The Central Bank of Kenya has launched the CBK DhowCSD, a web platform and a mobile App that will allow retail investors in Kenya and abroad to invest in Government Securities in an easy and convenient way. The new platform, which went live this Monday, allows retail investors to participate in securities auctions, view auction results and payment details, check upcoming corporate actions, access updated portfolio statements and initiate secondary market and pledge instructions.

Treasury Bills are a paperless short-term debt instrument. Treasury Bonds are a paperless medium to long term debt instruments issued by the Government through the CBK to raise money in local currency.

The platform has been in development for three years, and it allows investors to open bond trading accounts directly with the CBK. This streamlined approach means investors can place bids for their preferred securities during auctions directly from their mobile devices.

CBK Requirements for Signing Up on DhowCSD

In order to sign up for this Investor Portal App (Mobile App) one is required to have a smart phone so as to be able to access the App and enable them invest in the various products of Government Securities.

One must also be at least 18 years old and a registered, active Mobile Subscriber locally. The monetary authority reserves the right to verify with the local Mobile Network Operators (MNOs) the authenticity and status of one’s Mobile number.

The Monetary Authority will have the authority to request the Mobile Network Operators (MNOs) for an investor’s personal information held by the Mobile Network Operators and the Mobile Money Account service including one’s phone number, name, date of birth, ID or Passport number and such other information that will enable CBK to identify one and comply with the regulatory “Know Your Customer” requirements.

Here’s a step-by-step guide on how to invest in Treasury Bills and Bonds using the DhowCSD platform:

- •Download the DhowCSD Mobile App or visit the DhowCSD online portal at http://dhowcsd.centralbank.go.ke.

- •If you are a new user, click on “Create Account” to begin the registration process.

- •For existing account holders, simply select “Already have a CSD account” to activate your online account. All your existing details will be seamlessly transferred to the new DhowCSD system.

- •Enter your email address, choose a username, and set a secure password of your choice.

- •Accept the Legal terms to proceed.

- •Click on “Start registration” to initiate the official registration process for your CSD account.

- •Input your personal details exactly as they appear on your official identification documents (I.D./ Passport).

- •For an individual account, select “Physical Person” under USER TYPE and “Household” under ECONOMIC SECTOR.

- •Choose your preferred broker to facilitate your transactions.

- •Enter your main registered phone number, and any other optional details.

- •Upload a passport photo and a copy of your ID or passport.

- •If applicable, include your KRA PIN certificate and any relevant tax exemption certificate. Note that individuals are generally not tax-exempt, but specific entities like NGOs may qualify.

- •Validate your email address by entering the verification code sent to your registered email.

- •Complete the registration process within seven days, as incomplete profiles will be automatically deleted by the system.

- •Once your account is approved, you can start investing. The approval process typically takes 2-3 days, a significant improvement from the previous 1-month turnaround period.

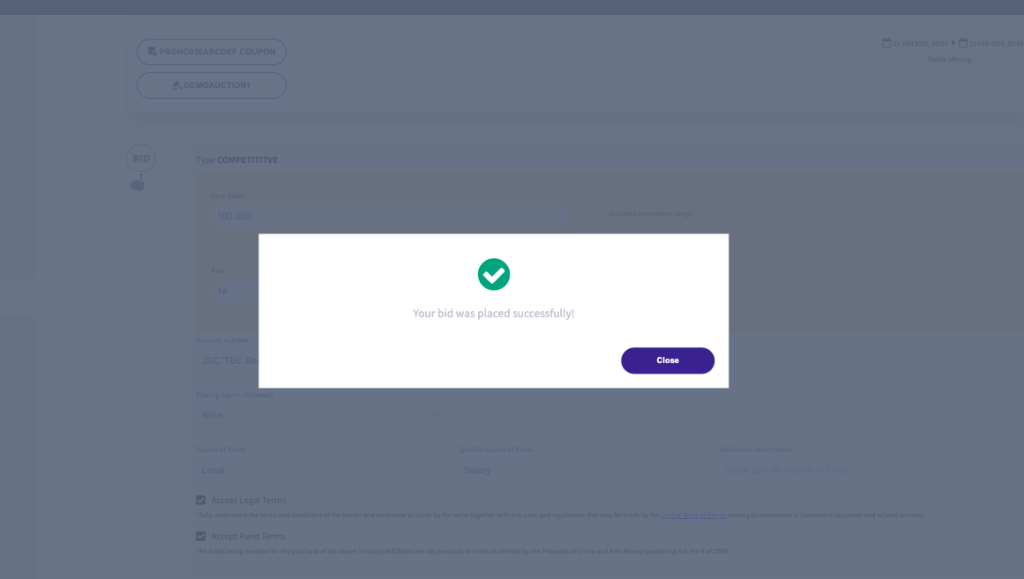

- •Click the BUY/SELL button to create a bid for your preferred Treasury Bills and Bonds.

- •When placing a bid, choose either “competitive bidding” and “noncompetitive bidding”. A competitive bid is one that an investor specifies the prices or yields at which they wish to purchase securities. In competitive bidding, bids will be accepted in order, starting with the price higher than the minimum acceptable price or the yield lower than the maximum acceptable yield set by the Central Bank of Kenya. For noncompetitive bidding,you specify the quantities you wish to buy, while the price or yield is determined by the accepted competitive bids at the auction.

The CBK DhowCSD offers various types of Treasury Bonds that you can invest in:

a) Fixed Coupon Bonds: These are the most common type of T-bonds, with a stable interest rate over the bond’s lifespan, resulting in consistent semi-annual interest payments.

b) Infrastructure Bonds: These fixed coupon bonds are specifically aimed at funding designated infrastructure projects. They often attract significant market interest due to their tax-exempt returns.

c) Savings Development Bonds: These are long-dated fixed coupon bonds targeted at encouraging saving among investors.

ALSO READ: Kenya’s Banking Industry Balance Sheet Crosses KSh 6.5 Trillion Mark