The Nairobi Securities Exchange (NSE) is on a record-breaking run with all major indices now posting double-digit returns so far in 2025.

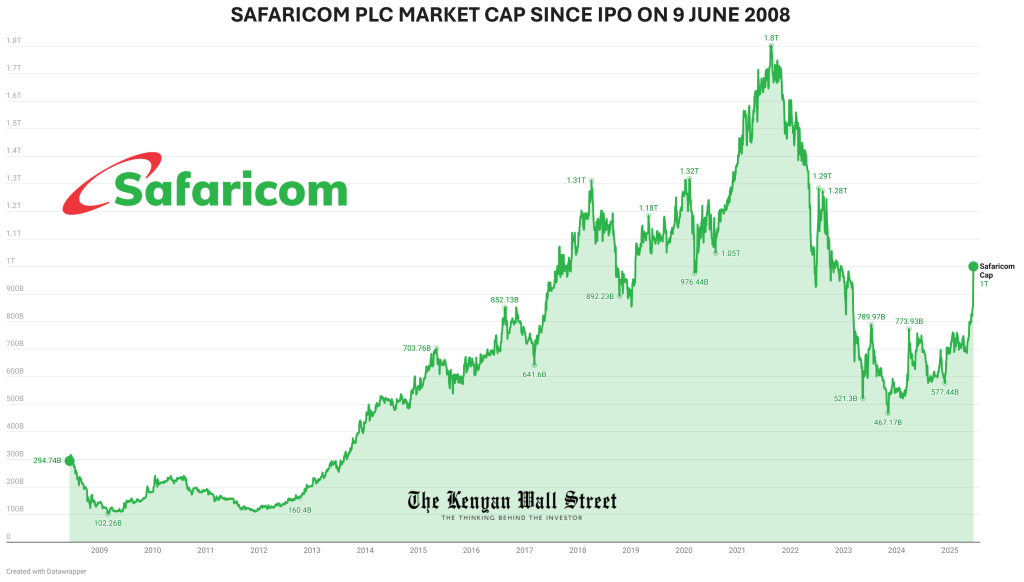

- •The rally has been supercharged by Safaricom’s meteoric surge in recent weeks with the telco briefly crossing the KSh 1 trillion valuation mark for the first time since December 2022.

- •This week, the NSE All Share Index (NASI) has jumped 9.16%, closing Thursday at 147.83, 73% up from its October 2023 lows.

- •The index posted gains above 2% for three consecutive days, a rare streak seen only once before in the past decade-between March 22 and March 26, 2024.

The rally is broad-based. Returns on all equities indices have climbed into double digits:

| Index | Start of 2025 | June 12, 2025 | YTD Change |

|---|---|---|---|

| NASI | 123.48 | 147.83 | +19.72% |

| NSE 20 | 2010.65 | 2,264.63 | +12.63% |

| NSE 10 | 1302.31 | 1,453.83 | +11.63% |

| NSE 25 | 3402.80 | 3,767.00 | +10.70% |

Safaricom Leads the Charge

Safaricom PLC has been the clear engine of this rally. On Thursday, the stock crossed the KSh 25.00 mark intraday for the first time since December 22, 2022, briefly reclaiming a KSh 1 trillion market capitalization, then closed the day at KSh 24.90, just KSh 2 billion shy of the milestone. Year-to-date, Safaricom shares have soared 46.04%, far outpacing the broader market.

The telco’s market capitalization at KSh 997.6 billion, has overtaken the combined value of all 11 listed banks and 6 insurers on the NSE, which collectively stand at KSh 949.5 billion..

The bullish momentum has also lifted total NSE market capitalization. The figure rose from KSh 2.146 trillion last week to KSh 2.325 trillion as of Thursday, with Friday’s trading still pending. Investor wealth has expanded by nearly KSh 180 billion in just four sessions.