First Published on May 3rd, 2023 by Aristofanis Papadatos for SureDividend

Johnson & Johnson (JNJ) recently raised its dividend by 5%, and thus it has now raised its dividend for 61 consecutive years. This is one of the longest dividend growth streaks in the investing universe, which is a testament to the company’s business model’s strength and solid execution. It is also worth noting that the stock has underperformed the S&P 500 by a wide margin this year, as it has shed 7% whereas the index has rallied 8%. As a result, the stock has become attractive.

You can download an Excel spreadsheet with the full list of all 68 Dividend Aristocrats (with additional financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

Business Overview

Founded in 1886, Johnson & Johnson is a diversified healthcare company and a leader in the area of pharmaceuticals (~54% of sales), medical devices (~30% of sales), and consumer products (~16% of sales).

Johnson & Johnson has 28 brands/pharmaceutical platforms that generate more than $1 billion in annual revenues. The company is a leader in its markets, as it generates approximately 70% of its sales from the Nr 1 or Nr 2 market share position.

Moreover, Johnson & Johnson is the fifth-largest company in the U.S. and the eighth-largest company in the world in the total amount spent on Research & Development (R&D). Thanks to its exemplary R&D department, the company has an impressive growth record. Johnson & Johnson grew its adjusted operating earnings for 36 consecutive years until 2020, when the pandemic caused a benign 7% decrease in its earnings per share. A 7% decrease in the earnings per share during one of the fiercest downturns in history is a testament to the company’s resilience to recessions. Johnson & Johnson has emerged stronger from this crisis, with record earnings per share in 2021 and 2022.

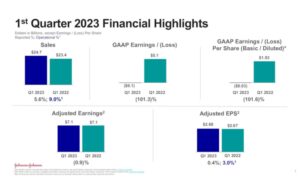

Johnson & Johnson currently enjoys positive business momentum. Thanks to solid growth in all its business segments, it grew its operational sales by 9.0% over the prior year’s quarter.

Pharmaceuticals, medical devices, and consumer products grew their operational sales by 7.2%, 11.0%, and 11.3%, respectively. Adjusted earnings per share edged up only marginally, from $2.67 to $2.68, but they exceeded the analysts’ estimates by $0.18.

Notably, Johnson & Johnson has exceeded the analysts’ earnings-per-share estimates for 20 consecutive quarters. This is undoubtedly an impressive performance record, which confirms that the pharmaceutical giant enjoys sustained business momentum. Thanks to this momentum, management recently raised its guidance for the earnings per share this year from $10.45-$10.65 to $10.60-$10.70. At the mid-point, the new guidance implies 5% growth of earnings per share over the prior year to a new all-time high.

Johnson & Johnson has grown its average earnings per share by 7.0% per year over the last decade. Given the commitment of the pharmaceutical giant on investing heavily in its R&D department and its consistent growth record, we expect the company to grow its bottom line by about 6% per year on average over the next five years.

Dividend

On April 18th, 2023, Johnson & Johnson announced a 5% dividend raise. As a result, the company has now grown its dividend for 61 consecutive years and is currently offering a 2.9% forward dividend yield. This yield may seem lackluster to most income-oriented investors, but it is important to note that this yield is a nearly 10-year high for this premium stock. Due to the exceptional performance record of Johnson & Johnson and its reliable growth trajectory, it is rare to find a stock with a much higher dividend yield.

Johnson & Johnson has always been a cash flow generating machine, as its unparalleled product portfolio has always generated excessive free cash flows, which have highly rewarded the shareholders. The same was evident in the latest quarter.

In the first quarter, Johnson & Johnson invested $3.6 billion in its R&D department, while it also distributed $2.9 billion in dividends and spent $2.5 billion on share repurchases. Management has made it clear that it prioritizes reinvesting earnings in the business in order to grow organically and perform high-return acquisitions over shareholder distributions. Thanks to these priorities, the company has achieved its impressive growth record. Even better, despite the material investments in its business, the company has always generated excessive free cash flows and thus it has easily remained one of the most popular stocks in the income-oriented investing community.

The company is currently facing a threat due to the numerous pending lawsuits related to the adverse health impact of talc on thousands of people. Johnson & Johnson is trying to transfer all the liabilities from this issue to a separate division, thus trying to protect itself from the effect of these liabilities. This practice has become quite common in recent years but the Department of Justice has not accepted this strategy of Johnson & Johnson so far. Therefore, there is high uncertainty over the final impact of the thousands of lawsuits on Johnson & Johnson.

On the other hand, Johnson & Johnson has a rock-solid balance sheet. It is one of the extremely few companies that pay absolutely no interest expense while its net debt is only $84 billion, which is just 20% of the stock’s market capitalization.

Moreover, Johnson & Johnson has proved essentially immune to recessions thanks to the strength of its brands and the essential nature of its products. While most companies incurred a collapse in their earnings in the Great Recession, Johnson & Johnson kept growing its earnings and its dividend throughout that crisis.

Given the healthy payout ratio of 45% of Johnson & Johnson, its rock-solid balance sheet, its resilience to recessions, and its reliable growth trajectory, investors should rest assured that the company will continue raising its dividend for many more years. Johnson & Johnson has grown its dividend by 6% per year on average over the last decade and over the last five years. As it is likely to grow its earnings per share at a similar pace in the upcoming years, investors can reasonably expect the dividend of the stock to continue growing at its historical pace in the upcoming years.

Final Thoughts

Johnson & Johnson has underperformed the broad market by a wide margin this year, primarily due to the uncertainty resulting from the company’s numerous pending lawsuits. As a result, the stock has become attractive, offering a nearly 10-year high dividend yield. Thanks to its rock-solid balance sheet and the strength of its brands, the pharmaceutical giant can endure the ongoing downturn and recover strongly whenever the lawsuits are settled. Therefore, the stock is likely to highly reward long-term investors, who can wait patiently for the storm to pass and remain focused on the solid fundamentals of this best-of-breed stock.

This article was first published for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

How To Build Your Dividend Growth Portfolio From Scratch In 2023