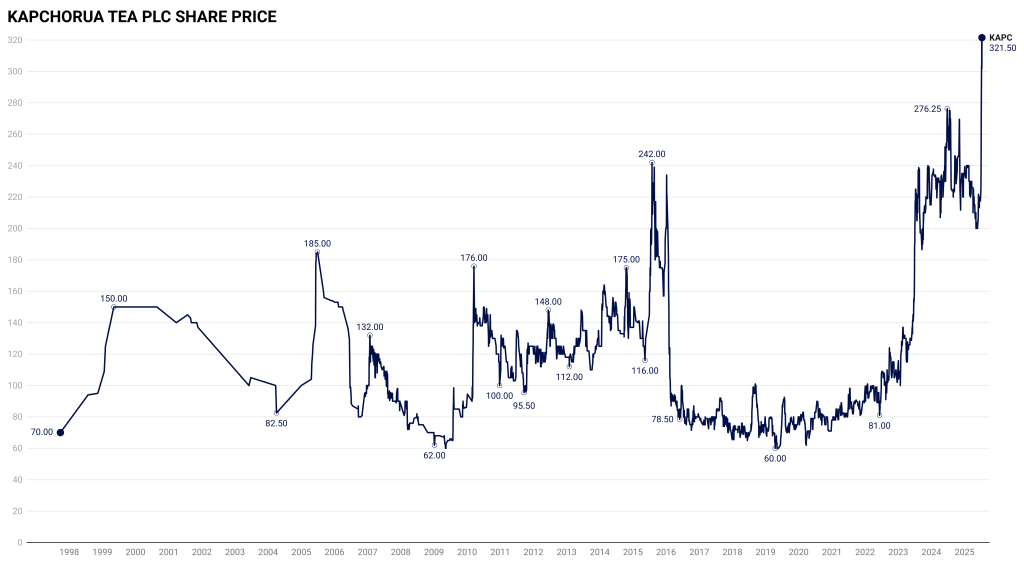

Kapchorua Tea Kenya Plc surged to an all-time intraday high of KSh 332 on July 11, 2025, before closing at KSh 321.50, marking a 6.46% gain for the day.

- •This rally caps a remarkable run for the stock—up 13.9% in a week, 45.5% over the past month, and 42.2% over the last three months.

- •The counter has advanced 36.2% year-to-date, defying its recent profit warning and subdued earnings.

- •First listed on the Nairobi Securities Exchange in 1972, Kapchorua Tea has a long presence in Kenya’s agricultural economy.

- •The stock’s strength stands in contrast to weakening fundamentals. In May 2025, the company issued a profit warning, cautioning investors of a significant drop in earnings for the financial year ending March 31, 2025.

- •This warning was confirmed in late June, when Kapchorua reported a 55% fall in net profit to KSh 181 million, down from KSh 399 million in FY2024. Revenue inched up just 1.1% to KSh 2.22 billion.

- •Operating profit slumped by 75%, and earnings per share declined from KSh 51.04 to KSh 23.16. Still, the board declared a KSh 25.00 per share final dividend, unchanged from the previous year.

- •It also proposed a 1:1 bonus share issue, capitalizing KSh 39.12 million from reserves to boost shareholder value.

Management linked the downturn to a global tea glut, falling prices, and currency pressures from a stronger Kenya shilling.

| Metric | FY2025 | FY2024 | Change |

|---|---|---|---|

| Revenue (KSh) | 2.22 billion | 2.20 billion | ▲ 1.1% |

| Net Profit (KSh) | 181 million | 399 million | ▼ 55% |

| Operating Profit (KSh) | Significantly lower | — | ▼ 75% |

| EPS (KSh) | 23.16 | 51.04 | ▼ 54.6% |

| Dividend Per Share (KSh) | 25.00 (Final) | 25.00 (Final) | Steady |

| Dividend Cover (x) | 0.93 | 2.04 | ▼ |

| Average Tea Price (per kg) | 228.02 | 299.88 | ▼ 24% |

| Tea Production (kg) | 8.3 million | 8.7 million | ▼ 4.6% |

| Net Assets (KSh) | 2.1 billion | — | — |

| Biological Assets (KSh) | 456 million | 377 million | ▲ 21% |

Background and Ownership

Founded in 1869, it rebranded to Kapchorua Tea Kenya Plc in 2017, after operating for decades as Kapchorua Tea Company Limited. It is based in Nandi Hills, Kenya, and is ultimately owned by UK-based George Williamson & Co Plc.

The company manages over 660 hectares of mature tea plantations and more than 30 hectares of immature fields. It markets its teas under the Williamson Tea brand and also maintains interests in forestry. Despite its smaller scale compared to its associate Williamson Tea Kenya Plc, Kapchorua consistently achieves higher average prices per kilogram, reflecting strong brand value and pricing power.